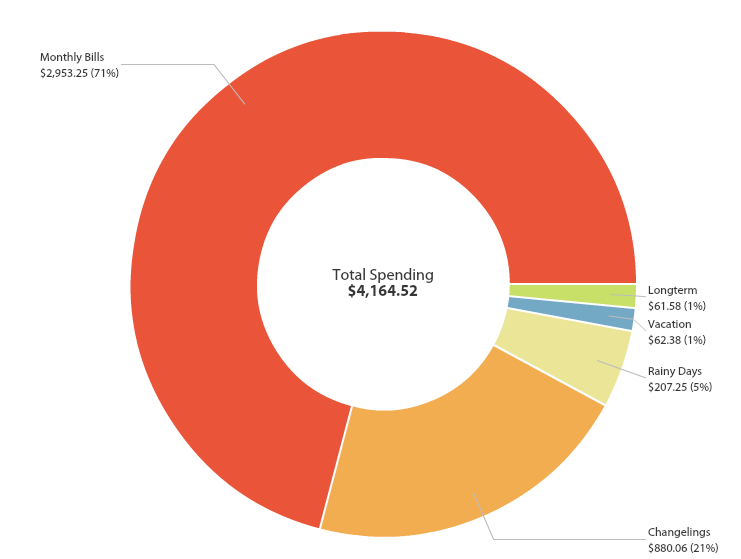

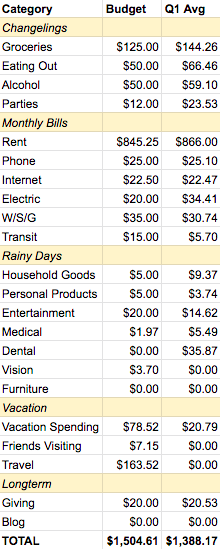

How is 2019 25% gone?! I feel like Christmas just happened! I guess time really does speed up as you get older…and while you’re having fun. Above is a snapshot of my Q1 spending from YNAB. Let’s get into what happened:

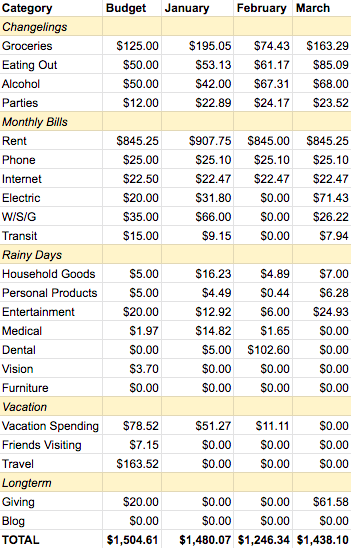

And for a month by month breakdown:

CHANGELINGS

I call this section “changelings” because they’re the items that change the most month to month. So what happened this quarter? I let the changelings get out of control!

Groceries – $144.26/month on average

I overshot my grocery budget ($125/month) despite being gone in Costa Rica for a week in February. We have also been getting fancier with our Weekly Supper Club menus. I don’t regret that, but I do need to keep an eye on this to make sure it doesn’t continue to increase.

Eating Out – $66.46/month on average

We went out with friends quite a bit this quarter. I’m happy to report that we only went out to eat when others were involved instead of 1/2 with friends and 1/2 without that we normally do.

Alcohol – $59.10/month on average

Well there goes my theory that completing a Dry January would decrease my alcohol costs overall. Oops! Spring seems to have come early in Seattle and the outdoor bars and beer gardens have been calling me. Time to reign it in!

Parties – $23.52/month on average

This category is for when we purchase wine or snacks to bring to someone’s house. This is double my allotted budget, but I don’t regret the spending so I guess it’s time to increase the parties budget!

MONTHLY BILLS

Pretty self-explanatory. This section doesn’t vary a lot month to month. Q1 spending in rent specifically was a little over budget because our annual rental insurance is all charged in January. Electric was a little higher than usual this quarter since we were still using the heater, but since Spring come early I expect that to decrease next quarter. And despite taking several Ubers around town like a princess I was still under my transit budget. These boots are made for walking!

RAINY DAYS

This section is named based on a principal in YNAB: saving a little for inevitable things that don’t happen monthly so when a rainy day hits you have the funds. This quarter that included paying about $100 for a dental filling, a karaoke booth, random household goods, our monthly Netflix subscription that we let our families use for free and theater viewings of Aquaman ($6 matinee at AMC before 12pm) and Captain Marvel (full price $12 matinee, but the seats were amazing and reclined so I’m saying WORTH IT!).

VACATION

Very little happened in this category since basically all of Costa Rica was pre-paid for. Usually I would have bought all my flights for the year in this quarter, but our apartment situation is currently up in the air so I’m trying to sort that out before locking myself into anything.

LONGTERM

This category is for you guessed it “longterm” items that come up rarely. The entire list includes the blog, my bike, giving, electronics, taxes, credit card fees, and moving expenses. This quarter all the costs in this category went into “Giving!”

OVERALL

So far this year I’ve spent $4,164.52, 23% of my $18,000 goal. It’s time to see if I can reign in these changelings and otherwise keep on chugging! To the rest of 2019!

What about you? How has your spending been lately? Are you on track to reach your goals?

You got this!! I totally understand the increased alcohol spending with nice weather showing up but now you’ve got me as an accountability buddy so don’t hesitate to ask me to talk you down when needed (which I should of asked last Thursday when I really needed that bottle of wine ahah). I feel like the grocery budget will be easier to lower in Spring/Summer/Fall with more yummy fruits & vegetables in season.

Way to go on the low transit costs especially considering that there was snow a few times in Seattle ;)!

Yay accountability buddies! I actually resisted both eating AND drinking out yesterday. My boy tried to tempt me because they were having some type of $3 sushi, $3 sake special. Nope! Resisted! Feel free to reach out if you need me to (virtually) slap a bottle of wine out of your hand 😉 .

I hope you’re right on the grocery budget! Not sure what I did there lol. And yeah the transit part was easy because Seattle shuts down in the snow lol. There were no buses or ubers to take during the storm. I’ll try to keep it up though I have been taking more ubers lately, but am happy to see that didn’t mess up that budget category. Anyway, let’s do this!!

2019 is 25% gone??? Where did the time go?

I love how detailed you’re making your spending categories, and especially the rainy days one. I always fall into the trap of “oh this $100 thing only happens once a year so I’m not gonna count it” but it *happens every year*!

Currently in China I don’t keep a budget beause in a ‘bad’ month I might spend like $300 in total. But when I eventually make my way back to Canada I’ll definitely be keeping an eye on things.

Hi There! I don’t know where the time went honestly. So glad you like my detailed categories! My partner thinks they’re too detailed, but I love having granular data to help me analyze my life.

And yeah it’s a good concept to have (a rainy day fund) since you’re right – SOMETHING happens every year even if it’s not the same thing. And $300 total is so impressive!! I’m curious to see how that changes when you’re back in Canada 😉 . Thanks so much for stopping by!

our spending is what i call normal but we don’t have formal goals. we save and invest and spend what’s left if we feel like it. it’s worked well so far but it helps we don’t have expensive tastes except for good wine. nice job on that steak. we are spending some bucks to have the attic studio in our house upgraded with electrical and drywall. we decide very carefully what is really an upgrade to us. that’s why we have a crappy kitchen but will soon have a sweet art space with no taupe colored granite.

I like your approach. I do the opposite just because I like the challenge of it (saving X amount and spending the rest). I see it as a little bit of a game. Thank you on the steak though our sous vide machine gets all the credit. I just seasoned it, put it in a bag and walked away. Good luck with your renovations! It’s awesome you’re so intentional about them!

My spending has been normal — so not great, not terrible — but I did some sort of math wrong when keeping out my monthly funds (I only get paid once a month). I may come up short at the very end of the month. I’m going to try to make my dollars stretch as best I can to see if I can avoid transferring in any more money (already had to do that once to pay the yard guy since I don’t have the normal cushion). Sigh. Hopefully, April to May (I get paid mid-month) will be better.

Oh no – I’m sorry that happened with your calculations (I only get paid once a month too and it’s super annoying and has messed me up in the past). I hope you can make those dollars stretch and can avoid another transfer. So happy to hear April and May will be better. You can do this!

I have a feeling with all the great draft beer options in Seattle, we’d probably spend that much on an evening or two there – I’d say you’re doing a good job haha.

Hahaha – thank you for another perspective 🙂 . I’ll try to go easier on myself.

Groceries are tough. We always go over our budget too on that. I budget $100 a week (for a family a four and this includes our food, all toiletries, diapers, formula for our kids, etc.) but we always go over a bit. My husband does our grocery shopping now and that’s part of it. When I did the shopping, I usually stayed under!

Haha – what’s different about your and your husband’s grocery shopping styles that leads to a discrepancy in the cost? I’m curious. $100 a week for a family of 4 is impressive (especially including all those household items)! I keep updating the budget I’m trying to hit based on what I actually spent the year before. Where did y’all get the $100/week number?

Those food pictures look incredible! I love seeing these budget posts because I think it really reveals that you don’t need to spend that much but you can still do things like hang out with friends, go to the movies, and eat delicious things. When are you going to do a roadtrip to Portland??

So glad you like them! And yeah people keep mentioning ‘deprivation’ to me, but I’m not seeing it lol. As for Portland, I thought you were leaving soon! How much time do you have left?? Maybe I can bribe someone to drive me (carfree over here) or I guess I could take the train. I LOVE TRAINS!

Interested in comments from someone who has been budgeting for a long time? The numbers seem really tight. Is this how you plan to live indefinitely? Or is it a temporary experiment in extreme frugality? Will it still be fun in a couple of years?

Where does a new pair of shoes come in? Or a new laptop? Or a root canal?

I like to keep the categories fairly broad and fairly generous. In any given month a single category might get exceeded, but compensated for by another category that was under budget.

I applaud your grocery budget. I don’t know how you can do it. I’m a careful grocery shopper. Our budget is $1,000 (CDN) per month for a family of four. We do buy a certain amount of convenience food, we have three cats and do spend a fair amount on dietary supplements. I also include all consumables (not just food) in that category (so, cleaning supplies, toilet paper, shampoo, etc.)

Keep tracking! Love your blog 🙂

I’m totally interested! The way I budget is based on reality and by that I mean my budget goals for each category are simply based on what I spent the previous year. I do not expect to spend that amount forever (see my Project Retirement Budget where I increase categories like groceries, eating out, alcohol and transit based on my current assumptions: https://apurplelife.com/2018/05/07/projected-retirement-budget/)

I really don’t see this as extreme frugality since it’s just based on the realities of my spending 🙂 . I don’t limit myself if I want something. A new pair of shoes, dental work and a new laptop have been in my spending the last few years (check out my previous annual spending posts and were then included in my budget assumptions for the next year).

If a category goes over I do the same as you – move money from another category as YNAB dictates. As for my grocery budget, I actually wrote a post about that too (https://apurplelife.com/2019/01/15/how-i-spend-125-a-month-on-groceries/). I thought that was a normal amount of spending so not too sure what I’m doing differently. I can see how multiple people, animals and consumables could definitely inflate that number. This is just for me though. Thank you for stopping by!

Nice job keeping it low Purple!

I envy your small numbers. I’m spending like 3x what you do! LOL 😀

Makes me think I could do a lot better! Kids don’t need to eat, right?

Thanks so much! And spending 3x my amount for 4x the number of people sounds like a win to me!! And yeah I don’t know much about kids, but I think I heard they are self-sustaining/don’t need to eat…maybe this is why I wasn’t a babysitter growing up…

I really like how detailed you are with your numbers. I work in finance and I’m not remotely as meticulous with numbers as your budget. Way to go on keeping expenses within your budget. Makes me also want to tighten my belt as well.

Thank you! And maybe it’s because you’re in finance that you’ll less meticulous 😉 . You already get enough of that at your day job I imagine. So glad I could help! Let me know how the budget tightening goes!

Hi Purple,

Great work having a budget and sticking to it. In this day and age, a lot of people have no idea where all of their money is going!

FI in no time!

Matt

Haha – that’s the goal! And I stuck to it for the ‘most’ part 🙂 . Time to reign it in this quarter! Thank you for stopping by!

A very good point made by working-at-home-man above… by even having a budget and tracking against it, you are miles ahead.

I had lunch with an old friend today… 45, separated, and broke. Has no idea where his money has gone for the last 20 years. No retirement savings and no emergency fund. Lost his job this year. How do educated people get here?

Oh no! I have friends like that too. It seems they get there by just avoiding the issue (if I don’t think about it then it will go away). If they want help they know I’m there for them, but a lot of people seem a little delusional that everything will just work out. I have no idea why.

Hey Purple!

I love how intentional you are with your spending! It seems you’ve found a way to have just what you want without spending a lot.

I’m still trying to figure that part out ha ha.

Congrats on staying under budget! Reminds me that I could stand to take a closer look at mine.

Hi Shawn! Thank you – I try lol. If I can help you figure yours out let me know! Good luck.

You’re killing it! Do you like a lot of craft brews? I am pretty whimpy when it comes to beer. Pilsners and lagers for me. We also saw Capital Marvel. 5/5 stars!

Thank you so much! I actually LOOOOVE dark beers – beers where you feel like you’re eating bread, but since I went keto those beers are no more 🙁 . Worth it to fit into my pants (and not buy more), but still sad. Awesome you like pils and lagers. I wish I loved them more. And yaaaas Captain Marvel! So glad you liked it. I’m not sure why the internet was giving it shit – great movie!

I love keto! I’ve done it on and off. Miller Lite and White Claws are my keto go to. A liquor and club soda or water is rough. The Capital Marvel hate is just from salty little boys on the internet who can’t stand women in lead rolls! I was basically crying watching the scene where it showed a montage of her standing up over and over again throughout her life. I hope so many young girls end up being Capital Marvel next Halloween! What a role model Brie Larson is.

OMG my friend is bringing White Claws to our pool party tonight. I had never heard of them. Definitely trying one now! And I’m all about vodka + lemonade MiO + water right now. Yummmm. And ahhh I should have suspected salty boys. That makes sense. She’s obvi the most powerful Avenger. It’s crazy. I loved that montage too! And I love Brie just as a person – so happy that she decided to accept this role. And hell yeah a superhero costume for ladies at Halloween that isn’t basically a catsuit (Black Widow) or showing a whole lot of skin unnecessarily (Wonder Woman) – I am DOWN! October is COLD!

Let me know if you like and it which is your fav! Black Cherry is mine!

So for science I tried black cheery, lime and raspberry. All were lovely, but black cheery was indeed delicious!

🙂

Burning Question: What Internet provider/plan do you use for $22.50 a month? I live in NJ and seem to be stuck with Comcast and lowest i have been able to get is $72 per month.

Many thanks! And goodluck on your continued progress.

Jim

$22.50 is my half of the internet so it’s $45 a month. I’m also on Comcast 🙂 . I call every year, say I want to cancel and they give me the intro rate ($45 or less). Last year I locked in a 2 year contract at that rate so I don’t have to be bothered to call again in a year. I’d suggest trying that or if RCN is available in your area switch them they were AWESOME when we were in NYC. And thanks so much!!

Love it! I have been pondering whether i’d be willing to walk away from internet if they called my bluff. I might just do it. Only issue is I work from home one to sometimes two days a week using internet, so i’d be trading that for my 35 minute commute each way. Thanks for the super fast response!!

You don’t actually have to leave even if they call your bluff – just say “never mind” or “I need to think about it” 🙂 . It’s just that the people who can usually grant the discounts are in the cancellation department (as it’s a ‘last resort’ for them). Though if you have other internet options in your area I say go for it! Save that 35 minute commute! And no problem 🙂 – happy to help.

Thanks FIRE friend! Great talking shop with you.

Where do you budget in for purple hair? If you manage to do that for $5/ month under personal products, please share your secrets! Even when doing my hair myself, it usually costs me about $20-35 in products for fun color hair.

Good question. I didn’t dye my quarter so it wasn’t included in that amount. If you’re looking for that it’s in the budget check-in below. It costs me a similar amount upfront as well, but I usually get the large buckets of bleach and dye so subsequent times are included in that cost as well.

https://apurplelife.com/2019/10/01/q3-budget-check-in-2019/