Yeah, I know it’s not Tuesday.

I had to interrupt my regularly scheduled programming for this BREAKING NEWS!…That I guess the title gave away…Oops. Anyway, I HIT MY FINANCIAL INDEPENDENCE NUMBER!!!

My goal before quitting in September was to hit a net worth of $500,000. If you want to know the details of why I’m comfortable retiring with that amount feel free to check out an entire essay long post about it here.

So, after 9 years of working, including 5.5 years of intentionally saving, I have finally reached my goal! And of course, since everything involving me is over-dramatic and ridiculous, hitting this number was a bit of an emotional rollercoaster.

Given everything that’s happening in the world, I wasn’t sure if I would reach my goal. I also still have $24,000 that I’m going to save before I quit, so when the market started getting me close to my goal, even without those savings, my brain went on red alert. And then this happened:

UPDATE: Don't tease me market! I don't get paid until the 5th😬! pic.twitter.com/lPKNKbtK74

— A Purple Life (@APurpleLifeBlog) July 20, 2020

I told my partner and Mom what had (almost) happened and how close I was and they had some ridiculous and hilarious reactions including:

Mom: What if I loan you $2K until you get paid in a few days?

Me: NO! That’s totally cheating!

Partner (referencing how we pre-paid for our 2 monthly AirBnBs for August and September): I think in business accounting you would count a prepayment as an asset until the month you actually use it.

Me: Buuuut I already actually paid it and paid off that credit card so NO!

Interestingly, it turns out my partner’s suggestion is an actual thing under the “accrual basis of accounting method”, which I do not use 🙂 . Anyway, those two are cute and silly.

They really wanted me to reach my goal, which I knew I could do if the market held for a few more days and I got paid and relied on my actual income instead of the wild stock market of 2020, but then a few days before my paycheck hit I opened my account and:

Yesterday I hit my official $500,000 goal without any of the (ridiculous) ‘creative accounting’ suggestions of my loved ones 🙂 . It will probably surprise none of you that after I sent the above tweets, I calculated what kind of market moves would need to happen for me to hit my goal without waiting for my next paycheck.

And, of course, because I am dedicated (*cough* neurotic *cough*), I checked live stock market updates throughout the day to see what was up. It was actually a pretty sweet distraction between the constant waiting and checking in on Facebook Marketplace that I’ve been having to do to complete Operation Get Rid Of Everything 🙂 .

How It Felt

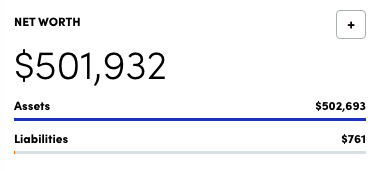

I was prepared to feel nothing when I saw my net worth number tick slightly higher. I had been warned it was anti-climactic by this powerful post from the Mad FIentist. So, I’m surprised to report that that was not the case when I saw this:

My heart was pounding, I was sweating (can I blame the Seattle summer heat?) and my hands were slightly shaking when it sank in that the goal I’d strived for longer than any other had finally come to fruition. I told my partner (or more like shouted…) the news, we did an air high-five across the room and then I had to keep my squealing to a minimum because he immediately got on a video call for work – Perfect timing 🙂 .

Me Vs The Market

Now, enough with those squishy emotions. Let’s get into some nerdy analysis! I was curious how much of my net worth is from after-tax savings from my earnings, compared to how much the market contributed, so let’s look at it! Below are my earnings recorded from the social security administration:

|

Work Year

|

Taxed Social Security Earnings

|

Taxed Medicare Earnings

|

|---|---|---|

| 2020 | $113,513 | $113,513 |

| 2019 | $111,156 | $111,156 |

| 2018 | $104,616 | $104,616 |

| 2017 | $100,908 | $100,908 |

| 2016 | $53,100 | $53,100 |

| 2015 | $64,669 | $64,669 |

| 2014 | $62,535 | $62,535 |

| 2013 | $47,389 | $47,389 |

| 2012 | $36,750 | $36,750 |

| 2011 | $18,952 | $18,952 |

| 2010 | $0 | $0 |

| 2009 | $0 | $0 |

| 2008 | $2,880 | $2,880 |

| 2007 | $0 | $0 |

| 2006 | $0 | $0 |

| 2005 | $408 | $408 |

2020 earnings are estimated and we’ve only made it halfway through the year so only half have been counted in my calculations. Also, strangely, SSA actually has my 2019 Medicare taxed earnings as almost double what I actually made, so I corrected that on the table above. I’m not sure if that means they’re still working on calculating it somehow or if an error has officially been made, but I’ll wait and see on that for now.

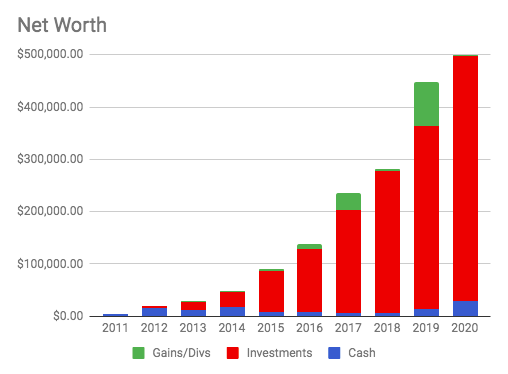

Unsurprisingly, after removing my taxes (about 25%) and my spending (about $18K/year now), the market contributed approximately 24% of this $500K. After a certain point, the growth started feeling exponential because it was – the market had my back:

How I Celebrated

Well, I wish I could tell you we did something wild and wonderful like having fireworks going off in the distance while we popped champagne on a yacht and tried on our new monocles while laughing with our heads thrown back (I assume The Rich People ClubTM sends out monogrammed monocles as soon as you are approaching ‘big money’ 😉 ).

Unfortunately, we are living in a COVID world AND my partner and I are in the final stretch of Operation Get Rid Of Everything before we leave our apartment and become nomads next week. So, we celebrated surrounded by a lack of furniture in a weirdly empty apartment. We danced to a silly song we enjoy and then started arguing about cash allocations because of course we would 🙂 .

After that I started messaging with a random stranger I met on the internet (from a Buy Nothing Group don’t worry 🙂 ) about a Crockpot he was late to pick up. And then life continued as normal with an occasional, random excited squeal from me thrown in for funsies.

What’s Next?

I started writing this blog when I had a little over $50,000 at the beginning of 2015 and now I have 10x that. It’s almost too wild to contemplate. Next up, I’m quitting my career in September and then I’m going to update y’all every step of the way about what I get up to in retirement. Thank you so much for being here and for your support during this journey. I really appreciate it! And, finally:

How are your financial goals going during this weird and wild year?

Discover more from A Purple Life

Subscribe to get the latest posts sent to your email.

Love it! Congratulations!!

You did it 😍

Looking foward to follow your journey!

Thank you! And yeah I can hardly believe it haha. We’ll see what happens 🙂 .

Wow Purple, that is FANTASTIC!!!! Such a great job and very well done! Thanks to you for sharing your journey with all of us, and doing it in your lovely, intelligent, easy going way. Woohoo!!!!!

Thank you Kathleen! And flattery will get you everywhere 😉 . Yay!!

Well done Purple!!!! Thanks for being an inspiration and showing that slowly but surely wins the race.

Thank you Giles! I’m a regular tortoise over here 🙂 .

Well done on staying the course!!

Thanks Tony!

Congrats! I have to tell you that I just discovered the FIRE community a few months ago, and it was from a blog post of yours, and as a result I jumped all the way in! I’ve read all your posts and many others (MMM, Mad Fientist, Paula Pant, etc) as well as consumed most of the ChooseFI podcasts. I went from spending all of my (high) income to saving about 75% just since April. Now I’m selling my house and downsizing and waiting for my lease to be up to turn in my car.

In other words, you changed my life with this blog of yours and I wanted you to know that. Good luck on your journey, I can’t wait to follow you to see what you do next!

Oh my goodness Kate you made me tear up!!! Thank you so much for telling me that. It’s so amazing how you’ve changed your life. Wow. Thank you and good luck on YOUR journey!

Good for you. Congratulations!!! You are an inspiration. Hopefully other peope will follow your journey.

Thank you Alain! I’m just here to do my own thing, but if people want to follow along that’s cool too 😉 .

Fun post. Congratulations on reaching your goal. I’m sure the ride will only get better!

Glad you enjoyed it and thank you! I agree 😉 .

Congrats, absolutely amazing! No better feeling than chasing something for so many years and finally reaching it. I really can’t wait to follow up on your journey post-FI 🙂

Thank you! It really is an amazing feeling. I’ve never worked for anything for this many years haha. Definitely different than reaching one of my smaller goals. Anyway, I’ll be sure to keep y’all updated!

SEXY TIME!!!

J. Money this is a family friendly website!…Obviously I’m just kidding (because I love my swears) and I know that’s not what you meant 😉 . Thank you!

What an awesome day. Congrats! For some reason texting the guy about the crockpot in the middle

Of your celebration really made me laugh. Lol. September will be here before you know it!

Thank you! And haha – real life is often ridiculous 😉 and yes so soon!

Very exciting news…many congrats!

Thank you David! I admit I freaked out a bit 🙂 .

As an accountant, I appreciate the accrual joke. Unlike businesses, I like to think that we both operate on the cash method haha!

In any case, this is awesome news and big time congrats! Hoping that you’re able to further grow your war chest in the next two months 🙂

P.S. – I just realized that you’re going to save $24K in the next 2 months. That’s superhero level, and I love it! Unless you already explained it in another post, I’m just curious how. Congrats again!

Haha my partner said he feels vindicated by this comment 🙂 . I do indeed operate on the cash method lol. And haha yeah – the $24K is a bit of a happy accident and is happening because:

1. We pre-paid that rent I mentioned so we don’t have rent payments the next two months, which is about 70% of my budget – all that is going towards savings instead

2. I haven’t taken any PTO this year so I’m getting paid out for all of it – about $4500 pre-tax

Congratulations! Super exciting! Surely your monocle is just delayed in transit due to COVID.

Interestingly, when you mentioned the accrual method, we kind of do a version of that for budgeting proposes only. When we pay for an Airbnb or car rental, we post-date the transaction to the month it will actually occur in. As nomads, it makes it really easy to see how much each city we stay in cost.

That said, we are still including those transactions in our net worth calculations real time.

Mabuhay!

Haha that explains the monocle delay! Here I thought rich people were immune to those types of things 😉 . That’s a great point about the accruals and a wonderful idea for when we’re nomads! I’ll want to separate out different city costs as well. And thank you!

Wow wow wow wow, Purple!!! What an amazing accomplishment. What hard work. Thank you for being so open about your journey to inspire the ones right behind you. ❤️❤️❤️

Thank you Hannah and of course – happy to help if I can!

I love all of this, but especially the Elle Woods GIF at the end. Plus the use of ‘funsies’

Yay Josh! So glad my first (and last?) use of GIFs and “funsies” was successful 🙂 !

A huuuuge congrats!

So in the end you didn’t send the BTC to Elon Musk, did you? 😀

Haha I did not – he’d try to steal my thunder 😉 . Thank you Mr. RIP! I’m excited to follow in your “StupidFI” footsteps 🙂 .

Well deserved—congratulations! Thanks for allowing us to vicariously bask in your FIRE glory 🙂

Thank you Torrie and of course! It’s more fun to celebrate with friends 🙂 .

Congratulations, Purple! Best news I’ve had all week 🙂

How you’ve made positive FIRE strides in 2020 is beyond me, as my progress is all “two steps back”. You da bomb!

Thank you Neil! So glad I could help your week and yeah I’m surprised as well given how 2020 is going, but if stonks want to be silly right now I’m here for it.

Congratulations, Purple! Thanks for not waiting until Tuesday to share the breaking news… 🙂

Haha yeah patience is NOT my strong suit 😉 . And thank you!

CONGRATS!!! So happy for you! I’m glad to hear it was such a euphoric moment for you (I was more in the Madfientist camp myself, maybe because I can’t quite trust the market). So can we take this line as a formal commitment? 🙂

“then I’m going to update y’all every step of the way about what I get up to during the next 70 years. ”

I really hope you continue to blog for that long so we can hear about your adventures!

Thank you! Yeah I was surprised and glad too about that. Fair on not trusting the market haha – especially now 🙂 . I feel a little better that I’m going to live on my cash cushion for a few years and then peek back in to see what the market did.

And haha I can’t even promise I’ll be alive in 70 years (morbid, but true) so sadly that is not a formal commitment BUT I can promise I’ll keep writing weekly until October 2021 and then I’ll reassess if I need to decrease that to fit into my retired lifestyle. But that’s something 🙂 !

Ahhhhhh I may have squealed a little for you too 🥳🥳🥳

Yaaas let the squealing commence!

Yeah congrats Purple, and the perfect time for some good news During a challenging 2020. When I first hit my Austin Powers villain goal of $1M! I totally wanted to celebrate but I didn’t feel ok about asking anyone to celebrate with me since few were following my FI sort of lifestyle and would have understood. Still I had a mini party in my head on my own…and it was glorious. Congrats and a toast to your milestone 🙂

Thank you! And a mini party in your head still sounds fun 🙂 . Cheers!

Way to go, Purple! Your hard work and dedication paid off. You are an inspiration! Enjoy the next 70 years! 🎉🎉😁

Thank you so much Aaron!!

Congrats Purple that is amazing stuff! So happy for you.

Thank you Bob!!

Congratulations! Very happy for you

Thank you John!

I only found your blog recently but love it. Congrats! That’s an incredible accomplishment. I Hope you keep writing to let us all know your post-retirement dos and donts.

Thank you Steve! I’ll be keeping my weekly posting schedule for at least a year into retirement so don’t worry – I’ll still be here for some ridiculous entertainment 🙂 .

Congratulations!!! I love your transparency in this post & your financial updates. You are awesome!

Thank you so much Diana!! I’ll keep it up then 😉 .

Throwing flower petals in your direction, how EXCITING!!

We don’t have a specific goal this year other than hoarding like Smaug since so many things are uncertain and I’m trying to be kinder to my micromanaging money mind. 😉

Yes I feel them raining down on me! And haha I feel you on hoarding like Smaug. Deep breaths and bask in that pile of gold you’re laying on 😉 .

Congratulations and well done!

Thank you Weenie!

Happy for you from random internet stranger : )

Hahaha thank you Justine!

So happy for you!

And as an accountant, I love your partner’s accruals idea 😂 but as I do personal budgeting on a cash basis, I agree with you it would have been cheating!

Thank you Aimee! And haha don’t encourage him 😉 . Cash basis for the win!

Achieving FI at such a young age is a huge achievement and a great inspiration.

My wife and I set 2024 for our FI-Target, until then we will have reached at least 1 Mio. in Investments generating roughly 40‘000 per year. I will be 45 when reaching FI and looking forward to, but we already enjoy the process, so many positive side effects and learnings.

2020 was tough so far, so much uncertainty and concerned for loved ones and everyone‘s health.

Stay safe and all the best!

Cheers

Thank you! That sounds like an awesome goal and I love that you’re enjoying the process as well. That was a key consideration for me too. 2020 has indeed been rough, but I’m optimistic the future will be brighter. You too!

You are the bee’s knees kid! A lot of people talk big, you have done big. That’s going to inspire a lot of people.

Haha thank you and I hope so!

So happy for you!!!! So glad you were able to “feel it” too and truly get excited for yourself. I’ve listened to a lot of podcasts where the dudes were like, “Yeah.. I reached 1 million, saw it, and it didn’t change me much.” I’m just like…????

You deserve to get excited for the dream life ahead of you. And if it dips back down below for a little while, hold tight to this moment, know it will happen again, and never forget what a badass thing you’ve done.

As for anyone reading, I started blogging at a similar time as APL. We had a similar net-worth at the time. She has blown me out of the water with her high earning potential, simple living, and investments. Me? Well, my house ate my money and I keep having kids. But she lets me know it is possible!!! Ha ha ha.

Thank you lady!! I prepared for the worst, but was definitely happy I felt something haha. Great advice on if the market falls again – strangely I kind of stopped paying attention to it after this, but is…different for me 🙂 . And oh no I’m sorry your house ate your money! You’re too kind lady.

Congratulations, Purple!! It seems only fitting that yesterday, the day you hit your FI/RE number, there was a massive storm here in NYC, your former home, complete with PURPLE LIGHTNING!! AND strikes near the Statue of LIBERTY! Boom! Way to go!! And continued Joy in your Journey!

https://gothamist.com/news/videos-intense-thunderstorms-unleash-purple-lightning-nyc-statue-liberty?mc_cid=21ea3c92a8&mc_eid=96fcfe354d

Thank you and WHAT?! I didn’t hear about that! That’s SO cool! Like the Earth was celebrating with me 🙂 !!

This is great!!! I LOVE following your journey and I can’t wait for what September will bring!

Thank you so much!! I’m so happy to hear you’ve been enjoying it!

Congrats, great news!

I hit my number about 1 year ago. So yes, for me – got the OMY syndrome…+ was worried with what is going on in the country so wanted to wait to see election results + also worried a bit about what will I do next, will I be happier with not working or will I be bored? Not worried about the next 2-3 years, more about the following 40… anyways need to be ‘there’ in my head, not just on paper I guess.

Can’t wait to see how you will find your new life, might give me ideas!

Thank you Eric! That’s awesome about hitting your number. Sounds like you’re doing some awesome thinking to prepare yourself if/when you decide to quit. And I’ll keep y’all posted 🙂 .

Congrats and welcome to the club! I am excited to see the next chapter of your journey. We were planning to hit SE Asia this fall, but we decided to put that off for a bit…. for obvious reasons. Perhaps our paths will cross eventually. Now go get rid of the rest of that stuff!

Thank you – excited to join 😉 ! I’m sorry about your travel plans, but YES our paths will indeed cross when travel is a thing again 🙂 . I’m planning to be all over the place. And aaaah don’t remind me haha. Just kidding – I’ll get back to it now 🙂 .

I just got goosebumps! So excited for you, CONGRATULATIONS!

Aaah thank you Eileen!!

Wow! This is awesome – congrats. I wish we discovered FIRE in our 20s! We just hit our FI number this year in 2020, and we FIREd in our late 30s / early 40s with two kids. Never too late?! I look forward to seeing what is next up on your adventure.

-Tara of Four Take Flight

Thank you Tara and congratulations on hitting your number! It’s definitely never too late. I’m curious what’s next too 😉 .

Congratulations! So exciting. Very proud of you.

Thank you CG!

Congratulations! You did it! I’m so happy for you 🙂

The market was no match to your determination, haha!

Your laser like focus & single mindedness on achieving this goal is an inspiration to me.

Looking forward to following the next phase of your life!

Thank you!! You are too kind. I’m looking forward to it too 😉 .

Ahhhh that’s awesome! (A little late to the party, but anyway-) CONGRATULATIONS! This is a huge achievement. If you can do this, you can do anything! You should be incredibly proud of yourself and you’re an inspiration for the rest of us. Hopefully you did end up celebrating with something more than an argument about cash allocations lol.

I hope you continue sharing your FI journey with us, and let us know how the next chapter goes.

Thank you! And I’m still celebrating over here so I don’t think you’re late 😉 . You are so kind – also arguing about cash allocations is fun for us so don’t worry 🙂 . Last week we were in the depths of getting rid of everything, but this week we’re celebrating by getting takeout from 1-2 of of our favorite restaurants, watching movies together and enjoying the summer weather! I will definitely continue keeping y’all updated. Thank you for stopping by!

AH! Congratulations!!! Definitely an inspiration to know that you hit your numbers early, and screw the idea that it’s anything but a celebration! WOOHOO! You did it!!

Thank you!! And yeah hitting it early in the hellscape that has been 2020 was a surprise 🙂 . Woohoo time to celebrate!

Congratulations! I am also impressed by your big salary jump back in 2016.

I may be “retiring” along with you but under very different circumstances. I should be more scared but life is too short to work for a terrible boss.

Thank you! The salary jump is misleading there because it wasn’t my salary that increased – it was the first time I stayed at a job a full calendar year so the whole salary was recorded 😉 . My actual salary jump there was $20K. Congratulations on your retirement! I too lean on the side of “life is too short” instead of “but what if” 🙂 .

Hey, congratulations! Halfway to dos commas and you’re not even aiming for them.

Now, live life and worry even less. That’s the trick.

Thank you Chris! And haha yeah I have no need for the two comma club, but when it hits when I’m 41 or so that will be cool I guess 🙂 . And I’m on it haha!

Congratulations!!! I’m so excited for you!! You’re so inspiring.

Thank you so much Samantha!!

So awesome, I’ve been reading your blog for a while now, just wanted to wish you congrats. Seems like you’ve done a lot right on the journey. I’m super excited for all that is coming for you. Also, always happy to see more folks interested in doing FIRE on a lower amount as well as more representation beyond cishet, white men. You and your partner are about to have even more fun than before! ;P

Hi Max! Thank you so much for commenting – I really appreciate it 🙂 . And yeah a bit wrong, but a lot right. I’m glad I had other people in my life and the internet to learn from. And haha let the good times roll!

Congrats Purple! Amazing milestone and definitely well deserved! 2020 has been wild but you’d departure from the office timing turning out to be perfect.

Thank you Court! And haha yeah against all odds this timing is going pretty well 🙂 .

Congrats! Reaching your FI number is such a huge milestone!

Thank you Andrew!

Huge congrats!!! What a milestone. Enjoy the freedom and don’t look back!

Thank you Camilo!! Will do 🙂 .

This NW number is really impressive for a single woman by age 30 and still good for a couple in a relationship. If it is the former, congrats and really well done!! If it’s the latter, this is still a good accomplishment w/ more room to grow the combined NW.

Thanks – it’s the former situation 🙂 .

Wow – this is awesome!

I’m super stoked reading this post because it’s the culmination of years of hard-work, saving, and strategic planning of increasing income and reducing expenses (moving from Manhattan -> Seattle), and is a huge win.

Congratulations!

Thank you 🙂 and I’m so happy you enjoyed it.

I’ve been going back over old posts of your blog, Mad Fientist, MMM, Millenials, etc. to keep the picture clear in my head of which ETFs everyone chooses and how they balance and rebalance. I wish there was a spreadsheet comparing all the FIRE bloggers chosen investments. I have been following your blog since 2020 when you retired, and now I’m close to that number, and I can’t believe it either. I’m not sure of my number and I also have wonderful part time work, so I have a few things to figure out before making any changes. I’m a little sad I can’t share it with anyone because I realize how personal and how complicated FIRE is. I have a lot of friends and loved ones who own houses, or have different financial plans, or think they need millions to do anything. I don’t want to be judged either, so I’m keeping it to myself. I’m so grateful for your blog, along with many others, and could not have done what I have done without your guidance and shares. Thanks Purple!

That’s a really cool idea! And if you like spreadsheets, it sounds like you have the knowledge from checking all those blogs to build it – just saying 😉 .

And oh wow – 2020 feels like a lifetime ago. Thank you for still being here and Congratulations!!! That’s an amazing accomplishment. I’m sorry you’re not able to share it with people offline – money is unfortunately a weird subject. But thank you for sharing with me! I’m so excited for you and so happy something I wrote helped a little on the way.