Another year done and what a year it’s been. I feel like I’m saying that every week, but December for me is about reflection and unfortunately there’s a lot to reflect on 🙂 .

Luckily, we are talking about positives here! I saved a surprising amount in 2020, so let’s dive into how I did it, where the money came from and where my net worth stands at this point. As a reminder, I quit my job at the beginning of October 2020 to retire at 30. So let’s do this!

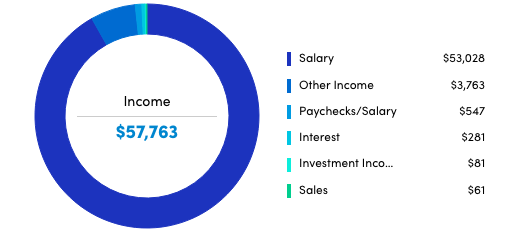

Income

Here’s where my money came from in 2020:

Full-Time Job

It turns out that I had an annual salary of $114,229.45 in 2020. It always varies based on how much of our stretch bonus I receive, but after being told I was not receiving my last bonus and then fighting for it, I can add over $2,000 to that amount. Persistence pays off 😉 .

However, since I only worked 75% of the year, I actually only took home $72,683.77 after tax. $52,783.77 of that amount is shown as income above (plus a few meal reimbursements from my company) and $19,500 + $400 went straight into my 401(k) as contributions from me and a company match respectively.

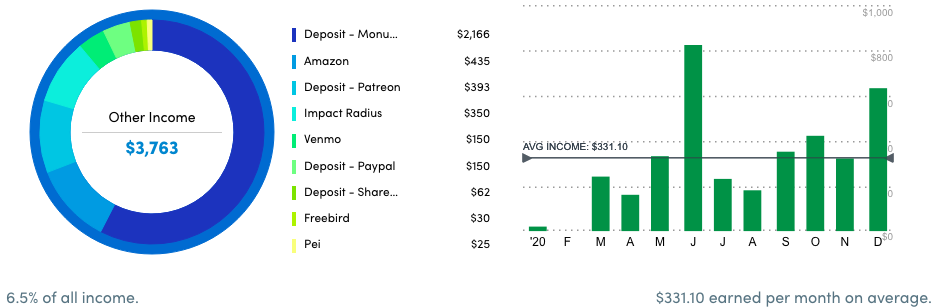

Other Income

Despite my best efforts, I accidentally made some extra money this year 😉 . Previously, I’d want to roll my eyes when early retirees said they ‘accidentally’ made money, but I have to eat my foot (…or is it hat? where does this phrase come from?!) and say that Past Purple needs to suspend her disbelief because it’s true.

When working towards early retirement, I was VERY clear that my entire goal was to “Do Nothing.” I wanted to lie facedown on a couch until I got bored of it, which I assumed would take several months….if not years 😉 . Instead, I have become intricately entwined with this financial independence community to the point where most of my friends are now from this circle.

I thought I would retire to a complete slug existence that would allow me to rest after a decade of working my ass off and also “thumb my nose” at all those ‘productivity peeps’ who think I can’t just do nothing forever 😉 . My belief that I would be happy doing ‘nothing’ is based on the fact that that’s what my Mom seems to have done for 6 years of retirement – chilled, traveled and helped her family.

Well, it turns out I was wrong: I’ve done shit. My bad 🙂 . I’ve also reclassified what my Mom has been doing as almost the complete opposite of “nothing”. Within helping her family, for example, she’s been helping take care of my baby cousin while his parents worked. And after only a week of assisting her in doing that, I can confirm it is the farthest thing from nothing. I’ve never been so tired in my life 🙂 .

Anyway, with that context, let’s see what I made this year outside of my day job. Note that I’m only counting what’s actually hit my bank account so far this year. In the case of blog monetization specifically this is because most payments are 2 or more months delayed and at times are not paid at all, so I’m only counting the amounts that are in my account since I know they are legit 🙂 .

All other numbers that come through will show up on next year’s annual summary. As a side note, if you want to see how blogging is a great way to quickly replace your income and become a millionaire in 5 seconds – look below!…I’m obviously joking 🙂 .

Anyway, here’s what I’ve received in my “other income” checking account this year:

Blog

Income: $3,013

Estimated Taxes (30%): -$903.90

Expenses: -$38.35

Profit: $2,070.75

Hourly Wage: $3.64/hour

Shockingly, this blog made money this year. And because I didn’t have a lot of large expenses, such as the conference I attended last year, that profit was way larger than I expected. However, before you think blogging is the path to riches, please check out this tweet I sent in August:

#Blogging is the best way to make money FAST💰! I did it and YOU can too! Here's what I've made👀:

Y1: $0

Y2: $0

Y3: $0

Y4: $0

Y5: -$800

Y6: $1,600

Blogging is the ultimate get rich quick scheme!!!…as long as rich = $5.71/hr and quick = years🤣🤣🤣.— A Purple Life (@APurpleLifeBlog) August 30, 2020

TL;DR: Blogging is not at all a good way to make money – fast or at all. I do it because I love it and was lucky that on my 6th year of doing it it started paying for itself 🙂 . So, what’s next?

I’ve promised that I will continue blogging weekly until the anniversary of my retirement (October 2021). At that time I will assess (1) If I want to keep blogging at all and (2) If so, what my new schedule will be (Weekly? Monthly? Quarterly? Once in a Blue Moon?). Anyway, regardless of that decision, we shall see if this level of income continues until then, but luckily – I don’t care because I don’t need the money 🙂 .

Speaking

Income: $150

I was asked to do basically a live podcast for a closed finance group for free and I agreed 🙂 . Later, the leader of that group said that she would like to pay me for my time so that’s what this is from. To be clear, podcasts do not usually pay their guests. I was tickled to find someone online who thought I was rolling in additional income because I was “raking in podcast dough” because yeah, that’s not a thing. Podcasts are free.

Anyway, I had a lot of fun doing this live podcast format with that group and since then I’ve done another virtual meet/greet Q&A type thing (once again, for free). I suspect this will be an anomaly in my income going forward, which is fine with me. It was cool to get paid for my time, but just chatting with y’all is a reward in and of itself 🙂 .

Patreon

Income: $453

Fees: -$59.85

Estimated Taxes (30%): -$117.90

Profit: $275.10

After a few threats from friends, I created a Patreon for the 20% of the recipients of my weekly Accountability Beast tweets who want to pay for the service (the rest are on the free.99 plan 😉 ). Every Wednesday, I take to Twitter and remind people of their goals…and bother them until they accomplish them 🙂 .

Surprisingly, a few readers have also joined the Patreon this year just because they like what I do here and want to support it (Thank you Vron and Ariana! You’re too kind 🙂 ). Not bad for a weekly tweet thread that I happily did for free for almost a year.

Apps

Income: $55

I mentioned in this post that I began to dabble last summer with the wonders of apps like Freebird and Pei. They give you cash back on things you’re already buying like Uber and Lyft rides for Freebird and basically everything else on Pei 🙂 . I’ve enjoyed gathering some extra money here without lifting a finger – it’s my favorite way to save money 😉 .

Selling Stuff

Income: $1,865

My partner and I became nomads in July of this year and to do so, we sold everything we owned. I did so slowly over the course of several months in the hope that I would recoup some costs – or as it turned out in some instances – turn a profit! So this is what I made by selling my used stuff on Facebook Marketplace. Check out this post if you want details on how I did it.

Stimulus Payment

Income: $547

I find this a little silly because I’m in no way struggling, but I qualified for a partial stimulus payment – a little less than half of the total amount. I worked to put the money into our local Seattle economy by helping to keep our favorite small restaurants alive and tipping even more than usual. So far none of them have shut down so I’m feeling pretty good about our small part in that 🙂 .

Self-Care Gift

Income: $150

This wasn’t really income, but it was an inflow of cash, so I included it here. I was nominated to receive money from a fund started by Jillian Johnsrud for self-care at the height of the #BlackLivesMatter protests. I was honored to be nominated even though I’ve tried to make it as clear as possible that I’m not hard up for money 🙂 .

However, if it makes people feel better to push me to do some self-care, I won’t stop you! I spent this money on fancy Holo Taco nail polish, top coat and polish remover, nicer conditioner, La Croix seltzer (I usually get the name brand), fancier face masks and eyeliner – all things that make me feel a little better 🙂 . And that’s all logged in my normal annual spending report that’s coming out later this month. Thank you so much again for the nomination and the gift!

Spare Change

Income: $68

So this happened:

Mom: I was cleaning out your old room and found a container with coins in it. I had it converted to cash and it was $68. What were you doing with all those coins?!

Me: I guess the money hoarding started early…#FIRE pic.twitter.com/XmegREfCk7— A Purple Life (@APurpleLifeBlog) July 8, 2020

My Mom found a hoard of coins in my childhood bedroom, got them converted to cash and sent it to me. Afterwards, I asked her how she converted the money and she told me Coinstar. I explained to her that they actually take a large cut when you convert coins to bills there so I actually had more than $68 😉 . It was still a lovely surprise though.

Also a heads up: I learned later that Coinstar has an option of converting coins to Amazon Gift Cards and if you do that, they don’t take a cut (I imagine they get the cards at a discount and that’s how they make their portion). Anyway, wins all around!

Interest

Income: $127.99

This is interest I received from my high-interest Ally savings account. They have understandably continued to chop interest rates from 2% when I started, to 0.5% currently. However, that rate is still way better than that 0.05% I get in my regular savings account so I’m continuing to use them to store some of my retirement cash cushion.

Total Income

Overall, I made $78,034.61 of profit in 2020. That sounds like a legit chunk of change! Not bad for my last year as a corporate drone 😉 .

Spending

It looks like this year I’m going to spend a little less than $16,000, which I go into detail about in my annual spending post 🙂 . This amount is obviously way less than the $20,000 I budgeted for retirement and also less than the $18,000 I usually spent in Seattle. 2020 has been a weird year in many ways, but it’s been a great one for my wallet in that I’ve learned how to be happy staying home and enjoying simple pleasures, which is surprisingly cheap 🙂 .

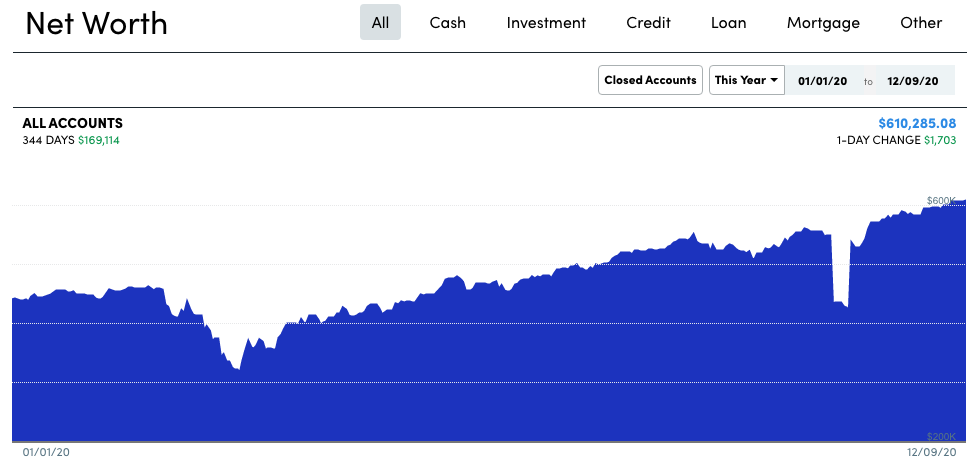

Net Worth

My 100% stock portfolio is currently up 19% and as of this writing my net worth is $610,285. Since 2019 my net worth rose $169,114 or 27%. Given that I only saved $62K of that this increase is shocking to me given the year we’ve had, but once again I am being taught that I cannot predict the future and I made the right choice by not altering my path even when it looked like the world was starting to implode in March. I kept investing, kept saving and against all odds hit my FIRE number in July and retired in October. The power of the stock market and compound interest is still shocking to me.

If you’re interested in monthly net worth updates throughout retirement, feel free to follow me on Instagram or check out my Numbers page.

Conclusion

And that’s it. My goal for next year is pretty straightforward:

- Enjoy retirement 😉 !

The beast that was 2020 is almost over! Let’s see what 2021 brings 🙂 .

Did you hit your monetary goals during this wild year?

Discover more from A Purple Life

Subscribe to get the latest posts sent to your email.

Glad to read that you’re enjoying retirement.

Three days to go for me…

THREE DAYS AHHHHHH!!! That’s so exciting! CONGRATULATIONS!!!

Congratulations on the retirement and loving your retirement Instagram posts. I have to say as bad as 2020 had been, stocks have done excellent and hoping to continue the run next year taking me closer to FI 😀

Thank you! And I’m so glad you’re enjoying them 🙂 . Agreed – 2020 has been hard, but it’s cool to see money compound. Good luck on your journey!

Boom! And yes, surprisingly I did hit my goal of hitting six figures of net worth, which I was absolutely sure would not happen this year. I was prepared for that to be the case. So it was a big surprise!

I also prepared myself for it to be anticlimactic but it felt really good – I know it’s a bit of a hump, that once you get past it the money starts growing at a surprising rate.

I really want to help others get to where I am at, while I work toward getting where you’re at! I’ve heard from a couple of friends who lost a little money in the stock market and immediately cashed out, saying “see, this doesn’t work.” I think a lot of people might have this attitude and don’t realize it’s a long game, that losses are part of it and you’re worried about the whole picture. I need to think of a shorter way to explain it than constantly copying and pasting the link to JL Collins’ Stock Series…

Haha *MIC DROP*. And WOOHOO congratulations that’s amazing!! I’m glad it felt like something. And that sounds like a good goal! If you figure out how to explain in a shorter way let me know. Personally I send that Stock Series link and it quickly weeds out people who aren’t even willing to put in the effort to click a link. And that helps me figure out who isn’t ready yet ;). When they are ready they’ve come back and are willing to put some effort in so I help them out some more. Maybe that’s mean, but my time is my most precious commodity 🙂 .

Very impressive! I like all the ways you’re generating income.

Maybe I should open a Patreon account for my cooking channel stuff.

What do you think? 🙂

Your net worth increase is amazing too. 2020 is a crazy year.

Thanks! It’s definitely a random assortment this year 🙂 . And sure on Patreon – you’ve got nothing to lose from trying it. And yeah it’s been a wild year!

I think you combined the saying “eat my words” and “foot in mouth” to come up with “eat my foot”! 😆 Congrats on a successful 2020 and realizing your dreams and goals! It’s nice to hear something positive coming out of such a crazy year!

Haha thank you for figuring out my weird mental gymnastics 🙂 ! I appreciate it – that sounds right 😉 . And thanks so much! I’m clinging to everything positive over here.

I retired in Sept and have met all my $ goals and more. My spending is way down as well and I think I’ve saved more than 50% of my net income this year. Pretty cool. I’m doing well on the slug life. The only thing I ‘have’ do is walk the dog everyday, because she’s so good at the guilt trip look. Congrats on a successful year!

That’s awesome – congratulations! And woohoo on the slug life – it’s hard to avoid those adorable looks. Thank you!

Congratulations on your high savings rate and reduced spending! I know lots of people (including me) have written about how they are spending less by staying at home, but I don’t think it’s a given. Some of my friends are spending much more than they expected on childcare, takeout, and home repairs/renovations that aren’t offset by reductions in commutes or travel. I’m excited to crunch our numbers at month’s end too! Thanks for sharing your example.

Thank you! And yeah I don’t think it’s a given – totally depends on how you’re spending your time at home (pun intended 😉 ). Looking forward to seeing your numbers!

Nice job. Especially with having additional source of income, even if they’re small. Every little bit helps, and it’s especially helpful when all of your eggs aren’t in one basket. That’s pretty impressive.

Thank you! It was all accidental so I feel like I can’t take credit, but it’s cool to see that extra money trickle through. I’m curious to see if it will continue in 2021 or peter out – we shall see 🙂 .

Well done Purple!

For sure blogging can o my be fun and sustainable if it doesn’t sounds like work 80% of the time (because let’s be honest, sometime you need to do it if you’re want to stick to a weekly post schedule isn’t it?).

I was also expecting some income coming from the mailbox services you promoted. Isn’t it being reported because you are still waiting for the payment to hit your bank account? I’m sure that’s can generate a decent amount of income moving forward.

Thanks! For me blogging weekly has never felt like work in any capacity luckily – if it did I’d stop doing it or skip writing that week. It’s funny you should mentioned Traveling Mailbox – they’re one of the main reasons I put that caveat about blog monetization payments. They owe me about $100 and I haven’t received any of it. I asked them about it and was ignored by the one dude who runs the program (also having 1 person in charge of an affiliate program sounds sketchy to me, but that’s a separate issue). So yeah – once again glad I don’t need the money and don’t need to chase these people to pay me. If the money comes through, it’s gravy and if not, whatever.

I think you will be fine. Just need to be a bit more patient when dealing with affiliate advertising 🙂 Affiliate advertising tends to take anywhere from 1-3 months to pay you back. If you read our post about our blog income we derive from Traveling Mailbox you can see that they are paying us.

Sorry to hear that you didn’t hear back from their affiliate program manager (was it Travis?). This is a relatively small company and they might be victim of their recent gain in popularity.

Btw, Amazon does the same as well. Right now in December I’m getting paid from the commission I earned back in September!

I love this post, APL! It’s awesome you were able to save so much even with all the changes happening in your life this year. And thanks for sharing your blog income. Blogging certainly isn’t a get rich quick scheme lol. But it is cool to get paid even a small amount for doing something you are passionate about. Otherwise, it’s awesome that you are finding your groove in early retirement. I’d be diving into the FI community more too. Thanks for sharing!

I’m so happy you enjoyed it 🙂 ! And yeah it’s pretty ridiculous. I wasn’t expecting to save this much. Thank you!

Nicely done Purple! Very impressive numbers.

Wait wait wait, you mean blogging won’t bring me massive amount of quick money? Boo!!!

Thanks and haha yeah – I’m shocked too 😉 .

I love that you share exact numbers for everything! Thank you!

I just learned about Bask Bank to keep your savings in (opened my account yesterday) and wanted to share with you too! It works like a HYSA but you earn American Airline miles. You get like 1 mile per dollar per year or something (if you have $20,000 in savings then you get 20,000 miles that year). I value this to be much higher than the very small .5% that all the regular savings accounts are at right now!

Of course! And that sounds interesting 🙂 .

Not bad at all for such a tough year! You should be proud of yourself.

Thank you!!

Congrats on your accomplishment of saving $60K in a year! 🙂

Thank you!

Continued success to you!

Thank you!