My original plan for retirement involved dropping the mic at work and then exploring Australia, New Zealand and Argentina before going to New York to visit family for Christmas. Now that ‘Rona is deciding our fate, I’m instead looking at perhaps a year or more of staying in the US. Instead of global travel, I’ve pivoted to my other main goal in retirement: spending time with loved ones.

The new plan is to move to the east coast and stay with or near my partner’s family in Georgia in order to see them much more often. Instead of the constant jet-setting I had originally planned for, we may be in one place for a 1/4, 1/2 or a whole year depending on how the US is handling the virus (Spoiler: It’s not looking good…).

Originally, I was going to only bring my shockingly affordable 40L backpack on our travels while my partner planned to travel with a carry on rolly bag for himself. But now, instead of traveling every few months, we’re planning to stay in one place for an unknown amount of time based on travel advisories (aka ‘Rona pending).

So because we will be in one place for the foreseeable future, this has started to feel more like a regular move instead of a ‘sling a backpack over your shoulder with everything you own because we’re nomads now’ situation. As a result of this new reality, the number of things my partner wants to bring with us is also expanding.

Instead of just bringing the amount of clothes that can fit in a small carry on, we’ve decided to bring items that might make our new place more homey. For example, our lamps (that luckily fold up), good knives and possibly even our nice pots and pans. My partner is also looking into shipping costs for sending his favorite books across the country.

Previously we were going to just purge everything and take only essentials that would fit in an airplane carry on, but here’s where we’ve landed now: instead of just taking my 40L backpack and his rolly bag, we are flying off to Georgia with 2 large suitcases, 1 rolly bag and my 40L backpack while a box or two of his books are being shipped across the country.

We are bringing a few items that will make our stay in Georgia more comfortable since plans have changed, and I’m not immediately leaving to trek all over Down Under with as little luggage as possible. However, when we do hit the road again, I am planning to cull my things down to fit into my 40L backpack.

I still want to avoid those baggage fees and suspect I don’t actually need that much to live if packing for my previous vacations is to be believed (aka I usually don’t change out of my pjs because I’m all about the #SlugLife 😉 ).

So things are shifting a bit – instead of getting rid of basically everything we own, we are now bringing a few additional items with us, but not enough to warrant getting a storage unit or a moving truck. We’ve shifted from full on nomadic packing to a micro-move.

MY RETIREMENT TO DO LIST

Now that our new packing parameters are established, let’s see how my long ass list of to dos are going!

2020 Ongoing Monetary Goals

- Max my 401K ($19,500 + $450 match) – $13,302 SAVED!

- Set aside Year 1-2 Retirement money in cash ($40,000) – $21,660 SAVED!

- I have $27,660 total in cash currently

- Max a Roth IRA ($6,000) – UNDER CONSIDERATION

- Overall save $52,000 before I quit in September – $34,962 SAVED TOTAL!

The stash is growing bigger! Despite the madness that is 2020, I’m still kicking ass at my monetary goals, which is super exciting to see! I’m still on track to save about $52,000 before I leave my job.

Also, above I broke out how much I’m saving this year from the amount of cash I have for retirement years 1-2. I am basically adding cash on top of my emergency fund that already existed, so that’s the difference in those two numbers.

I need to start making a decision about maxing my Roth or not this year. I’m still leaning towards “no”, but shall see how I feel next month when I need to make a decision.

2020 Ongoing Life Goals

- Buy nomad gear – COMPLETE!

- Read books that have been sitting on my shelf forever before I donate them – IN PROGRESS

- Play PC video games – IN PROGRESS

- Fit into my pants – IN PROGRESS

Buy Nomad Gear

I think I’ve finally got all my gear! I stocked up on a Portable Phone Charger, this fancy and sneaky Laptop Case and this Portable Luggage Scale so we can make sure we’re within airline weight requirements.

I also recently bought a Travel Umbrella and paid a few extra bucks to get a galaxy pattern on the inside of it. I thought I was being a little silly, but really enjoyed using it at the Black Lives Matter protest in Seattle a few weeks ago. It was raining pretty hard and during a workday, but that didn’t stop us!

Read and Donate Books

I’ve been better on the book front! On our daily walks, I’ve usually been taking one book a day to donate to our local Free Little Libraries to slowly get rid of what’s on my shelf before we sell our bookcases. However, I have also kept up my trend of getting distracted by books that are not on that shelf (my bad!)

I’ve been spending my time reading Carry On, which was originally described to me as “Harry Potter, but gayer” and it’s living up to that description 🙂 ! I also started reading The Wave: In Pursuit of the Rogues, Freaks, and Giants of the Ocean, which is interesting and terrifying.

Anyway, despite how interesting those books are, I need to crack down! We are only in this apartment for 3 more weeks and I want to re-read (or at least skim) the rest of my physical books before giving them away. It’s time to roll up my sleeves and get to work!

Play Video Games

I’ve been continuing my Twitch streams every other week to enjoy our gaming PC before we have to get rid of it. We recently tried playing the new Sims 4 Eco Living Game Pack, which has been super fun and also hilarious to play out some incorrect FIRE stereotypes, such as dumpster diving and plain old mooching.

Fit Into My Pants

This is a new goal that I added in June. I originally called it “Losing The COVID 19,” which is similar to “The Freshman 15”, but is caused by stress-eating during a global pandemic instead of an abundance of cafeteria food. I used carbs to “quaran-cope” this spring and it affected my waistline.

I actually didn’t gain 19 pounds, but I did gain 13 pounds and for me that is still more than enough, especially after I tried on one of the few pairs of pants that I’ll be bringing on my nomadic travels and they would hardly button!

So I went back on keto hardcore, went dry for another 100 days and have so far lost 9 lbs. Not bad at all! I know weight loss will slow as I progress, but I’m hoping this fairly quick trajectory continues and I can shake off those extra pounds before riding into the new food adventure filled sunset after I quit my job in September. I know this kind of routine I’ve created now will be more difficult to replicate as a nomad, so I might as well double down while I still can!

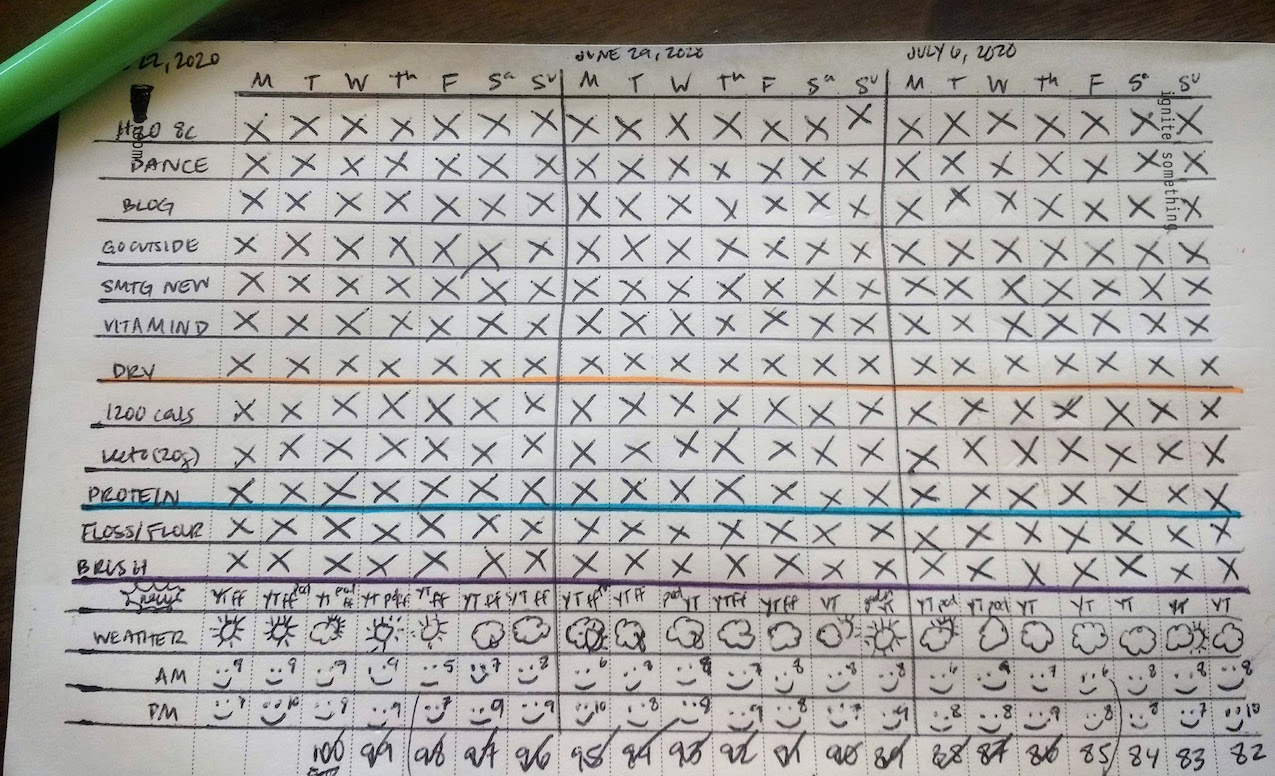

One thing that has really been helping me on this journey has been an idea my partner started: A CHECKLIST!

Having these items to do every day has helped me make sure I do things that make me happy in the long term, even though it feels hard at the time (like putting on pants, a bra, a shirt, shoes and a mask to go for a walk – life is rough 😉 …). It has also helped me stay on track with my food journey. So far I’ve gone 12 weeks without missing a check. Checkmarks for the Checklist Gods!

July To-Dos

- Set up Traveling Mailbox – COMPLETE!

- Give apartment notice we’re leaving – COMPLETE!

- Cancel my WiFi service – COMPLETE!

- Book fall travel – COMPLETE!

- Get rid of basically everything I own 😬 – IN PROGRESS

Traveling Mailbox

When embarking on nomad life I had a challenge: How would I get my mail when I was gallivanting around the world? Enter Traveling Mailbox – they provide a service where you can have an address in any state you wish and they will scan your mail or receive packages so you can decide what they should send to you no matter where you are.

Since we’re leaving our apartment this month, I got an annual subscription for a premium address in Washington State that was $199/year or $16.85/month. I was later able to add my partner to that account for no extra cost (you can have up to 3 recipients on the base plan) and split that payment amount in half – nice!

The sign up process was straightforward and quick. I had one question about where to place a notary stamp and they got back to me in only a few hours despite the fact that it was a Saturday AND July 4th. Very impressive.

I’m going to write a whole post about the sign up process, how I went about changing my address and any tips I have so you can avoid mistakes I made during this process so look out for that on August 11th.

Internet Shenanigans

I should have known something was afoot when I tried to cancel my internet service with Comcast and thought “oh wow this has been surprisingly efficient.” Unsurprisingly given my dealings with Comcast in the past, that one positive thought turned into my own personal hell that I am (unfortunately) used to when dealing with this company (Side Note: If you ever see me recommend Comcast it’s actually a cry for help and a sign that I’ve been kidnapped).

Basically, a simple cancellation of service turned into countless robot chats, 3 phone calls and a visit from a technician. I am SO excited to say goodbye to this company and the usual ridiculousness of the monopoly a few companies have on the internet in this country. It’s time to say goodbye to simple displeasures!

New Travel Plans

Well, it’s official y’all. My Mom and I are not going to Australia and New Zealand this fall. This has not been a surprise to me given how poorly the US has been handling the pandemic. Even if those countries open up to tourists, they would be silly to include us in that list 🙂 .

What finally sealed the deal for us though was that our original reason for picking that part of the world (the Etihad First Class Apartments) are no longer an option this fall. Etihad and a few other carriers have discontinued their A380 flights (which contain that apartment) until mid-2021.

So we’ve been going through the process of cancelling our accommodations and are waiting until we can reschedule our flights and hopefully not lose the points. Obviously, in the grand scheme of things, missing out on a vacation, even if it was my retirement ‘victory lap’, is not a big deal. I’m just happy the people I love are healthy.

So anyway, since it’s official that I won’t be going Down Under in the fall, I booked a flight from Seattle to Atlanta after our AirBnB bookings here are complete in September. I was able to use a Delta eCredit I received in 2017 to knock $50 bucks off the $193.10 one-way flight. Nice!

Operation Get Rid Of Everything

This is going well so far! As I mentioned, we have 3 weeks left until we’re out of this apartment and I started selling and donating items about 6 weeks ago. It’s been slow going and I had no idea how much work went into selling and giving things away on Buy Nothing Groups since our donation centers are closed.

I also thought we didn’t have a lot of stuff and have since been proven wrong. It’s not been a perfect process, but it has been happening and I’ve been making a chunk of change to boot! For example:

I just sold a $300 painting I bought a decade ago for $270 and a $130 painting I bought 7 years ago for $150. Is this what people mean when they say art is an investment👩🏾🎨? pic.twitter.com/4JciXx3Yzb

— A Purple Life (@APurpleLifeBlog) June 21, 2020

August To-Dos

- Live in an AirBnB for a month! – POST-CORONA CONFIRMED!

- Decide how I’m dividing money across my bank accounts in retirement – COMPLETE!

- Sign up for an online ballot so I can vote for local and federal elections – COMPLETE!

AirBnB Update

I asked our first monthly AirBnB if it would be possible to check-in early and check out late since we’ll have a large window of time between when we have to be out of our apartment and into the AirBnB and a similar large window between check out time and check in at our next AirBnB at the end of August.

They said that because of COVID, they had actually been blocking days on each side of our reservation for deep cleaning, so we can come at ANYTIME on the day of check in and leave anytime on check out day. That is AMAZING and takes a fair amount of stress off my back. Phew! One more logistic thing I don’t have to worry about…and now I just need to do the rest of this stuff – Shit😬 !

Bank Accounts

Going into retirement, I’ll have 2 years of projected expenses or $40,000 in cash, so I need to decide how to spread that across my accounts in a way that’s optimal for gaining interest and for real world ease. So, here’s what I’m thinking. I have the following accounts and am planning to use these monetary distributions of that $40K:

- Ally ($34,900): 1% interest rate

- Standard Bank Account ($5,000): Linked to my Chase Sapphire Preferred Credit Card that pays all my bills

- Charles Schwab ($100): Free global ATMs

My Ally High-Yield Savings Account currently provides interest of 1%. It was 2% when I started a few months ago, but let’s not talk about that 😉 – either way it’s much better than the 0.05% my regular checking account returns. Because of that low interest rate, I just want to keep a few months of expenses in my Standard Bank Account.

A few months ago, I opened a Charles Schwab Investor Checking Account, which provides free global ATMs so I don’t have to pay any fees if for some reason I need cash. We live in a mostly paperless world so I imagine using an ATM would be rare and as a result, haven’t put much in that account. Also…

Just hit a new selling milestone during Operation Get Rid Of Everything. I've made over $1,000 selling my used stuff – a lot of which I got for free🤑. Have I been doing this #FIRE thing all wrong? Maybe I should have been a flipper…. pic.twitter.com/5sN9vpewJa

— A Purple Life (@APurpleLifeBlog) July 9, 2020

Per the above, I also have an unusually large amount of cash at the moment as a result of selling things from our apartment. So I should be good for now, but I’ll increase the amount I keep with Charles Schwab when we can finally hit the road again to international destinations. So that’s how I’m going to split things up for now. We’ll see if it’s optimal in practice and if not I will adjust!

Voting

I registered for online voting with my Traveling Mailbox address. In my county doing so allows you to vote online for local and federal elections. What a sweet perk! I thought I was going to have to have the mail-in ballots we receive (which are also awesome and every state should do them) sent to wherever I am in the world (…is that legal?), but in the age of the internet, it seems that’s not necessary! Amazing.

September To-Dos

- Give my notice at work!

- Live in a (different) AirBnB for a month!

- Set up health insurance – IN PROGRESS

- Cancel flight to LA – IN PROGRESS

Health Insurance

So I’m actually changing my health insurance plans for the first phase of retirement because COVID has put a wrench in the original plans 🙂 . I’m writing a whole post about that and it will be live next week so stay tuned.

Flight Cancellations

As for my LA flight, it was only $69 and I can cancel it now without penalty, but I would only receive a travel credit and since it’s for an airline that doesn’t fly much on the east coast (where I’ll be) that’s not even helpful to me and I can’t guarantee that I would be able to use it before it expires next year. So I’m waiting to see if they change or cancel the flight themselves so I can get a sweet, sweet full refund like I did in this situation:

October To-Dos

- Transfer my 401K from my company account – IN PROGRESS

- Change my taxable dividends to go into my checking account instead of being reinvested

Recently I discovered something about certain 401(k) plans:

HOLD UP! I thought you could only rollover your 401K to an IRA when you leave the company, but I just learned I could have done that at any time?!? I could have avoided these wild fees for years🤦🏾♀️?!?! I'm going to go hide in a cave. #WorstPFBlogger

— A Purple Life (@APurpleLifeBlog) July 1, 2020

But, sadly, it turns out that mine is not one of them:

UPDATE: So apparently this is a financial soap opera. In summary: I do not have access to an in-service rollover with Nationwide until I'm 59.5.

Here's the full story:

1. I got a letter saying I have to rollover my 401K to another account or it will be closed in 1 month…— A Purple Life (@APurpleLifeBlog) July 1, 2020

Feel free to read the above tweet thread to see the entire saga of what happened and how I figured this out, but in essence, I now have real-world experience with the steps needed to transfer my 401(k) after I quit my job. I’ll try to write off this headache as future learning then 😉 .

Conclusion

And that’s what’s up in my life! It’s time to get serious about purging basically everything we own. The next time you get one of these updates we’ll be nomads and it’ll be my final countdown to retirement post! 9 Mondays to go…

How has the last month been for you? Did you accomplish your goals?

Glad you are still moving forward with your (slightly modified) plans. Hope this clears up soon so you can hit up Australia! My wife’s Australian passport expires later this year. We were going to use that as an excuse to go ou there, but looks like we will be going to the consulate instead!

Max

Yep – gotta pivot 🙂 . And thank you – as long as we can get this pandemic under control within the next 70 years I can still reschedule 😉 . That sounds like a great excuse. I’m sorry it’s not happening.

Thanks for the book tip. Just put a library request in for Carry On on audiobook.

It’s a shame you won’t be making it to our fine country down under for now, but on the flipside, they won’t let we Aussies outta here right now, so we’re even(?)

Loving all the detail in your updates.

Haha I’m glad that description sparked your interest 😉 . It is indeed a shame, but it will happen one day! And they’re not letting y’all leave? I didn’t know that. I’m glad you like the detail! This post turned out way longer than I expected even after I cut some stuff haha. I’ll keep it up!

You’re getting so close! I am so happy for you!!

Thank you! So excited!

I’ll never for the life of me understand why when it comes to cable/internet companies, apparently it’s totally OK to have a nearly complete monopoly. Where I live we have Charter as really the only viable option, and they sound pretty similar to Charter. Fortunately a new company came to town to take them on and I signed up ahead of time in order to support their build out. They’re promising way faster speeds and at a much cheaper price. Switching over was a no-brainer. I’m curious what StarLink will look like when it becomes active too.

Sorry, small part of the post but I have strong feelings lol

I mean I understand why – I assume it’s greed and money talking 🙂 . I haven’t heard of Charter, but will steer clear. We actually used RCN our last years in NYC and LOVED them. Seattle is slowly getting some more of those gigabit super fast internet companies out here, but they haven’t reached our apartment yet sadly. Glad you were able to switch and glad I won’t have to deal with these people for the foreseeable future 🙂 . And no worries about your strong feelings – let them out 😉 .

Hola Purple! I have been reading your blog for months, and this is my first comment! I wanted to congratulate you on how well you pivoted from one goal (nomadic travel, victory lap) to the other (spending more time with family). Also a question. What are the factors that will help you determine whether you proceed with the Roth contribution? Thanks for sharing your words!

Hola Tara! Thank you so much for commenting – they make my day 🙂 ! And thank you for saying that – flexibility is a main ‘pillar’ of my early retirement so I’ve got to 😉 .

The Roth is a weird one. I max my tax-advantage accounts every year and since I tested out of qualifying for a Trad IRA I’ve been filling a Roth. I was also planning to save 1 year of retirement expenses in cash.

However, with everything 2020 has thrown at us (COVID, market crash etc) I increased that to wanting to have 2 years of expenses in cash based on an optimistic vaccine timeline. So I’m now deciding if I think I’ll be able to save more than I forecast to have 2 years in cash and fill a Roth. It’s not looking likely that I can save an extra $6K after tax 😉 so I might have to put that goal aside for now.

I love how flexible you are with your plans. There have been lots of times in the past few months that I’ve been discouraged with cancelled plans, but it’s so important to just go with the flow in times like these! And always 🙂 . So kudos to you on your flexibility and finding the silver lining of being able to spend a lot of time with your loved ones rather than trekking around down under! Hoping you’ll be able to make it down there soon!

Thank you! It’s obviously not ideal, but I try to remember that in the grand scheme of my life cancelling plans or rescheduling them isn’t a huge deal. One day!

I have also put on the COVID 15 🙁 I had to go to work for a meeting for the first time in 4 months and didn’t fit into my work pants! Time to stop the constant snacking that seems to come with working at home (for me anyway)!

Oh no! I’m sorry, but I’m with you Aimee. We can do this! Being so close to the fridge is a challenge for me as well 🙂 .

Yesss Carry On!!!!!! I know Magenta (is that the color I was calling him? I forget…) read Fangirl–have you read it yet? Still one of my all time favs.

Also, this post is perfect because I was literally just looking around your new abode and thinking about how J and I need to start looking for a Craigslist dresser and some bookshelves to make it more homey! And a composting toilet? 🙂

I don’t know what his name is anymore like – Magenta? Mr. APL? MAPLe? He read Fangirl, but I haven’t been able to because our ex-friend borrowed it and then never gave it baaaack. Very sad. I need to request the eBook from the library. I’ll do that now before I forget. And just texted you about the rest of it 😉 .

our life is going swimmingly. the bills are paid we got it made in the shade.

gonna live in georgia for a year, eh? you’ll figure out how to have fun i’m sure.

Sweet! Enjoy that shade 🙂 . And I lived there for the first 17 years of my life – I think I’ve got this 😉 . I was just looking up local vineyards whose tastings I enjoy…

It sounds like everything is coming together, despite the chaos in the world! That’s great and a sign of how well you’d planned and can adjust. I’m sorry the final months are more hectic than celebratory, but glad it’s all going to work out.

Also, I love the Comcast thing. I hate that company more than anything, and all our worst customer service experiences have involved them. (With a close second to Verizon.). A Comcast recommendation being a covert cry for help is exactly right.

Shockingly it is 🙂 . This month is hectic, but I think the next two will be quite celebratory so don’t worry 😉 . Also I’m glad to know my hatred of Comcast is shared – you have great taste!

You have made an incredible amount of progress. I can’t wait to follow the next phase of your journey!

Yeah it doesn’t look like nothing when it’s all written out like that 😉 . And thank you!

Long time reader, first time commenter. I haven’t seen a great explanation for why FIRE enthusiasts don’t like the Roth IRA. It seems to me that if you’re maxing out your 401K and you have some extra taxed cash, then it’s not a bad idea to let it grow interest free in a Roth IRA. Does it have to do with the availability of funds? Or the tax liability later down the road? What are your thoughts and/or have you seen any articles?

Hi JD – Thank you for commenting! I haven’t personally seen FIRE people that don’t like the Roth IRA, but have seen general rules of thumb for the order in which you fill your investments, which is usually 401K (because of the tax savings and match) -> A) Traditional IRA (because of the tax savings) or B) Roth IRA (if you make too much to qualify for the Trad IRA tax savings) -> Taxable Account.

I follow that strategy and am totally not against a Roth – I’ve maxed one every year I didn’t quality for a tax-advantaged Trad IRA, but since I’m now increasing my cash allocation given the wild world we live in I might throw more cash on the pile instead of filling the Roth this year.

Yes, this is what we meant by art is an investment! Proud of you!

Haha thanks lady!