If you’re on the road to financial Independence, you’ve encountered this unfortunate, but undeniable truth: It’s mostly a long and tedious slog. While discovering you can save enough so you don’t need to work anymore is a battle won in and of itself, the length of the ‘war’ in front of you can be daunting. For some of us, we are working towards a goal 10, 15 or even 20 years in the future.

To put into perspective how crazy this long-term of a goal might seem, my colleagues look at me weird when I ask for PTO permission 10 months in advance…I gotta book my reward tickets people! The road to FI can be quite long and for some people, that fact alone can make them give up before even trying (I’m sensing a ‘get rich quick scheme’ coming on…Who wants to buy my leggings/juice cleanse/make up?!)

This road and long-term investing in general is just that: long-term and over the past 4+ years I’ve come up with a multitude of ways to try and quantify this crazy, huge goal to make it seem relatively close and tangible while giving me indicators that I am slowly, but surely inching closer to it.

The First Year

Before I dive into the specifics, I’d like to address a special time in this journey: The First Year. If you’re in Year 1 of your journey, you might have no idea what I’m talking about when I say it’s mostly a slog. In my first year I was extremely busy and (happily) distracted. There was so much to learn and plan! I dove head first into all the books, blogs and forums I could find to learn how this crazy FI idea worked.

I came home from work and excitedly started reading the tax code to see how I could make some of these FI strategies work (and that is not normal for me – I’m not THAT much of a nerd 😉 ). I was constantly taking notes and running (and re-running) simulations. That first year I was a sponge absorbing everything and constantly learning until I created THE PLAN: How I was going to reach financial independence in 10 years despite living in Manhattan and making about half of what I do now.

For the rest of the year I executed THE PLAN: I experimented and saw if I could reduce any expenses without decreasing my happiness. I was able to reduce my expenses and subsequently increased the amount I was investing. I completed every step of my plan and then after that flurry of a year evaporated around me I wondered…NOW WHAT?!?

The Remaining Years

As I often do, I glanced at the countdown clock that’s on every page of this site today. Despite accepting that my original road to FI would last 10 years, I look at the 1 year and 4 months I have left and it STILL feels far away. I wrote briefly about how being 2 years from a huge goal seems harder than being 10 years from it because it feels REAL and as a result impatience sets in. All this to say I need the tools I built years ago even more now to help me keep my eye on the prize! This is how I stay motivated:

1. Quantify It

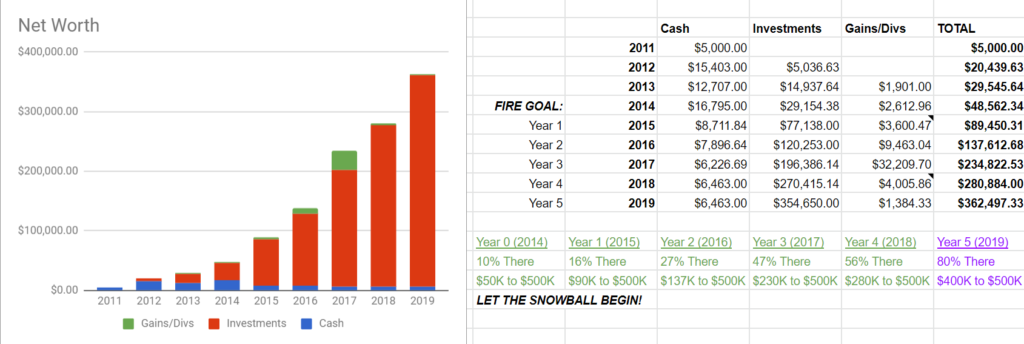

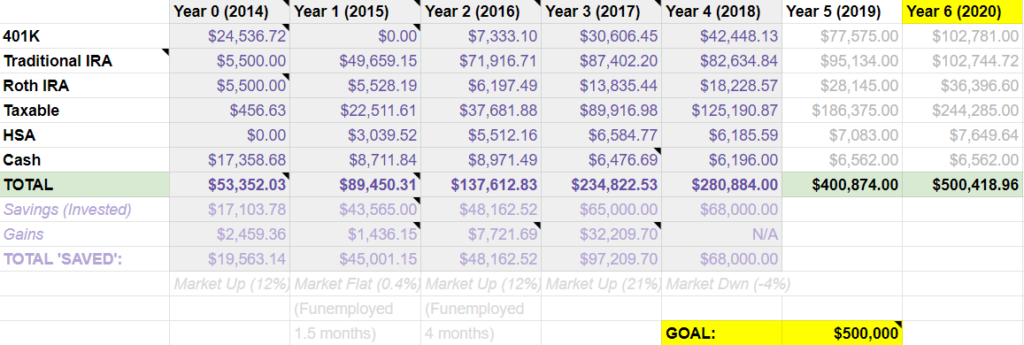

As you may know I’m a data nerd (I know – who could have guessed?!) and I love spreadsheets, charts and graphs. At the beginning of this journey I created some pretty standard excel sheets to track my progress:

An Annual Savings Tracker

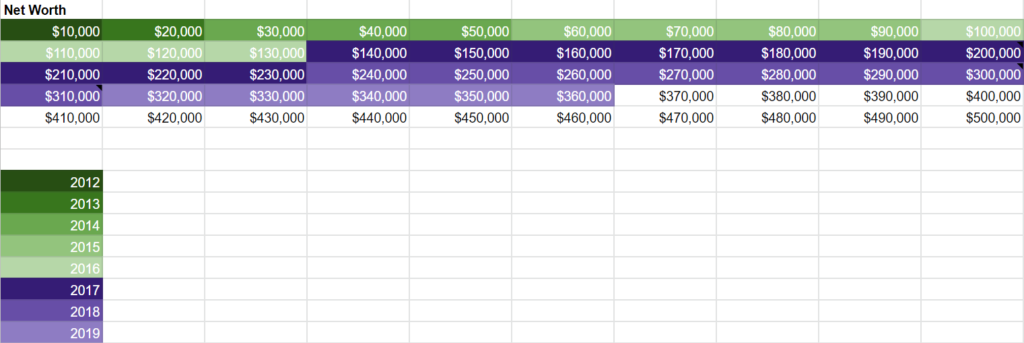

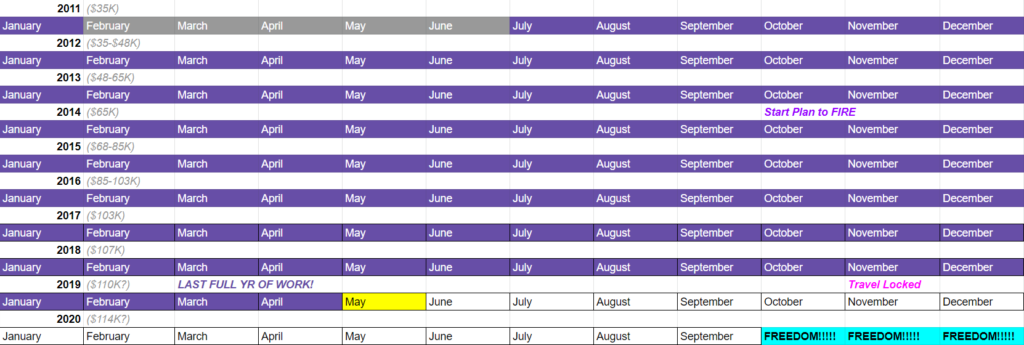

A Net Worth Tracker

A Retirement Projection Tracker

A Milestone Tracker

This one I won’t show because it has too much identifying information, but I have a chart that shows each month what visitors we’ll be hosting and what trips we’ll be taking as well as what I have invested, what 4% of that amount is and what that could translate to. For example, this month 4% of the amount I have invested would net me $14,000 a year. That’s enough to buy 2 of those discounted First Class Emirates tickets to the Maldives I enjoyed, EVERY YEAR for the REST OF MY LIFE.

This spin helps put these numbers on a screen into something tangible. This goes back to the example I’ve mentioned before that every time I move money from my checking account into my investments I imagine stacking X number of $1,000 MacBook laptops in my closet instead of pressing “Confirm” on a computer and watching numbers fly across the Interwebs.

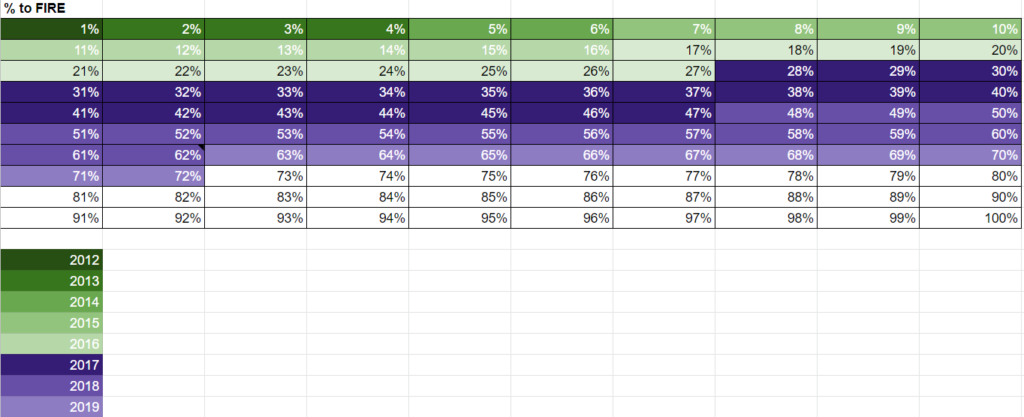

2. Visualize It

I’m a visual person (in case the idea of hoarding laptops in my closet didn’t tip you off) so in addition to the charts above, I have also created ways to help me see each tiny step I’m making towards my goal. These include:

A Percent To FIRE Chart

A Visual Savings Chart

A Visual Countdown Chart

3. Celebrate It

Creating the above charts makes it easy to see that there are a multitude of smaller wins to celebrate and they should be celebrated! When we discovered that my partner and I were both 10 years or less from retirement we celebrated with a home cooked steak dinner. Every time we hit a $50,000 milestone together or separately we raise a glass of lovely boxed wine 😉 in acknowledgement. Instead of waiting for our ‘retirement party’ we have mini parties along the way, which help reinforce our progress and how far we’ve come.

Conclusion

Each time I can update my charts with new information or move any of the above visualizations forward, I feel a sense of accomplishment. Every time I feel empowered enough to tell my boss exactly what I do and don’t want, I feel a sense of progress. There is not just a start and finish line to financial independence. On this path there are hundreds of accomplishments to grab and celebrate. I hope seeing how I identify and internalize them will help you do the same.

How do you stay motivated on the path to financial independence? Have you created any kind of tricks or mindset shifts to help yourself stay focused?

Awesome post, Purple!

Would you like to share your spreadsheets eventually?

Cheers,

your friend R2FI

Yeah, I’d love to borrow the format of these spreadsheets to stay on track too! 🙂

Added to the to do list! Thanks for stopping by!

Thank you! And huh – I have literally never thought of sharing them. Good to know there’s an interest! I’ll put on my to-do list to clean them up and figure out a way to get them out into the world! Thanks for the great idea!

Need I tell you how much I love this post??? I doubt it cause you know I’m part of the not-so-secret “Spread Sheet Nerds Unite” club 😂.

I have a few visual spread sheets and I love these so much. I add the kids ages that year and info like what grade they will be in. Every time I color one of those boxes and change some info it makes me feel so motivated! Now you gave me some new ideas of spreadsheets to help make those next 5ish years go by faster :D.

Oh and also, how that first year just flies by! I’ve found that if I can get engrossed in learning something, it helps make it go faster, like how I focused on paleo + reducing our expenses last year. It’s still not quite like how engulfed I was with learning about FIRE that first year though. Luckily this blogging thing also helps keep the motivation up for me :).

Haha you need not – thank you for inspiring it! I can see how adding the kiddos ages and milestones like that would help with perspective. And yes please let me know if these help you at all!

You’re spot on with learning making time fly (in a good way). I was actually just writing notes for my 1 year blogiversary post and that was one of my points – learning everything that goes into blog has been so all consuming that time has been flying. I wonder what other unsuspectingly all-consuming hobbies like that are out there. I imagine anything digital since you can’t actually see everything that goes into it? Happy blogging is helping you stay motivated!

These tips all seem great for motivation especially for those who’s income is such that the saving will require some pretty drastic lifestyle changes. The more change, the more motivation needed. I think celebrating milestones like you do is important as well. As the goal gets closer the other I would add is to map out what life post FI will look like and start to realize as much of it as possible now. For example fitness, meditation, and personal growth stuff are all free. Building those before FI is reached help make FI a continuation rather than some false end point. It helps motivate by realizing some benefits that the FI journey has already provided while on the path.

That’s an interesting point (the more change, the more motivation needed). I’m totally with you on living the FI life you want while on the path as well – that’s why I’ve been increasing the number of weeks I work from other locations and have people come to visit to take advantage of my remote work situation. Personal growth is another good point that I’ve been trying to tackle – teaching myself Spanish and calligraphy instead of waiting for retirement. There are definitely benefits to the FI path before you have completed it.

Wow, love all the charts and spreadsheets. I’ve built many that are similar for long term tracking, but like your short term milestones charts. Once we finish downsizing our house and see that big jump, we’ll be in the slog. I’m not sure I can find any other big accelerators after three years of obsessing! Time to implement the smaller win tracking.

Thanks! Yeah I think we’ve accelerated as much as possible personally. After a while there’s not really anything more you can do. Yes to smaller milestone wins!!

You’re right. The first year requires a lot of lifestyle changes, but it’s a long slog after that. I think the key is to build up a good routine and stick to it. Once you have that, the years will roll by. Of course, when you get closer to the goal, it can be distracting.

To keep focus, I usually keep a percentage. If I have 2 years left, then I track the percentage. After a year, I’ll be halfway (50%). Etc…

I like that percentage approach! I’ll have to add that to my list. A good routine sounds like a good idea – I should probably institute one…but I love variety…though I could build that into my routine 🙂 . Thanks for stopping by!

i don’t know if we ever had a date or number in mind and still don’t. here’s how it worked in my house. i was working lots of mandatory and lucrative overtime a few years ago. i spent almost none of this on our lives as we had plenty of cash flow at the time. i bought a few riskier growth stocks in our after tax brokerage with this blood money. i’m not talking speculation like alligator farms or bitcoin, just a few companies that i thought had a future. a couple of those have gone on to 3x or more gains in 3 years so that helped.

Not having a date or number is probably a better approach, but then what would I track obsessively 😉 . Your path sounds like a pretty solid one – and as unique as the person that created it 🙂 .

“To put into perspective how crazy this long-term of a goal might seem, my colleagues look at me weird when I ask for PTO permission 10 months in advance…I gotta book my reward tickets people!”

That’s me!! I get this reaction too!! Thanks for sharing this!!

Glad I’m not the only one! And anytime!

Love your charts, very nice. Reminds me of that quote “well life is a slog, so why shouldn’t other things in life be a slog too?”

Thank you! And haha I haven’t heard that quote before.

You would have all of those charts. It motivates me just to look at them. I have a lot longer but I try to just pretend like I never found FIRE and like I’m going to work forever. If I trick myself long enough, then when I realize that I don’t actually have to work forever, it feels great 🙂

Charts seem a little more realistic.

Haha – I love charts. Glad they’re motivating! I like your approach – it sounds like it would really help with my impatience 🙂 . While charts seem a little more realistic, your way sounds really healthy.

Yaasss, I love this, I can’t wait until I FIRE – which is going to be still ten years. At the one hand, time flies by but on the other hand, it is taking too long. After you’ve adjusted your spending and tracked it all down, the waiting game begins. So yes I 100% get where you’re coming from.

As an excel spreadsheet enthusiast, I approve those sheets. I can spend hours and hours making sheets haha – good thing that’s also what I do during my day job.

So exciting that your FIRE date is coming up relatively soon!

Time is a weird beast like that (flying and yet still feels far away). Lol – so glad you approve. That’s awesome you can make this stuff during your day job. And thank you!

My financial independence won’t come until retirement age, so I definitely need to find a way to celebrate small wins to stay sane! I think that really is the right idea. Rather than working toward one huge goal, you’re working toward a bunch of smaller ones. So it doesn’t feel like as much of a slog because you’re routinely hitting milestones.

Now I just have to figure out what those milestones should be…

It’s working for me so far – I hope it works for you too! As for milestones I think it depends on what motivates you – I try to cover all the basis because they all energize me – new net worth high, new passive income achievement (like the Emirates example), new behavior I did at work as a result of feeling more financially secure etc. I’m curious to know what you decide!

You seem so motivated to me! I was surprised by this title.

It’s great to hear your honesty and advice on this topic (especially offering perspective for me and other people who are REALLY far off). I especially love your idea of little celebrations. I need to do that more for myself and my partner.

Maybe motivated wasn’t the right word 🙂 I suck at titles. I’m an impatient person by nature so keeping my eye on the prize and not chasing a new shiny object is hard for me (e.g. “why am I saving so much money – I should just quit now and travel until the money runs out!”) so helping myself see progress is key lol. So happy it could help! Let me know if you institute little celebrations! I’d love to hear about it.

I’ve come to the realization that celebrating the small successes along the FIRE journey is crucial. We within the FIRE community don’t like to spend money at all but quite often spending a small amount of money to celebrate these small successes can keep you motivated for the long run.

And yea, spreadsheets, those are totally awesome (I’m a spreadsheet nerd lol).

Yeah – I’m all about spending money on things I want. I’m lucky that what I want is usually inexpensive (sous vide steak at home and a fancy drink enjoyed on my couch). I’m with you! And so glad you like the spreadsheets!!

Tracking milestones like, lean,flex,full and fat FIRE has helped me along the way. I know it’s going to come faster than I thought and I may be able to reduce work as I get closer but it makes everything in between feel daunting!

That’s a good idea! I’m going to add those milestones to my celebration list. I’m with you – big goals a long time in the making are very daunting and it’s easier to break them down into chunks. Seems like you already have that covered! I hope your journey does indeed go faster than you anticipated!