I love answering y’alls burning questions so I put out the call on Twitter and Instagram to see what inquiries you had for me to answer while celebrating my first month of retirement!

It’s been an absolutely wild month that has felt like years (because of everything I’ve experienced and learned) and at the same time – no time at all. It’s super weird and I’m loving it 🙂 . So anyway, let’s get into it! Here are the questions you asked:

PRE-RETIREMENT

What surprised you most on your journey to FIRE?

Time dilation. When I started looking into FIRE seriously and internalized that I could shorten my career from 45 years to 15 (my original timeline) it felt like such a relief. That’s a lot of years saved. However, once I got into the groove of the journey, impatience set in because I was watching my money pile higher than I ever thought possible and as a result I began wanting the freedom I could see on the horizon NOW.

This feeling of impatience increased as I got closer to my goal until about a month before I retired and then life became a whirlwind. Before I knew it I had leapt off the cliff and into retirement. I thought time would feel the same no matter what, but it’s been all over the place.

Looking back on your journey, any regrets?

None that I can think of, but I’ll let you know if that changes 🙂 .

Now that you are not working, I’d love to hear what you wish you would have done/learned/seen on your way vs waiting for ER to do. I’m on the path, always struggling between paying for adventures now vs waiting & letting compounding take me there. I’d love your perspective!

This is something I thought about a lot and I intentionally started doing everything I wanted to do in retirement while on the journey. For example, I wanted to explore new countries that had a lower cost of living than the US – so I convinced my Mom to go with me to Costa Rica, Mexico and Thailand instead of our usual haunts of Tahiti, Fiji and the Maldives.

Another retirement goal of mine was to see my family more so I got a remote job with an awesome boss who didn’t care where I was as long as I got my work done. I started increasing my time working elsewhere until the year before I quit when I worked from my family’s houses in other parts of the country for 1/6 of the year.

The only thing I did put off until retirement were things that I wanted to do, but that were more stressful while I was working. For example, I love camping. My partner and a Seattle friend of ours made it a goal to go camping every month when the weather was warm.

However, because we all worked standard hours and there is no cell service where we camp to take our work with us if needed, this meant we were leaving Seattle in Friday evening rush hour traffic, hanging around weekend crowds in packed campgrounds and fighting our way back to the city in the Sunday afternoon rush.

All of those facts made camping much less enjoyable. In comparison, I have taken time off work before and enjoyed lounging in campgrounds during low traffic weekdays much, much more. So our last year in Seattle we planned to go camping less and ramp it up after I retired and could do so during the week. That’s the only thing that waited until retirement and since campgrounds were closed for most of the year because of the pandemic and I was wary of them after regardless, we didn’t actually lose a lot of time 🙂 .

So I guess what I’m saying is: Don’t wait! Do whatever you can now instead of waiting for later unless that activity would be infinitely better and less stressful in retirement – like camping is for me.

SPENDING

How do you keep your expenses low?

Overall by being a weirdo 🙂 . My preferences luckily lend themselves to lower expenses since I don’t have or want kids, a house, a car or pets. Other than that, domestic geo-arbitrage has allowed me to have the same or better standard of living for half the cost by getting out of expensive Manhattan and moving to Seattle. I also plan to keep up this pattern and go a bit further with it when international travel is back on down the line. Having that geographic freedom helps me keep my expenses low as well.

Does your free time spending match what you estimated it would?

It’s way less since I’m hanging around the US and living in a tiny house during a pandemic instead of jetsetting around the world in first class as planned 😉 . For free time spending specifically it is also way lower since I’m hiking nature trails to avoid people instead of going out to restaurants and bars every other night. I’ve spent $15K so far this whole year and it looks like I might spend less than my usual $18K that I spent in Seattle and that’s obviously way less than my projected annual retirement spending of $20K.

INVESTMENTS

What’s your portfolio breakdown?

Investments: $529,608 as of this writing – half in taxable accounts and half in tax-advantaged accounts, all invested in VTSAX.

My goal before retiring was to have $500,000 invested, but the stock market had other ideas 😉 .

Cash: $50,344 as of this writing – mostly in a high-interest savings account with Ally.

My goal was to have 2 years of my projected retirement expenses in cash ($40,000), but I was able to save more than that so far this year. I’m planning to move $6,000 into a Roth IRA before the April deadline and most likely invest an additional amount in my taxable account as well.

How do you withdraw money to fund your retirement?

I’m currently spending from my cash accounts. Originally I was going to have one year of spending in cash when I retired, but when the pandemic hit and I saw vaccine timelines I decided to save two years in cash in addition to my investments, which is $40,000 cash.

Given the 2 years of cash I intend to keep and the taxable dividends that will be deposited into my checking account, I won’t need to touch my portfolio until March 2023. And that assumes I don’t accidentally make any money. Down the line I’ll sell some of my stocks once a year to top up my checking account and fund my lifestyle.

Are you invested in anything else besides VTSAX?

No 🙂 – I talk about why here.

Is there an age where you’ll move your investments out of 100% stocks?

I’m not planning on it, but I never say never. Right now 100% stocks matches my risk tolerance and need for portfolio longevity, but if any of that changes, I’m open to changing my allocation.

Are you getting paid from your 401K to retire early?

No – I can’t access that until I’m 59.5. I’ve rolled my 401(k) over to a Traditional IRA and am doing a Roth IRA Conversion Ladder. While I wait for that to grow, I’m spending my cash and then will sell stocks in my taxable account when my cash reserves get low.

What was your average savings rate, and how many years did you save before retiring? Also what’s your ROI?

77%, 5 and my Vanguard account says 12% so let’s go with that 🙂 .

Do you have contingency plans if the market tanks and suddenly you have a lot of sequence of returns risk?

Of course – I would spend less by making our next nomad destination a LCOL area in the US or internationally and if I’m really worried I’ll make some money. Easy 🙂 .

POST-RETIREMENT

What’s your next big dream?

To no longer feel tired and pay back my sleep debt 🙂 .

Is there anything you thought you would feel but don’t? Also any little things on a list that you finally did?

I actually didn’t have any assumptions about how retirement would feel. I had been cautioned that it’s still real life and real life can be tough sometimes, so I went into it with a blank slate and didn’t have preconceived notions about it.

As for little things I’ve done: YES! All the things on my weekly list of Fun Facts Nobody Asks For! I have always been curious about the world around me, but never took the time to actually do the research and figure out how things worked, but now I do!

Do you still feel the urge to be productive or has that urge already worn off?

I’ve never felt the urge to be productive so I’m all good there 🙂 .

Does it still just feel like a long vacation?

No – because vacations end. I’d always be counting down until I had to go back to work. This feels totally different. And yes, I’ll let you know if this awesome feeling ever goes away 🙂 .

I love to hear all about how time perception has changed now that you’re a month in!

Time dilation continues to astound me. This month has FLOWN by, but also felt so full. I’ve learned more and had more time with the people I love than I ever had before. We’ve made more great memories than all previous holidays combined and now I see a month as a short amount of time, which is hilarious to me. I used to think a week-long vacation was long (maybe because that’s basically the longest I’ve ever taken), but now I’m thinking we need to be in new locations for a minimum of 6 weeks because 4 weeks seem short to me.

Will we ever get to see what you look like?

Maybe, but not for a while until my partner retires as well. I’ll never put my name on the internet though so get used to calling me ‘Purple’ 🙂 . If I did share my identity, I’d have to stop giving y’all all my numbers (net worth, income, spending etc) and I don’t want to do that. I polled y’all in a post asking Should I Reveal My Identity Online and you said you’d prefer to have the numbers than my identity so that’s what I’m going to do!

What are you planning to do to help make sure that the high of no longer working never wears off? Like did you keep past frustrating emails/demands from work to look at from time to time to remember?

Here’s one way:

I chat with my ex-coworkers who are friends regularly over text, but lately I've had a video chat hangout with one of them every other week and have decided that hearing about the garbage I'm missing at work helps keep my life in perspective😬🤣. #BiWeeklyRealityCheck pic.twitter.com/IOEZAbT2dg

— A Purple Life (@APurpleLifeBlog) October 21, 2020

Besides that, I have kept some reminders from my work days, such as screenshots of my (too full) work calendar and some email gems. I also have all my wonderful tweets where I told y’all about my frustrations in real time. Reading those now help me remember:

Me: Maybe I'm not giving that coworker enough credit. Perhaps I'm remembering them as worse than they actually are!

[2 minutes later]

Coworker at 4:55pm about a project we started yesterday and did not provide a deadline for: We need to deliver this TONIGHT!!!!!

Me: pic.twitter.com/xSdDVwAt0i— A Purple Life (@APurpleLifeBlog) September 29, 2020

Any plans for future projects or just resting?

No plans besides continuing to post here every Tuesday until at least next October. Resting and time with family is my main goal 🙂 .

What are you doing about health insurance?

Here are all the details on that. The TL;DR version is that I was planning to get expat insurance, but that requires you to be out of the US for 6 months of the year and since I can’t guarantee that with the pandemic, I am using a stopgap plan of travel insurance and WA state insurance (which is required since travel insurance is supposed to be supplemental).

Obviously, healthcare in the US is a huge issue and I only feel secure in my plan because I have no dependents and am completely location independent and can use medical tourism if I need to (Mexico is currently open to Americans 😉 ). I’m a cautious person and that’s why I’m comfy with my number, but if circumstances were different I would have saved more for healthcare specifically.

Have you had a moment where you fretted about work or woke up and thought “Oh no, I have to go to work,” and then remembered you were retired? I feel like that would happen to me in the first month or so.

I actually haven’t…I wonder if that will happen later. I haven’t even had a dream about work. Maybe my brain just completely purged it from my memory 🙂 .

What’s the WORST part of early retirement. (The rest of us need something to hang onto!)

Uhhh being sleepy from too many naps 😉 ?

What has been the biggest surprise about early retirement so far?

The biggest surprise is that it’s still hard to get everything done that I want to – there aren’t enough hours in the day 🙂 . I have more energy, more time and more mental space, but am still not able to do everything in a day that I was hoping to and as a result, the list of things I want to do, watch, read and research is growing exponentially. We’ll see if I can make a dent in it over the next 70 years 🙂 .

What do you have to say to the “hOOmAns aRe MaDe tO wOrK” crowd?

Thanks so much for continuing to work and driving my stocks higher while I lounge on the beach 😉 !

What was your biggest hurdle?

In my pursuit of financial independence and in life, my biggest hurdle was overcoming fear. Like I said, I’m a cautious person and even with all the mathematical models in the world, I know that the past cannot predict the future. So allowing myself to take the leaps I have throughout my journey (job hopping 5 times, moving across the country, investing like a mad woman etc) and then retiring at 30 during a pandemic and recession involved overcoming a lot of fear.

What’s the year 1 plan vs year 10 plan?

1 year plan: See family. 10 year plan: I don’t have one 🙂 .

What happens if you realize you didn’t save enough?

I make more money 😉 . In my field of marketing, that’s really simple and I don’t need to come back to a salary anywhere near what I used to make in order to cover all my expenses. In fact, even my very first job out of college – an entry level marketing job – would cover all my expenses.

Also, my last job basically begged me to come back in whatever capacity I want (contract, freelance, part-time etc) while I travel the world so that’s cool to have in my back pocket.

And even if the market never goes up again, starting right now, I still have enough to live on for almost 30 years, so I have plenty of runway to find another job and make money if I need to.

EMOTIONS

Do you physically feel less “fight or flight” response/stress hormone in your body?

Yes – very much so. I didn’t realize that I was tense and stressed all the time until work (and looking for work) was no longer a factor in my life. I no longer have that constant tightness in my chest and my shoulders have given up their permanent residence around my ears. I’m calm and emotionally ready to tackle actual problems now 🙂 .

How did the first morning feel?

Amazing and freeing 🙂 .

HEALTH

What’s your mental health like now?

Never better 🙂 . I expected my depression to flare up like it often does with big life changes, but it hasn’t! I expected it to flare up again when it started getting darker earlier in the day (I’m a sunchild), but it hasn’t so far. My depression is at bay and my anxiety is lower than ever. I’m content 🙂 .

How is your sleep now that you’re retired?

Awesome – I’ve always been bad at sleep, but since I quit my job I haven’t been waking up in the middle of the night anymore! Also if I feel tired during the day, I just take a nap. It’s amazing 🙂 . I’m on my way to repaying the sleep debt I’ve wracked up over the last decade.

RELATIONSHIPS

Has retirement changed any dynamics with your SO? Can we get a quote with his thoughts on it and everything since?

Here are quotes straight from ‘the horse’s mouth’ – my partner everyone!

“So far [it seems] like a very very long weekend. You seem less stressed and happier, but pretty similar to how you used your free time before retirement. Like you’re catching up on sleep. I’m sure things will change once the pandemic opens up and you’ve had time to decompress.

Also, I’m definitely not jealous and mad I lost the race” (…to FIRE, after telling me about it in the first place 😉 ).

What does your family think of your early retirement?

They’ve all known about my goal and plan from the beginning, so they’ve just been supportive. The same with my friends and ex-coworkers that know.

Did coworkers know about your FI plans before you quit? Were they surprised?

I didn’t tell anyone but my coworkers who were friends that I was retiring. However, I did accidentally let it slip to my boss on my last day:

🚨RED ALERT🚨! I JUST ACCIDENTALLY TOLD MY BOSS I'M NOT TAKING TIME OFF, BUT ACTUALLY RETIRING EARLY😬. OOPS. HOLY SHIT. AHHHHH😱!!!! pic.twitter.com/lRAxBVOI4p

— A Purple Life (@APurpleLifeBlog) October 1, 2020

I talk about why I didn’t tell the whole company like I originally planned in this post if you’re curious about that. The people who I told were not surprised though – my friends who were coworkers knew about this the whole time and I guess I’m not as subtle as I thought because my boss didn’t bat an eye when I let it slip 🙂 . Maybe I shouldn’t have been talking about 401ks and investment fees randomly the last 4 years…#StealthFIREFail

Did you meet and develop new friendships in the FIRE community during your journey?

ABSOLUTELY! Doing so helped me stay motivated and inspired along the way! It’s been awesome to talk about this stuff with people since our world thinks money is such a taboo topic. In fact, most of my friends these days are from this community. It’s taken over my social life and I love it 🙂 .

TRAVEL

Any destinations you would love to visit in the next 2-3 years?

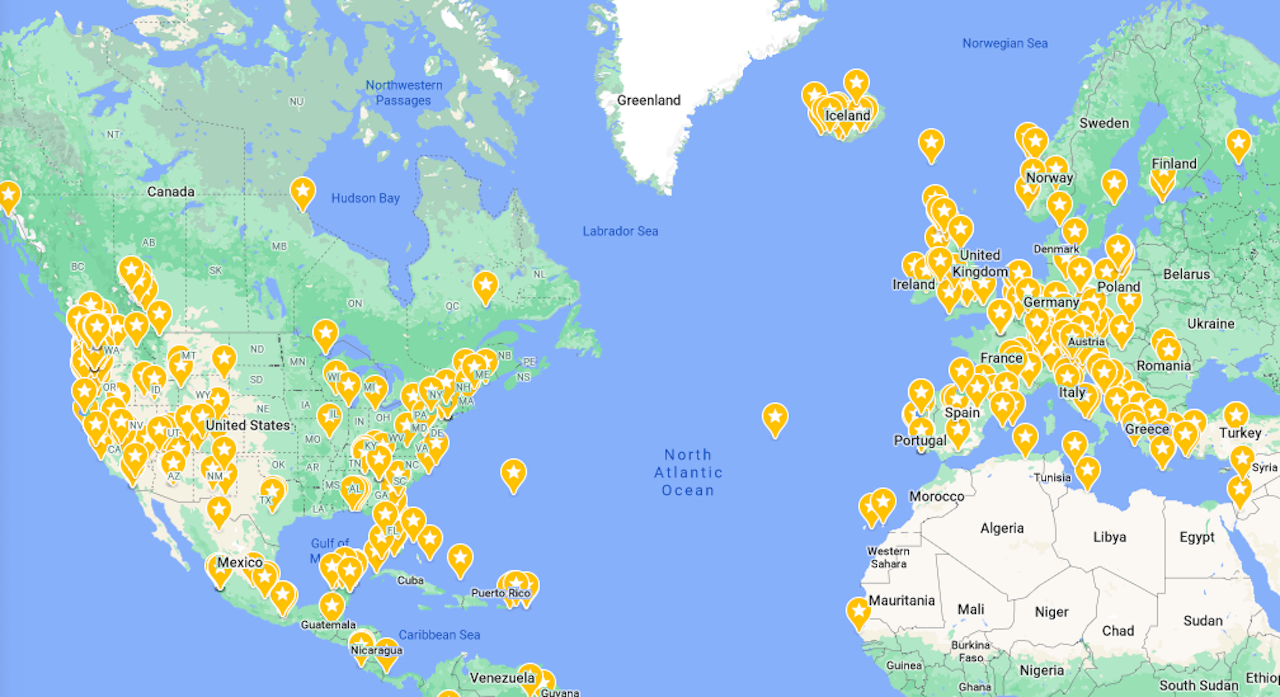

Yep 🙂 :

This is a screenshot of all the places I want to go that I’ve saved to my Google Map (in the Northern Hemisphere at least 😉 ). I’m going to be BUSY!

Have you had to change your travel habits with this pandemic?

I’ve completely had to change my plans 🙁 . Originally, my first few months of retirement included flights to Australia, New Zealand, Argentina and Thailand. Now it involves road trips to Georgia, South Carolina, Connecticut and New York! Obviously this isn’t the travel I planned, but I’m making the best of it and it’s way cheaper than what I originally planned so that’s cool too 🙂 .

I’ve shifted from focusing on exploring the world to spending time with family and that’s been really wonderful. The world can wait 🙂 . It’ll still be there when I can travel safely and I can’t say the same for the people I love, especially during a pandemic.

What did you keep when getting rid of all your stuff?

Here’s a list of what I still own 🙂 . Let me know if this is something y’all would like to hear more about – if so, I can make a whole post about it with pictures and stuff.

LUGGAGE: 40L Backpack, Travel Backpack, Small Purse, (6) Packing Cubes

CLOTHING: (7) Underwear, (3) Bras, (2) Sports Bras, (10) Shirts (2) Sweaters, (2) Tunics, (1) Dress, (1) Peacoat, (7) Bombas Socks, (2) Smartwool Socks, (1) Bedroom Slippers, (1) Legging/Pants, (2) Yoga Pants, (1) Travel Pants, (1) Shorts, (1) Belt, (1) Hat, (3) PJ Pants (mostly from international First Class flights 😉 ), Hiking Boots, Privo Shoes, Flip Flops

ELECTRONICS: Kindle Paperwhite, Kindle Charger, COWIN E7 Pro Headphones, Noise Machine, Skullcandy Earbuds, MacBook Air Laptop, Laptop Charger, Laptop Case, Moto G Stylus, USB-C Phone Charger, Sonicare Toothbrush, Toothbrush Charger, Power Bar

HOBBY STUFF: (2) Coloring Books, Colored Pencils, Calligraphy Pens, Notebook, Pen

MISC: Eye Mask, Slim Fit Earplugs, Travel Umbrella, (2) Sunglasses, (2) Glasses, Great White Shark Stuffed Animal, Travel Scale, Nail Clippers, Travel Towels

KITCHEN STUFF: Anova Sous Vide, Vanguard Mug, Vanguard Glass

RANDOM QUESTIONS

Do you think anyone can do what you have?

If you mean retire at 30 then: Absolutely not. I do not think anyone can do that. It took me having a very high income for my age and having preferences that automatically lower my expenses for that to happen.

However, I do think many people could improve their financial situation, even marginally, and I think that’s a great goal to strive towards.

What are you listening to music wise?

I’m all over the place these days, but my daily go-tos right now are: Years & Years, Hamilton (I’m obsessed) and Bastille.

Are you relying on your blog income to supplement your savings?

Haha that’s hilarious. Oh, are you serious? I talk here about how I love blogging, but the way I do it does not make a lot of money. I made $225 of profit in all of 2019. This year it’s looking like that number will be higher, but nothing very substantial after self-employment taxes.

I’ll give y’all the full update and breakdown of how much I made this year from various sources in my “How much I made” annual post that will come out in December. Also, with blog income, it’s not steady and I cannot rely on it. As a result, I always assume it will leave at any second, which is pretty accurate – it dried up when the pandemic hit and hasn’t recovered.

WEIRD ASS QUESTIONS

No tea and no shade, but some of y’all had me scratching my head at your questions. They did not compute 🙂 .

Are you bored at all?

Have you heard the phrase “Only boring people get bored?” 😉 . But seriously, I can honestly say that I have not even for a second felt bored. I usually feel like I have too much to do, which is ridiculous and hilarious when I compare my life now to my previous calendar that included work. I still don’t get to everything I want to in a day.

Are you picking up new habits? Do you find you have too much free time?

Yep – I talk about that in my weekly retirement updates and what the fuck is too much free time?!?

Do you feel anxious? I think I’d feel I’m missing something from my daily routine if I wasn’t working

I do not feel anxious – I’ve never felt calmer actually. And yes, I feel like something is missing – the constant anxiety from working a stressful job 🙂 .

Do you ever feel like “Damn I could have just worked today and made $x, but instead I just did…”

It hasn’t crossed my mind, but I’ll let you know if it ever does. Basically there is no dollar amount I would trade for my time since it’s the only thing I can never get back. Making money is simple in comparison.

Also “just worked” not a thing for me. Personally, working sucks – I’m seeing that more clearly now that I’m not doing it. Even a good job (which I had) infected every aspect of my life – stress, sleep, relationships, mental health etc. It’s just not worth it to me.

Now that you are retired, how do you plan to remain fulfilled and satisfied without working, will you be volunteering or starting a class to help people identify birds, etc.

I have never felt fulfilled or satisfied by my work so there’s no hole to fill there luckily 🙂 . I have no current plans to start any type of side career, such as those you mentioned.

Do you ever feel like your days are wasted because you have so much time?

This question really doesn’t compute for me 🙂 . How can having the time to do what you need and want be wasted time? My time working was wasted time. I worked super hard for 8-12 hours a day – I was on conference calls and getting yelled at by clients for someone else’s mistakes to in the end create…an ad.

An ad that no one wants to see 🙂 that will be sent to someone’s junk email folder or blocked by an ad blocker. How is THAT not wasting time? So much effort for no good in the world (besides my ability to eat that month).

Will you be pursuing any other type of job just for fun?

This doesn’t compute either. Jobs are not fun for me – or at least none of the 6 corporate jobs I’ve had have been anything close to what I would consider fun. So – no. I’m not planning to ever have a job again. If I somehow find a job that actually sounds fun, I might reconsider, but I think that’s as likely as finding a unicorn in the woods of Georgia 🙂 .

Does it feel like you made the right choice??

Absolutely.

Do you feel like your life lacks meaning and focus because you’re not working?

In case that wasn’t clear: No 🙂 .

CONCLUSION

Thank you so much for submitting your questions on Twitter and Instagram! I hope I answered them to your satisfaction 🙂 . If you have any other questions, feel free to drop them below. Cheers to one month of early retirement! Now onto the next 70 years 😉 .

How was your month?

Thanks for sharing! I was definitely curious about what you kept from the purge so Im glad someone asked.

I’m super inspired. I’ve only just started at 32 but I hope to be financially independent in 8 – 10 years. I’ll be selling my car in February. 😫

I have two questions:

Was eating out or ordering in the plan for your food expense in retirement or did you plan on mostly cooking?

Can you spell out what the 4 Vanguard accounts are? Apologies if youve already done this.

That’s awesome – you’ve got this! To answer your questions: (1) I’m still mostly cooking at home, but my eating out budget has been higher than I originally anticipated because I want to support local businesses in this hard time. However, I did expect my eating out to be more than when we stayed in one place in Seattle because we want to try the new local cuisines. Right now we’re ordering in 1-2 times a week.

(2) Which 4 accounts? All my money is invested in VTSAX within these buckets: Traditional IRA, Roth IRA and Taxable Brokerage accounts. Let me know if that doesn’t answer your question.

Girl, I absolutely love how unapologetic you are about disliking work.

As Americans, I feel like we are conditioned from an early age, to value hard work over everything else. Due to this being such a strong value, it feels sacrilegious to say anything negative about your job.

We all must come to peace with a certain amount of work we dislike, so many of us need to come up with stories about how it is meaningful. I do genuinely think there are people who enjoy work, more than others and to those folks…I solemnly say, thank you for your service!

I myself, enjoy occasionally providing value to others (in totally random ways, like tarot card reading), but if I had to go with internal motivation only, I would make about $1k a year, lol!

Thank you for this article, it was wonderful:) I look forward to Tuesdays because of your blog!

Haha I’m so you enjoy it 🙂 . Based on some of the questions I’ve gotten this will be a point of contention. All solid points and I too would make no money if I was just internally motivated haha. And yay to looking forward to Tuesdays – that makes my heart happy 🙂 !

Just speak to my soul why dontcha lol. That last section absolutely made my day! Thank you for continuing to write and keeping me looking forward to Tuesdays. I’d love to hear more about your car-free life. I live in Atlanta and would love to get rid of my car but it seems more of a hassle unless you’re in one of the rare walkable neighborhoods (even without considering commuting). I know we’re not going many places nowadays but would still love to hear how you do car-free life.

Haha my bad 😉 . As for car-free life in Atlanta: it might not be possible honestly. That’s one of the reasons I left. Right now it’s working for me only because I can borrow my BIL’s car at times and if not I rent a car or take an uber, but we’re outside Atlanta so that’s easier. Also, if the pandemic was over I’d be taking the bus (we do have a bus system were I’m staying so that’s awesome). In ATL proper it might not be possible. Let me know what you decide to do – I’m super curious!

Sigh, that’s the conclusion I’ve been trying to avoid. Though I won’t be making a decision for a while, gotta wait until things are less uncertain. Whether or not my job lets me continue non-pandemic work from home will be a big factor, plus where I live is also subject to change in the next 6-9months. This is the one area where I’ve recently paid a bit more rent to use my car less, but I’ve been pandemic bubble-ing with my parents and those dollar signs in the savings account are very enticing. Certainly, I will update on whether I pull the plug or find a compromise of some sort!

I completely agree with your advice on being intentional about priorities before FIRE whenever possible. One of my big goals after I retire is to do an extended Spanish immersion. I probably need at least 6 months or more likely a year or more. As a mini-experience, I did a 2 week trip to Guatemala just before the pandemic started. It was like a scouting adventure, and I learned so many helpful tidbits for a longer post-retirement experience! (I highly recommend La Cooperativa School in San Pedro La Laguna, for anyone else who has this on their bucket list) 🙂 We never know what the future holds so it’s important to enjoy life along the way!

That sounds like a wonderful trip and great idea! Also I’ve just added La Cooperativa School in San Pedro La Laguna to my to do list 😉 … Totally agree!

Your list of clothes! Enviable!!!! I would love if you talk about your pared-down list of things. Maybe how you made the decision. Is it a long standing practice or did you throw/donate when you were ready to move? Seventy five percent of what’s in my closet is a waste of space but I am so attached to it. 🙄 I have other things, books, art and so on. I am not giving that up. But the clothes – I’ve gained weight so really what’s the problem? Ridiculous! Anyway, thanks for your transparency. It helps tremendously.

Alrighty – I’ve added a post on the subject to my list! I talk a bit about how I made the decisions in the post below, but overall I tried to be realistic with what I actually wear and use (even at different weights) and if I kept something just for sentimental value I took pictures of it, but still got rid of it. It was a tough process, but it’s now been 3 months since I did it and I don’t regret anything I got rid of – in fact, I’m thinking of getting rid of more haha. Happy to help!

https://apurplelife.com/2020/08/18/how-to-sell-everything-you-own/

👍🏼💥

I am loving these retirement posts! Thank you. I’m not sure why so many people want to work, as my goal in life is to not need to. I guess to each their own.

Any who, I would love to see a more detailed post about what you kept, because wow that might be the hardest part of this for me. Eeeek. Saving is easy, but getting rid of everything? Huh, I’m thinking that’s not going to be an option for me. I can get rid of stuff, but almost everything? Nope.

YAY! So happy someone besides me is enjoying them 🙂 . Getting rid of everything is definitely not a requirement to retire so don’t worry 😉 that’s just how I wanted to do it. And a post about the subject has been added to my list!

“An ad that no one wants to see that will be sent to someone’s junk email folder or blocked by an ad blocker. How is THAT not wasting time?”

This truly resonated in me since I work in a similar field. So much work for something nobody cares about, it must have been really depressing sometimes. 🙁

Yep – it was super depressing 🙂 . I’d be in a meeting where people were celebrating a 1% open rate in an email and I’d think “Why are we even doing this again?” Siiiigh – whatever, it got easier when I switched from ad agencies to marketing and (usually) made things that actually helped people – even if the people were executives that wanted to be promoted by saying my work was their own 😉 .

Very nice AMA. It sounds like retirement agrees with you. Enjoy! Travel can wait until the pandemic subside. That’s the good thing about early retirement, you don’t have to rush anything.

Thank you Joe! Retirement does indeed agree with me 🙂 . Totally agree with you about rushing – if I had taking a sabbatical for a year to travel for example I must admit I’d be a bit pissed all this was happening at this time. Luckily I just moved my 2024 “USA road trip” plans up to 2020 😉 .

I use a timer whenever I take naps. For some ironic reason, naps longer than 20 or 30 minutes make me MORE sleepy rather than less sleepy. Of course, that means I’m in real trouble those times (ok, it was only once so far, but still!) I happen to fall asleep on the couch while watching a ball game on TV with my SO. You know you’ve slept TOO long when both teams on the field have changed their uniform colors. Took me a moment to realize, oh, this is a DIFFERENT game – guess I slept through the one “we” were “watching”. LOL

That is SO smart! And haha about the ball game – I’m sure they just changed their shirts to confuse you 😉 .

My first thought upon opening my eyes again was “why did all the players change uniforms?” LOL

Thanks for this post and your continued posting post-FIRE! My path has been slightly different — after 3 years of a very high stress job after college, I’d saved up about 2x my yearly expenses and decided to take a year off to pursue all the stuff I wasn’t able to because of work. Everyone in my life thought I’d be bored, without purpose, subject to a lot of risk trying to reenter the job market after being unemployed, etc. — and it even turned into some self-doubt!

That year off was one of the best decisions I ever made. Every night I went to bed feeling like there was still so much I wanted to do, that my life was so FULL without work. I was able to dedicate time to music, exercise, all sorts of hobbies. I took an extended trip by train around the country visiting friends and family (although I didn’t spring for the sleeper cars!) and had a lot of fun along the way. I even bought an old car and tried (mostly successfully) to fix it up myself. Some days (fewer than I’d worried!) I did very little, but like you I feel like that’s a totally valid and important thing to do sometimes.

When I returned to work about a year later, I was even more resolved to exit as soon as possible. I passed my number recently, but I’ve decided to work until next fall to build up an extra cushion. The biggest thing is I figure I wouldn’t be able to travel and spend time with people the way I’d prefer until after things clear up more.

Thanks again Purple!

You’re welcome 🙂 . I’m loving sharing this experience with y’all and documenting it so I can read all about it down the road as well. That sounds like a wonderful time – congratulations on taking that leap AND on passing your number recently!!! Totally makes sense – Good luck 🙂 .

This isn’t so much a question since it seems like you aren’t experiencing this, but I think about the friends and family I would want to spend time with once I quit working and then I realize most of them will still be working. It makes me a little less excited. Not a reason to not pursue FIRE, but just a thought and that actually goes along with your comment about it still being real life. I guess I could just continue doing what I do now, seeing them on weekends/holidays/combined vacations, but then that takes away the flexibility aspect and keeps the stressed gotta pack as much quality time into our short visit mentality. Would love to hear your thoughts!

Are you an extrovert? I ask because I’m a serious introvert and it really works out for my schedule that many of my friends are still working. Even if I’m visiting them and staying with them that means that I have at least 8 hours where I can do my own thing and recharge before they are available to hang out in the evenings. If they wanted to hang 24/7 that would not work out well for me – I’d quickly become a monster without my alone time 🙂 .

Another option if you’re worried about this is to find friends with alternative schedule (there are lots!) or other retirees. That’s another benefit of this community – you know people who can hangout on a random Tuesday afternoon 😉 .

OMG I am an extrovert! That is an important distinction 🙂 Its not that I’m worried about how I’d spend my time but really the lack of flexibility on the part of others. Which sounds bad but I just mean being able to seize opportunities because I’m already bad about putting off visits because of x, y, z, going on (although this year has definitely taught me to stop that!) Thanks for the response! I’m sure this will end up being a non-issue and as I said before, not a reason to not to continue down this path.

Haha yeah it sounds like you want some spontaneous buddies, which hilariously wouldn’t work for me even though I’m retired 🙂 . I need advanced planning in my life personally. I’m sure you’ll find a way around it and locking in visits in advance would help avoid putting things off.

Loved the answer to the last question 😃😃😃 Outstanding !!!

Haha thank you! I couldn’t resist 😉 .

After seeing your partner’s comment I am now in nosey mode… is there a reason it’s taking him longer to get to FIRE than you, despite starting earlier? Does he spend more/earn less? I remember you saying he likes his job so maybe he’s just taking it slower than you? Tell me to get lost if that’s too nosey 😂

I also love your answers to all these questions, but especially the ones about ‘missing’ work. I’m on the same page as you, even having a ‘good’ or ‘fun’ job takes over your life mentally and emotionally. I know that I will 100% not miss working when the time comes!

It’s so strange that even people in the FIRE community seem to not be able to get away from the concept of needing a ‘purpose’ and being ‘productive’. There’s nothing more purposeful than time with your family and enjoying your life. So happy for you to have achieved it!

Haha – both 🙂 . He basically took last year off, made less than me for almost all of my career and spends more than me cause he’s a bigger person who requires more nutrients.

So glad you enjoyed my answers! And yeah that ‘purpose’ and ‘productive’ bullshit seems to be really drilled into our heads – I get it, but breaking out of that script is one of the best things I’ve ever done. Completely agree and thank you!

Really enjoying the perspective from 1-month out and really curious how you’ll feel in 6 months – 1 year after decompressing. Your answers in the “Weird Ass Questions” are GREAT. I do not understand those questions either…bored, wasted, no purpose?!? Just odd, I never want to be someone that cannot even IMAGINE not working.

I’m similar age to you (just turned 32), well surpassed my FIRE goals, but still at my corporate job because…low stress, WFH, and very minimal hours (10-15/week). I’m struggling to pull the plug because it’s not TOO bad and I’m still figuring out exactly my next steps…where to live, if a house, if we want to have a kid. I wonder whether leaving and truly separating from work that is NOT my purpose would help bring clarity to the other areas. The gift of financial freedom and flexibility is wonderful even if I haven’t retired yet. Anyways, I appreciate your writing for your confidence in what works for you. I still let other’s expectation have a bit too much influence on me.

Well I have promised to be here writing weekly until 1 year after retirement so you will soon find out 😉 . And yeah – I labeled them weird ass questions for that very reason haha.

Congratulations on surpassing your FIRE goals!! Also I’m obviously biased 😉 , but quitting definitely helped me have more time to think and figure out what I want, though your set up sounds very sweet and maybe you will be able to figure that out with your job since it’s 10-15 hours a week. Having the time for uninterrupted contemplation is pretty sweet though.

Awesome post!! I agree, those are some weird ass questions… Believe it or not, when I had my 1 year maternity leaves I would get some of those. I didn’t know whether to laugh or cry 🤣.

I’m in for a post about what you still on! Also Hamilton is on repeat here to the point that the kids will gladly respond to some of it just naturally like I’ll say “yoyoyo what time is it??” To which they respond “Show time Show time!”. I love it haha!

A post on what you still own* ughhh lol

Thank you lady!! People said that about MATERNITY leave…in CANADA?!?! Wow. This ‘sickness’ runs deeper than I thought. Cool on the post about what I own. I guess it’s time to put my stuff in neat piles like I see in the big blogs 😉 . And awww that’s SO cute!!!

I recently discovered your IG page & blog. I like the transparency and simplicity of your page. My FI/RE journey is similar to yours. I started in 2014 (but began investing in 2018). That 4 year gap in not investing is huge :(. My goal is to early retire in 2024 (age 52). So on my Rollover IRA it’s allocated VTSAX- 87% / VTIAX- 8% / VBTLX- 5%. Previously, I was thinking of changing that allocation to more international stocks (20%) and more bonds (20%). But my VTSAX has been doing well & after reading your strategy on VTSAX, I think I should keep it at 85%. Just wanted to get your thoughts on that? Appreciate it!

Thanks! I don’t give financial advice so I can’t recommend what you should do, but if an allocation is working for you and your risk tolerance I would keep it if it were my portfolio. Good luck on your journey!

I wasn’t asking for your financial advice, as I always do my due diligence & research.

Another vote for the list of items that earned a spot in your travel bags!

The questions about needing work for a sense of purpose seem to be confounding work with purpose. I think purpose is independent of work and is defined by the individual. I feel that joining a company or academic institution doing the research that I am interested in would be necessary for me to achieve my goal of a significant scientific contribution to future generations.

Gaining financial independence should make that goal easier to achieve since it would remove financial stress to allow more focus. It would also grant the freedom to go anywhere and time to study and contribute. Also, significantly, it would allow me to exit any situation that negatively impacts my life.

There is also much more to life than that one goal, so I’m very much interested in the ability to take off for a year on an adventure or spend that time with family and friends.

Alrighty – the idea is moving up my list 🙂 . And that’s a great point – work and purpose aren’t the same thing in my mind either. Removing the financial aspect of something really is amazing – I didn’t realize what a difference it could make until I started this blog. I hear people talk about their blogs being a source or worry or anxiety because they’re trying to make money from it. It’s so different than what I feel and I suspect the “has to make money” part is the difference. Totally agree about removing yourself from anything that negatively impacts you – that’s huge. Sounds like you have some awesome plans!

Your previous posts about paring down items for permanent travel has really inspired me to no longer fear trying to sell my items myself online. There are a lot of things taking up space with no utility that I was hanging on to since I already sunk money into buying them.

I definitely agree with the need for income to be a large source of anxiety. Luckily, on the flip side, building savings has equated to more stable emotions. Still very far from full freedom, but working everyday towards it while also making lifestyle changes that can directly improve happiness along the way.

I really liked your posts about sous vide and keto. Low-carb/keto works really well for me and I’m always looking for new recipes and ideas. Currently guilty of having a sous vide since last Black Friday, but been too lazy/mentally exhausted to figure out how to use it. Planning to try it for the first time for Thanksgiving day off 🙂

That’s awesome! Let me know how it goes 🙂 . That’s so exciting. And totally agree that additional savings changes the game as well. I hope you try out the sous vide you already have and let me know how you like it as well! I’m still obsessed all these years later.

Used the sous vide twice so far with excellent results! Was able to make particularly soft and delicious lamb leg with it. Let me know if you’re interested in the recipe via email/pm (not sure if you are able to view email addresses from comments). The paring down of stuff is going slowly, but at least it hasn’t stopped 🙂

That’s awesome!! I’ll definitely reach out if we head into lamb-town soon (I can see your email 😉 ). And woohoo on the paring down! You’ve got this 🙂 .

I have been counting down to this day, as I am kinda living vicarously through you!!! Hope you have been well Purple! Thank you so much for sharing with us your numbers and journey <3

Woohoo!! I’m great and of course!

I just died reading the “Weird Ass Questions” section… I’ve heard most of those and had about the same reactions.

Same for kids-related inquiries, for example, “Does your life feel empty since you haven’t had children?”

Hahahahahahahahahahahahahahahahaha.

No. Respect to parents though…

Haha I’m glad it gave you a laugh and yeeeeah I have the same reaction to that question…;) .

I don’t understand the people that need to work to feel fulfilled either lol. But I do think that life is more fulfilling if we give back and I think you’re already doing that with this blog & social media. Teaching people about financial literacy and inspiring them with your story is probably more fulfilling than any marketing job haha.

Are you also paying a ridiculous amount for health insurance? I’m paying for cobra $300/month since I left my job. The health insurance plans were not better

in the marketplace since I didn’t qualify for subsidies.

Yeah it doesn’t really compute for me, but I can see how I would have thought that if I had continued down my original career path. You need to mentally justify it somehow I guess. And thank you for seeing this blog as giving back – I like that angle better than a shameless party of me-me-me 😉 . I agree on the fulfillment part 100%. Talking with y’all these past few years has been infinitely more fulfilling than my career.

I’m not paying a ridiculous amount no, but I didn’t go with COBRA. I’m using travel insurance through World Nomads for emergency coverage right now and it was about $500 for 6 months. That’s a stopgap plan until I can leave the country and do my original plan of expat insurance, which is a few thousand a year.

Hi Purple!

I’m bummed I miss your AMA but am so glad it’s being extended to the comments section of this blog post because I’ve been itching to ask you this:

– What percentage of your portfolio is in retirement accounts, and

– What percentage do you recommend having in non-retirement accounts before leaving your job?

I am aiming for FIRE one of these days but am realizing the majority (probably about 70%) of my portfolio is in retirement accounts. This means that I, as someone in my 30s, wouldn’t be able to access the majority of my money for another 20-30 years (unless I want to pay the penalty to withdraw early, which I don’t).

I always see FIRE-ers give their total portfolio numbers, but they almost never show how much is in non-retirement (401k, 403b, IRA, etc.) accounts.

Thanks!

Hi! I mentioned above that 1/2 of my investments are in tax-advantaged accounts. I currently have $530,000 invested so $265K in ‘retirement’ accounts. I don’t have a recommendation for a percentage – I just did the math to see how much taxable money I would need to cover my expenses until I could access the money I’m moving from my Traditional IRA into my Roth IRA and the money in my retirement accounts and having 50% in each more than covered it.

You should look into the Roth IRA Conversion Ladder and do the math to see if that fixes your money gap issue. Good luck!

Thanks, Purple! I didn’t realize tax-advantaged accounts = retirement accounts, so I appreciate your clarification.

And the Roth IRA Conversion Ladder tip was helpful. I’ve heard about this strategy before but never really understood how it could benefit my situation until now.

I gotta say I truly enjoy these post-retirement updates as well. I have more expenses than you but I am getting close to pulling the plug which is a good thing because I am feeling super-disconnected at work.

And I got ask about the Sous Vide – of all things kitchen things, what’s up with that? Why did that get priority? (Just curious, I have a vague idea of what it does but maybe not all that it does.)

I’m so happy to hear that! They will continue then 🙂 . And that’s so exciting about pulling the plug! And the sous vide is my baby 😉 – I wrote about it in a post below, but basically it lets me cook meat and eggs perfectly without watching over it. Restaurant quality food without leaving my home and without effort, which speaks to my lazy soul 🙂 .

https://apurplelife.com/2019/08/20/an-intro-to-the-magic-of-sous-vide-cooking/

I like that you are honest about the question whether anyone can become FI at such a young age. I often find that other, more “mainstream” FI-blogs are delusional about that (coincidantilly these are often written by white, techy, middle class men …).

And thank you for giving us a follow on Instagram! My sisters and I were fangirling hard. You are an inspiration for young women like us just starting their financial journeys. 🙂

Yeeeeah I don’t understand how anyone could think such a thing is possible for every one and I strive to be honest about everything so here we are 🙂 . Thank you for saying that!

Hi Purple,

Thank you. You really are an inspiration. I love your post-retirement posts.

I’m really happy for you. I can absolutely relate to the feelings you describe, as I’m quietly on my own journey. Yet I’m still a few years from reaching FI (if I ever will—its harder over here with European tax laws and considerable mandatory social security contributions. I wouldn’t want to trade, though, if that meant giving up on 6 weeks of paid vacation every year, and on never having to worry about health care, and on paid sick leave, etc.).

I’m not unhappy at work, but I surely wouldn’t miss it, either. The last question is just hilarious—who comes up with that?! I can only pity the ones who genuinely think that work is the only fountain of focus and meaning. Your answer is spot on.

The boredom question doesn’t also compute for me. I don’t think I’ve ever been bored. Ever. I can entertain myself quite well, but doing nothing is also absolutely a valid thing. There’s just no need for me to “accomplish” anything to feel good about myself.

Congratulations, enjoy your freedom, and keep us posted. Please.

Thank you! And yeah that sounds like a sweet set up (even with the additional taxes). I’m jealous 🙂 . I’m with you and yeah I don’t understand boredom – the world is so interesting and large and interconnected with the help of the internet that I can’t remember the last time I felt bored…even though ‘technically’ I have nothing to do 😉 . And yes – chilling is obviously valid and also just necessary to keep me sane 🙂 . I’ll definitely keep y’all posted!

Hi Purple… I’m 99% sure of this but just wanted to confirm. You keep 100% of your portfolio in VTSAX correct? You dont keep anything in Bonds? Why?

Hi! That’s correct and this is why 😉 : https://apurplelife.com/2019/10/29/why-i-own-100-us-stocks/

Awesome post. I’m a normal visitor of your blog and appreciate you taking the time to maintain the nice site. I will be a regular visitor for a really long time.

Thank you!