The main concern I have heard from US citizens who want to pursue early retirement is how to handle healthcare. Our country is messed up for many reasons, but we also happen to spend more per capita than any other developed nation on healthcare AND have worse outcomes. We pay more for less – how wonderful!

But I digress. My plan for early retirement is to be a nomad – to travel across the world and the US whenever it strikes my fancy. This presents a problem given how our healthcare system is currently set up, which is on a state-by-state basis. Basically if I leave the state where I have signed up for health insurance, I am at best “out-of-network” and at worst won’t be covered basically at all.

Expat Medical Insurance

My original plan to combat this reality was to get Expat Medical Insurance, which in essence is a healthcare plan that can cover you throughout the entire world – including the US. This is slightly different from Travel Insurance, which usually attempts to move you as soon as possible from an international location to your home country where your local health insurance would kick in and take care of a cut of your bills after you hit your deductible.

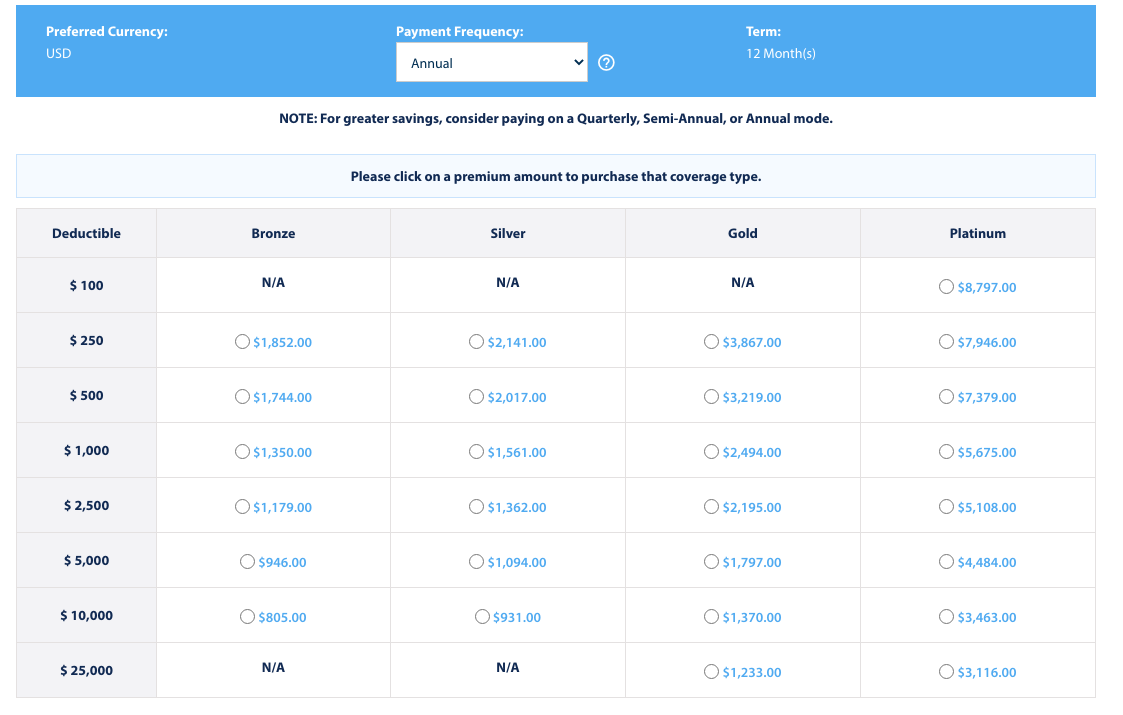

I was going to sign up for expat insurance with IMG Global, which would provide me with health insurance that I could use anywhere in the world. They were recommended to me by the lovely and genius 2 year veteran nomads All Options Considered and I’ve been having very helpful chats with IMG’s customer support team. Here are the deductibles and annual pricing I was looking at:

But, given the COVID situation in the US, I have discovered this plan will no longer work because IMG Global expat insurance has two main rules:

- Insurance starts the day you leave the US

- You must be outside the US for 6 out of 12 months

Because of COVID, I have been cancelling my international travel plans because countries (rightly) do not want us American fools in their borders. Similarly, I do not know when international borders will open to the places I planned to go or if (when they do open) it will be a good idea for me to travel there. As a result, I can’t guarantee when I will leave the country or that I will be gone for 6/12 months, so I need a new plan.

‘Home’ State Insurance (WA)

My first thought was to keep a version of the health insurance I am on now through COBRA or buying on the Affordable Care Act (ACA) exchange since me leaving my job would count as a qualifying life event to get new coverage outside of the enrollment period.

However, after doing some digging, it looks like my fears about state by state insurance rules were warranted and my Washington health insurance might be basically useless in Georgia and any other US states I’m planning to stay in for the immediate future.

Other State Insurance (GA)

So then I looked into buying ACA insurance for the state we know we will be staying in for at least a few months: Georgia. It looks like the act of leaving my job and moving would qualify me to enroll in a new health insurance plan so I could get one, but once again I am faced with the issue of it not being helpful in other states.

Based on our lack of immediate international travel, we are shifting to a US based travel approach for the foreseeable future. So getting Georgia health insurance may be helpful while we’re actually in Georgia, but less so when we plan to leave for other states.

Other Options?

Some nomads in our community have opted to use Healthshare Ministries that are not linked to a state plan. However, from what I’ve read, these are usually religion based organizations that make you claim things like you don’t drink or that you have certain beliefs, neither of which I can claim and I am not willing to lie about (I’m such a rule follower 😉 ).

World Nomads Travel Insurance

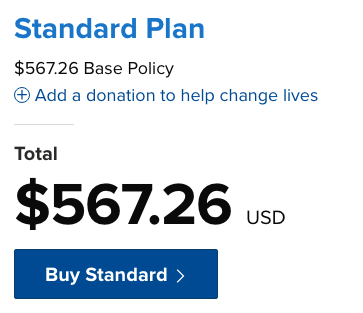

So after looking at all of the above options in the context that I want to be covered in any US state and ideally internationally, my healthcare plan is to use travel insurance offered by the company World Nomads. They are raved about in the nomadic community and have plans that are straightforward and well priced for up to 6 months of coverage at a time, such as my recent quote:

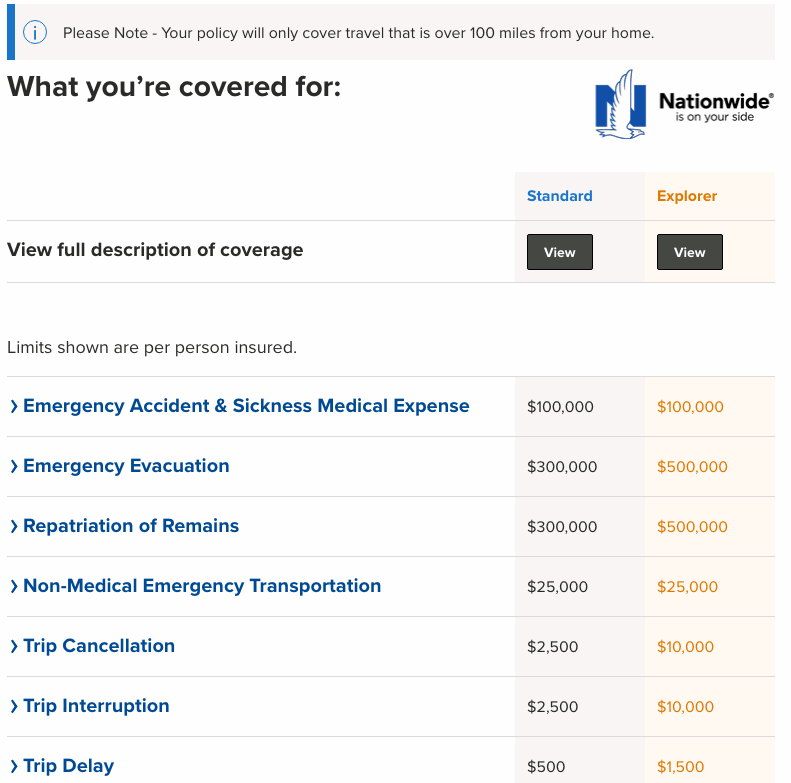

Previously, I had dismissed this option because World Nomads describe themselves as “travel insurance,” but after revisiting their website while re-examining all the options, that description doesn’t seem to be completely accurate because: World Nomads can be used by US citizens for health coverage in the US if they are 100 miles from their residence. That sounds like a half step from expat insurance to me and not straight up travel insurance, which would basically wave “See ya later, good luck!” after airlifting your injured ass back to your home country.

So I dove back in and confirmed that this interpretation of their plan was correct – I would be covered anywhere in the US outside of a 100 mile radius around Seattle, WA…which I’m not planning to be in for a while anyway 🙂 . I even reached out to their support team just to double check I was reading their policy correctly and they confirmed that I was. The only fly in the ointment is that it looks like when you submit a claim that they require an “Explanation of Benefits” from a primary health insurance plan that would cover you within 100 miles of your home. I’m still looking into that and if that is the case will need to figure out how to be within those guidelines as well (Check the end of the post for an important update on this!).

Here’s an overview of what the health aspect of this plan offers (it also covers things like lost possessions similar to more traditional travel insurance):

In doing this research, I also discovered something hilarious that I had somehow forgotten: I’ve actually used World Nomads travel insurance before to cover me specifically IN the US. I had previously tested my theory and didn’t even remember it – I need to start doing some Sudoku or something 🙂 .

I bought it in 2016 to cover me as I traveled around New Hampshire, California, Arizona and Missouri. After looking through my emails I remembered that purchasing the plan and interacting with the company was clear and straightforward so I’m looking forward to working with them again.

So I’m purchasing a travel insurance policy with World Nomads that covers the US and the two countries that I may (but probably won’t) visit in the next 6 months: Argentina and Thailand. Hilariously (I laugh so I don’t cry) adding those countries only added $100 to my 6 month plan cost – basically because including the US at all already ratchets up the price to one of the highest cost brackets.

Conclusion

So that’s the plan for now! In the future, when international travel is more of a guarantee, I’m planning to switch to Expat Insurance (once I can meet their criteria) since it covers more than emergency care, but this is the stopgap plan currently.

Also, in case this wasn’t clear: I am not an expert – in anything 🙂 . And I do not at all pretend that I completely understand the convoluted healthcare options we have in the US, so if I’m wrong about anything above or have missed something please do let me know! This is all just the best of my understanding on a topic that seems to be intentionally confusing.

Once I lock in a plan and submit an insurance claim down the line I’ll write a post about that experience as well so y’all can learn from my mistakes…or triumphs 😉 . Onward!

What kind of health insurance plans have you considered?

IMPORTANT UPDATE: I’ve discovered that World Nomads does require that you have primary insurance to use their service so you need to have health insurance that covers you within the 100 miles around your home address that they won’t cover. To combat this I applied for state health insurance in Washington, my state of residence, and was told that because of my (basically nonexistent) income that it would be free – which I appreciate since I can’t actually use it outside of Washington, a state I am very rarely in 🙂 . So heads up if you’re getting World Nomads – you also need some type of primary insurance.

Hi Purple – this is a nice overview. Where did you see the primary EOB requirement? That is the only thing that makes me a little nervous but you are obviously all over it. My guess is a letter letting them know you don’t have medical insurance would suffice.

Personally, at our age, 100k coverage for the ER would be all I need to feel comfortable (and I work in the industry). That where you are likely to get hit. When you deflate your income (particularly in 2021), you will have some other options in the hospital setting that can help mitigate risk.

I tried to get the plan documents/certificate but it looks like you may need to buy first. Careful with the definition of “emergency”, they may require you to be in an emergency room over urgent care.

Max

Thank you! I’m glad it made some sense especially to someone in the industry 🙂 . I saw the EOB requirement when I acted like I was about to buy the plan. There’s a checkbox that says “The coverages provided in the plan are secondary coverages” before I hit “Continue to payment”. When I click the “secondary coverages” part it opens to say “Because travel insurance is secondary, you’ll need to check to see if your medical expenses (except for emergency evacuation) are covered by your primary health care insurance first. You’ll need to send us the EOB (Explanation of Benefits) from your health insurance company along with the rest of your documentation.”

Sounds like primary insurance is needed, but even if it is World Nomads + WA state insurance is still less cost than just the state plan in GA and would obviously cover me in the other 49 states and internationally so it seems like a good intermediate plan for me.

To see the 21 page plan document I clicked “View full description of coverage” on the first page of the quote. Totally with you on the definition of ER vs urgent care. There’s an awesome company called Zoom Care that I use for urgent care. It was $150 to see them immediately when I had pnemonia and now they actually take insurance. I’m going to research equivalents in other states and use them for the $150ish they charge in non-ER related times.

Also what did you mean by “When you deflate your income (particularly in 2021), you will have some other options in the hospital setting that can help mitigate risk”? I didn’t know that would give me more options when already in a hospital.

As an English expat living in the US, I used to have Cigna Global health insurance, which you could also look into as a backup. They were always very helpful over chat, although more recently it’s been difficult to get through to them on the phone. I don’t know if they’d cover your situation, but might be worth looking into.

Also, I had no idea about health insurance being so difficult across different states! It really is a crazy system. It makes me grateful that I could always go back to England if anything serious happened that I needed healthcare for! I hope things improve in the future with US healthcare, for everyone’s sake.

Thank you for the suggestion! I’ll check them out as well as a backup. Gotta look at all the options 🙂 . And yeah health insurance here is ridiculous. We made some strides by requiring companies to insure pre-existing conditions (the bare minimum come on country), BUT we’re (hopefully) moving in the right direction. That’s awesome you could go back to England if anything serious happens – I’m jealous 🙂 .

Hola Purple! Between the World Nomads travel insurance and the primary insurance you’ll purchase in WA, what do you anticipate might be your total monthly expense for health insurance? Thanks for sharing specifics! It helps those of us who hope to follow.

Hi Tara! It’s looking like it would be $100-200 a month all together, but I’ll obviously include the actual final cost in my budget updates that I do on here. As for the cost’s impact on my specific budget, it’s fine and within the 11% budget wiggle room I added to come up with my $500K goal. Also obviously this is a temporary (and not ideal) solution in the time of COVID. However, it’s also looking like since I won’t be jetsetting as planned my overall costs will decrease as well so we’ve got buffers on buffers over here 🙂 .

As a fan of efficiency in general, I am continually flabbergasted at the U.S. health care system. It’s a confusing, duplicative and unnavigable mess. What you stated was 100% true – we pay more than any other country for health are but our system is generally ranked in the 30s by the World Health Care organization. When something like universal health coverage works in every other industrialized country in the nation, seems like it’s probably worth taking a look at.

Some people frame the issue as a moral one, but to me it’s simple dollars and cents. An argument against a universal system I hear goes something like “Why should I pay for someone else’s health care?” Well, in the insurance system, you’re not only paying for someone else’s health care; you’re also paying an entire industry to manage it and earn a profit to pay shareholders. An industry that, by the way, artificially inflated the cost of health care by demanding “discounts” (which led to prices to be inflated in order to offer those discounts). Much simpler to cut out the middle man – and frankly I don’t care if I’m paying it through taxes or through premiums. I do care about reducing costs.

Well, that’s my rant for today haha Nice post! I didn’t even think about the state by state issue – just one more strike against the insurance system!

Yeah if you’re looking for efficiency: Here there be monsters 😉 . It’s absolutely ridiculous and illogical. I’m all about actually well priced, good healthcare and also don’t care how I pay for it (taxes/premiums etc). Thank you for the rant 🙂 and yeah more striking against the system. Let’s burn it down – or as I’m planning to, opt out as much as possible until we get our shit together!

Last year we had an ACA policy through Blue Cross Blue Shield and it actually had nationwide coverage. In fact it had global coverage! I checked all the cities in Asia we visited and there were usually one to seven hospitals in each city that accepted BCBS as primary insurer. We didn’t even buy travel insurance (we are such risk takers!!).

So one crazy idea would be to shop zip codes till you find one that has nationwide/global coverage and “establish residency” there and get an ACA policy.

I was just going to comment about Blue Cross Blue Shield as well. I work remotely for a company based in Minnesota, so our company insurance is BCBS of Minnesota, but the in network coverage is all over the US, with emergency coverage abroad. I have never been to Minnesota, but I have used the insurance for in network coverage in the state where I live.

Very interesting! Thank you for chipping in – I’m adding this to my research to do list!

Iiiiinteresting! I did not know that. I’ll look into BCBS and see what’s up in WA and GA. I’m a WA resident for the next 6 years, but after that it’s a free for all so if expat insurance still isn’t an option that far in the future for some reason this sounds like a sweet option. Thank you!

This is enlightening! I think maybe I’m not understanding something though; Why are you a WA resident for the next 6 years?

Yay! And it’s because that’s when my current driver’s license expires and after that I can’t prove I live here to renew it (I’ll be gallivanting around the country and world instead) so I’ll have to come up with a new plan.

Good article. We don’t have to worry about health insurance yet because my wife is still working. Once she retires, then I’ll figure it out. Let me check the health ministry thing. Do you have to follow a particular religion? How would they check if you attend regularly? Pop quiz once a month? I’m a Buddhist…

So glad you liked it! And haha that’s the way to do it – I (semi) jokingly tell my partner the only reason I’d marry him would be to steal his health insurance. He doesn’t have that long left to work though so not a great trade off haha.

The healthshares I’ve seen have been Christian, but it’s very possible there are others for other religions! I don’t think they check up on it (quizzes or asking or anything), but I’m not sure. I believe Think Save Retire is part of a Christian one if you’re looking for someone ‘on the inside’ 😉 .

The healthshares bother me because of their exclusion of pre-existing conditions. Isn’t exclusion kind of against the Christian morals of including everyone? (I’m not religious like that, so just guessing a bit there there) 🙂

Did you look at short-term health plans? I know in some states you can buy them for a few months at a time. I purchased a one-month plan for Dragon Gal last year when I needed to bridge going from my insurance to the beginning of the 2020 insurance plan year. It was cheaper than being on a marketplace plan. I didn’t like it for long term because there are a lot of gotchas, but for one month it worked for us.

The state specific nature of many of the marketplace plans is really a bummer. We have some plans in our area that actually only cover you in one county! I will have to look into the travel insurance to supplement the marketplace plan Dragon Gal has. We have an international plan (of no use now), but nothing for her if we travel out of state.

I am currently on Cobra for myself because I need to see my specialists and the marketplace plans don’t cover them. It isn’t cheap but it is still cheaper than a marketplace plan and paying out of pocket for my specialists. I have until middle of next year to figure out my next options.

Haha don’t even get me started on how Christian morals can (and have by some) been corrupted to perpetuate hate instead of love (and similarly exclusion instead of inclusion) 🙂 . I could go on for hours.

I haven’t heard of intentionally short term insurance, but will add it to my research list! And in one COUNTY?! That’s so ridiculous wow. 1/50 states is bad enough. Sounds like you found a way to make it work in the meantime and I’m looking forward to hearing what you plan to do next year 🙂 . Good luck!

It sounds like you’re adapting well to your change of travel plans and navigating the craziness of the U.S. healthcare insurance wasteland. At least by keeping spending down, a subsidized ACA plan could be a viable cheap option. It just sucks how geographically limited they can be. At the very least they could cover the whole country. I like the plan you’ve set out so far though and am eager to see what you ultimately decide to go with.

Thanks! Trying to do my best 🙂 . Very true ACA would be a good option if I decide to be in one place. It would indeed be great if they would cover the whole country 🙂 . I’ll keep y’all posted!

Love hearing about the different options you considered. We used Liberty HealthShare before we moved to Panama for about 6 months and found some pros and cons. The biggest con is that we’re still chasing after them to reimburse us for charges from early 2019… not acceptable.

We then went to IMG Global when we moved to Panama. Never had to use them, but their customer service has been great so far.

Our new predicament is that we made the trip back to the U.S. temporarily and now we can’t get back to Panama with the borders closed there. If we’re stuck here for the long haul, we’ll need to switch providers so we’re not breaking the 6-month rule on having the expat insurance. I’ll have to check out World Nomads if we get to that point.

Thanks for the great info! Good luck on the last two months – the days seem to drag as you get closer to your last day of work! 🙂

Very cool! Ugh I’m some Liberty is being that slow – that’s ridiculous. Very cool to hear another thumbs up for IMG Global’s customer service. They’ve been awesome when I interacted with them even as a prospective client and I was super happy about that.

So complicated this early retirement/US healthcare thing 🙂 . I’m excited to see how y’all decide to handle it going forward. And thank you! Currently time is flying by, but I think that’s because we have 9 days left to get rid of all our stuff to become nomads. After that I imagine it will drag quite a bit 🙂 . Thanks for stopping by!

Healthcare is the one thing that makes me hesitate to completely stop working. I am so interested in the avenues you have explored as well as those of the others that have commented. Though my retirement will be much different than yours, I find you to be extremely relatable. Thanks for sharing!

Yep it’s a huge roadblock in the States. Glad you found this interesting and so happy you find me relatable despite our differences 🙂 . Thank you for stopping by!

Just ran across you from Gocurrycracker, great posts and congrats! I WAS going to retire (semi) early, yesterday. Today is my 60th birthday. We were going to use IMG Global as we wanted be outta the cold for at least 4 months anyway. So, I’m stuck working until the end of the year as I don’t see any good options. I REFUSE to spend maybe $1000+ on crappy health insurance a month, when it’s likely I’ll never even use it. But I’m not working past 12/31/20, no way no how. Hope it all goes well for you!

Welcome! Just curious: How’d you find me through GoCurryCracker? I didn’t think he knew of my existence 🙂 .

I’m sorry your retirement has been delayed. That sucks. Yeah there really aren’t great options out there without expat insurance off the table currently. I love the new countdown – I’m rooting for you! And thank you 🙂 .

What if you got cancer and wanted to return to Seattle to be home while you received treatment? What if you were visiting family or a friend for the day within 100 miles of your home and you just so happened to be in a car accident which requires an ICU stay and lifelong treatment? There are multiple scenarios that could end in financial ruin, bankruptcy or a horrible situation if you were to become sick. I love World Nomads and my wife was in a horrible accident in Vietnam five years ago and World Nomads took care of us amazingly well, I am a fan for life! But, if you are in the United States I believe an ACA healthcare plan is likely the best bet and you could pick up a world nomads plan very cheaply if you were to travel briefly.

I’m sorry about your wife. If I get cancer I’m not coming back to Seattle – we have no ties here, no family. We moved here without knowing anyone. In that scenario I would stay where we’re living (GA or somewhere else in the US) or go to Mexico if possible. The ACA plans I’ve seen on the GA exchange would cover me when I’m in the state, but we’re not planning to be there more than a few months a year. So it doesn’t make sense to me to pay for a full year of something I will only use a few months of the year and not cover me anywhere else. However, it looks like World Nomads requires that I have primary insurance in addition to theirs so I might need a combo of WA ACA insurance + World Nomads to qualify. Luckily even both costs together are less than the GA ACA plans I was finding on their website.

This was my concern as well, as it seems highly imperative to stay AWAY from wherever your “home residence” is established.

In a couple months I’m quitting my job and hoping to live a nomad life, by first moving to and establishing residency in Florida. I plan to set up an address with a traveling mailbox service, is the 100 mile radius based on that physical location? Since I actually plan on spending time in Florida too, maybe it’s best to set up residency in Nevada or someplace I actually don’t plan on ever going?

The longest contract you can get right now is for 6 months so yeah I need to stay away from Seattle for 6 months at a time, but can plan trips in the middle of the two contracts. The 100 mile radius is based on the address you gave them so if it’s the Traveling Mailbox address in Florida that’s it 🙂 . You do you as for residency. I’m not sure what the best solution is, but please let us know what you decide 🙂 .

I love all the information you share Purple. I want to copy you. If I’m able to, I’ll probably use the ACA.

I’m so glad you enjoy it! And great choice 🙂 . Good luck with your journey!