The journey to financial independence is the opposite of a get rich quick scheme. It is indeed a get rich slow scheme, which is a lot less sexy I hear 🙂 . However, one of the benefits of the “slow and steady wins the race” perspective that aiming for FIRE provides, is that it gives ample time to think about what you want post-retirement life to look like.

On my almost 6 year journey, I wrote several posts about this very subject, such as: How I Imagine A Day In Early Retirement and Testing My Early Retirement Schedule. Even adjusted for the pandemic world we now live in, these thought experiments had some applicable elements. So now that I’ve been retired for 6 months, I wanted to revisit what I wrote previously to see if my longest time away from a job ever, lived up to my expectations.

To summarize the above posts and adapt them to a pandemic world, I was hoping to include these elements in my post-work life:

- Slow Down

- Time With Loved Ones

- Be Present

- Be Closer To Nature

To explore how I’ve incorporated the above goals into my retired life, I’ve decided to go through what I have added to my life, what I’ve subtracted and if there have been any surprises along the way. So let’s get into it!

Additions

These are things that have been added to my life post retirement.

Curiosity About The World

I have always loved learning. It’s one of the things I enjoyed the most about my Montessori education. Instead of stifling a child with memorization, repetition and having to sit at a desk all day, I was allowed to do whatever the fuck I wanted and as a result, I sought out things that actually interested me. I had a healthy curiosity about the world.

That curiosity is one of the first things that left me when I entered a traditional high school. It was also stomped into the ground when I started my fast paced career. For example, instead of hearing birdsong in the morning and wondering what kind of bird that might be and if they were native to the area or just passing through, I was just pissed I was awakened by a noise and wanted them to shut the fuck up 🙂 .

Well, I’m happy to report that with the removal of the fog of work and my single minded focus on kicking ass at my job to pay the bills, my curiosity has returned full force. In every early retirement update I’ve written, I’ve listed things I’ve learned and explored as a result of my natural curiosity. All those posts can be found here.

Topics I’ve been curious about and explored include bird identification, plant identification, astronomy and cooking. And some have become full blown hobbies (*cough* obsessions *cough*), such as birding.

Being Present

Related to the above, I was not fully present when I was working despite my best efforts. I tried so hard to leave my work at work, but found that impossible – maybe because my laptop and cell phone were constantly pinging with work emails and texts no matter the hour or day, but I still believed that if I really wanted to tune it out I could. As a result, I tried just that for years…and it never worked.

I find it impossible to shut my brain off and compartmentalize in that way and as a result, during my career, I was always thinking about work. Evenings, weekends and on vacation – I couldn’t stop. I was always thinking several steps ahead about what could go wrong with a project and how I should go about fixing those imaginary problems. I couldn’t stop.

After trying for years to combat this from every angle, which included exercise, meditation and even the NYC approved pastime of binge drinking, I concluded that it couldn’t be done in a healthy way. I had already laid the foundation of a solution (retirement) and so I hoped that it would at least help with this issue.

Well as it seems is the case with a lot of things in my life lately, it’s been better than forecast. The minute I returned my work laptop, I have not had an issue being present in my life. This is no doubt linked to other things I have been able to remove from my life as well, such as social media and mindless scrolling which I will discuss below, but it does seem like work really was the main thorn in my side. Without it, I have no problem giving someone my full attention. My brain isn’t quietly running in the background. I’m really there.

One with Nature

Related to being fully present, I also wanted to be closer to nature. Instead of lamenting that rainy clouds are forming when I’m getting ready for work, I wanted to embrace the world around me and move to its rhythm. I wanted to stay inside and read on rainy days and head to the beach on sunny ones. I wanted to pause and watch sunrises and sunsets, to marvel at the celestial bodies above us and to just really BE in this world of ours in a way I wasn’t before.

And so far, I’ve done exactly that. One thing staying home all the time definitely helps with is establishing a routine around nature. I look at the weather and decide what to do that day, I stop and watch the stars. I’m here 🙂 .

Time With Loved Ones

This I was also able to change because of retirement. Stupidly (I think) my last company required that I lived in Seattle even though I worked from home 99% of the time. Despite having a remote job, I was stuck in one location, which happened to be on the opposite side of the country to most of my loved ones.

Well, once I knew I was quitting, my partner and I decided to become nomads with the main goal of seeing our loved ones more often and traveling the world. Obviously the pandemic kicked that second goal in the butt for now, but we also became even more fixated on the first goal for obvious reasons. It became even more clear that our time is fleeting and that we don’t know when it will be up for ourselves and those around us.

So we altered the plan. When I quit my job my partner, and I flew across the country and moved from Seattle to Georgia. We started living in a tiny house on the property of my partner’s brother and after taking precautions, we combined our covid bubbles. After over 6 months of isolation in Seattle, we were finally able to be around a (select and small) number of people. We had a few of our loved ones right there.

Between our commune life in Georgia and the 3 weeks I spent in Connecticut helping to care for my baby cousin, I have now seen those family members more in the last 6 months than I have in my entire life combined. Time with loved ones is a big fat check mark and will continue to be since they are the main axis that we are planning our travels around for the foreseeable future.

Subtractions

These are things I have been able to remove from my life as a result of retirement.

Stress

Similar to my inability to be present, as a result of always thinking about work, I was ALWAYS stressed about it. Low level stress that was always there – yes, even on nights, weekends and on vacation thousands of miles away. I was always thinking, always feeling that tightness in my chest.

Well, I haven’t felt that kind of low level constant stress AT ALL since I quit, which is shocking to me. I assumed that feeling wasn’t all from work, but it seems that all of that kind of stress was. I get spikes of stress when there is a horrible event that’s happened in the world or I have to do something stressful, such as find a vaccine in a clusterfuck of a system within 48 hours as I had to do with myself (I talked about that here if you’re interested in the drama) or moving during a pandemic and dealing with people being selfish idiots while trying to protect myself and my loved ones.

But still, it’s nothing like before. I get stressed about ACTUAL problems, not ones that are made up by a boss or wrapped in a client’s ego. Overall, I’m not sure I’ve ever felt this calm. Being a kid at Montessori school was close to that feeling, but I feel even less stress than that. Perhaps because I have my own money, a driver’s license and I can do whatever the fuck I want without parental permission 😉 .

Lack of Sleep

I’ve always sucked at sleeping. I have a hard time falling asleep, a hard time staying asleep and often awaken so sleepy that I wonder why I tried at all. As a result, I’ve been focusing on sleep in retirement. I sleep as long as I want, go to bed early if I want and have added naps, which are a new wonderful thing in my life.

Between all of this, even if I have a bad night, they are SO much fewer and farther between than before AND I’m starting to identify their origins and luckily the reason is never “work stress”. My sleep is better than ever and I suspect it will continue to improve over the next months and years. I’ve made it a priority and I think I’m finally getting back my sleep debt.

Mindless Scrolling

There seems to be a fine balance between decreasing the noise of social media and its negative effects, and staying in the know about the world around us in order to make informed decisions. I have seen people post-retirement that swing too far to the latter side and seem to no longer live in the world with the rest of us. They don’t seem to have a grasp of ‘normal people’ problems and become too removed. This can lead to them making false, uninformed and harmful statements to their (at times large) follower group (yes I am subtweeting 😉 ).

Anyway, I don’t want that to be me. I also don’t think I can properly engage with the world without knowing what’s happening in it, so I’m trying to find a balance. During the election, I became the constant doomscroller of my nightmares, but it was for a reason, so I think I have identified the guardrails of my possible social media experience and am aiming for a healthy middle and so far, I think I’ve been achieving it (if you think otherwise and believe that I’ve become an out of touch monster – please feel free to let me know 🙂 ).

Overall though, I have been a lot better about not mindlessly scrolling on social media. I only open an app with an intention to do something specific and when I’m done, I close it. I don’t allow myself to go down internet rabbit holes that I can’t climb out of and instead use my time online to do things that bring me joy, such as connect with you wonderful people 🙂 .

Distractions

One of the aspects I dislike most about modern work is the constant interruptions. There are emails, Slack messages, texts, Skype and whatever other platform my company claimed would make us more efficient, but actually just made us more scattered while also making the work we do more difficult.

There were always constant interruptions while I was working so when I needed to focus on something, it was basically impossible to do during business hours. This is one of the reasons I had to work so late throughout my career. The constant meetings combined with constant pings meant no time for deep mental work so that had to be done after hours when those two things would mercifully stop.

In retirement, I wanted to remove those constant distractions from my life. This was also to aid my goal of being more present and it’s worked! I talked about the mythical Do Not Disturb settings on my beloved Moto G Stylus Phone in a recent update and I’ve figured out a way to allow texts from my partner and mom to show as notifications and that’s it. Everything else is hidden. So if I pick up my phone to check the time when I wake up I see at most 1 notification, not 100+ as I would when working. I’ve been allowing myself to go about life more slowly and then engaging when I’m ready and it’s wonderful 🙂 .

Sometimes that means opening my notifications in the morning and sometimes that means not doing so until the evening when I’ve had a full day of fun and come back to a few friends playfully inquiring if I’m alive 🙂 . I can regulate the distractions in my life now and I’m loving it.

Response Rate

Speaking of those friends asking if I’m alive, as you may guess – I don’t respond to people right away. Often it’s because I haven’t seen the notification, but even sometimes when I do, I don’t respond right away. When I was working, I was conditioned by an early boss to respond to EVERYTHING immediately and if that wasn’t possible, at most within 24 hours.

Upon reflection, I took the same approach to all things in my life, even on the personal front: texts from friends and personal emails all had to be responded to ASAP and that all compounded on top of work to make me feel like I was constantly behind and under pressure. No longer! I don’t have a 24 hour SLA – I have a “you’ll hear from me when you’ll hear from me” agreement 😉 .

Surprises

These are things that have happened in the last six months that I didn’t expect or intend.

Productivity

I’ve gone on and on about how I love the #SlugLife and am an unproductivity advocate – well, I might have to hang up my badge. In retirement, instead of seeing challenges as something to be avoided, I took to them like a duck to water. For example, in November despite being in Connecticut to help my Mom care for my one year old cousin, I decided to embark on the wild time that is NaNoWriMo (National Novel Writing Month).

I decided to try and write a literal novel worth of words in one month while I was also helping to care for a new soul and live in a strange place. In essence, I lost my fucking mind 🙂 . However, my brain and writing fingers rose to the challenge and shockingly, I met that goal and wrote 50,000 words in the month of November.

Doing so allowed me to create the first Purplemas where I published 2 posts a week for the first time during the month of December. It was awesome to put more out there and also hear from y’all more often during the darkest month of the year.

Fortunately (or unfortunately? 😉 ), this trend continued into 2021. As a result of barely being able to get through any non-fiction books in 2020, I set the goal in 2021 to read one non-fiction book a week. I’ve been told I’m a fairly quick reader, but that does not seem to apply to non-fiction books – perhaps because I stop or re-read when I don’t fully understand a concept, but this self-imposed challenge has been HARD – however, I’m still on track 😉 .

It’s been hard in a good way and after 1/4 of the year, it looks like I might just hit this goal 🙂 . Anyway, the point is, I didn’t think I would want to challenge myself in any of these ways in the near future, but here I am doing it – and kicking ass at those goals 😉 .

Accidental Income

Once again, I need to eat crow. I shouted from the rooftops about how I didn’t think I needed to retire “to” anything and how I would never make another dime because I was so lazy…well, I was wrong. I didn’t anticipate that people would come out of the woodwork wanting to throw money at me for things I was already doing for free for years.

I have actually declined about 90% of the paid opportunities that have been offered to me and yet…I’m still making a little money in retirement. Cuff me and take me away Internet Retirement Police! But seriously, I thought this would never happen and I was wrong.

I am making a little money from the things I love. And if that stops happening, I will continue to do what I love, but the fact that some dough is trickling in is not something I anticipated based on the minuscule chance it would happen organically. For a detailed look at all the extra money I accidentally made in 2020, check out this post.

Fuck It Money Mode

I wrote an entire post about this, but overall: I’ve gone from caring a wild amount about my budget to not giving a fuck…and this is not something I ever imagined would be the case, especially during my first year of retirement. The first 5-10 years of early retirement especially rely on a good sequence of returns in the stock market for all this to work out properly.

I imagined when I quit in October 2020, that I was intentionally leaving at the worst time in recent history. I thought the stock market would be down, the economy would be bad and life in general would be shitty….but somehow only 2 out of 3 of those are true.

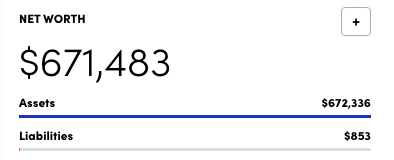

Instead of my assumption that my portfolio would stay low or decline further, it’s shot up since I quit my job. Despite not working since October 1, I’ve gone from having $540K to $671K:

In addition to that, I am living on a 2 year cash cushion that I built up as a precautionary measure when I learned about possible vaccine timelines a year ago. And on top of that, I’m making a little bit of money accidentally ($2K last year – you know, life changing money 😉 ). Because of all of the above, my retired life is monetarily going better than forecast. If I earn nothing else at this point, I don’t need to even start tapping into my portfolio until mid-2024.

As a result, I don’t care about money. I used to look at every receipt and count every cent, but I currently…don’t care. It’s wild. I give generously, I tip handsomely and just go about my life spending money without thinking about it. I never could have imagined this would be how I approached money given my background, but here we are. It’s “Fuck It” Money Mode!

Q&A

From time to time I like to answer y’alls questions in these milestone posts as well to make sure I’m answering the queries in your mind. So here are a few questions that came to me through Twitter:

Somehow I'm 2 weeks away from my 6 month retirement anniversary🗓️. That's weird🤷🏾♀️. I should probably write something about that🤣. Do y'all have any questions you'd like me to answer in an upcoming post🤔? #AMA

— A Purple Life (@APurpleLifeBlog) March 11, 2021

If you could, what is the one thing you would have changed about your FIRE journey other than possibly starting the high savings rate earlier? Would you have retired sooner? Would you have changed jobs? Or would you change something from these past 6 months?

I would have hoped I was more open to my partner introducing me to the idea of FIRE in 2013 instead of ignoring him until 2015 – even if I had not started down the path or started saving then so I could retire sooner. Just knowing there was another option in life and acknowledging it as something that can actually happen (I was a denier lol…). I think it would have helped me feel less trapped and stuck in my seemingly endless high-stress career.

How would you have rated your stress level on a scale of 1-10: * Before you made the final decision to retire * The day after you gave notice * The day you left * The next day * Now (lemme guess…zero?)

Yeah it’s shockingly 0 now – some days a negative number 😉 . Before I made the final decision, I’d give it a 5, a 0 the day after I gave notice (I was so relieved it went better than I could have imagined), maybe 1 the day I left since I was going into the unknown and a 10 most of my working career 🙂 .

What’s been the most difficult part from being on a schedule everyday to having the freedom to do whatever you’d like? (what the pandemic permits)

I’ve actually never had a problem with unscheduled time. I hate schedules and that’s one of the reasons I loved Montessori school and college – because you make your own schedule. I thrive in that environment and being able to follow the rhythm of nature and of my body instead of a clock.

And to end on a very serious question:

— A Purple Life (@APurpleLifeBlog) March 11, 2021

Conclusions

It’s been an absolutely wild 6 months. The time feels like it’s flown by in one sense, but also like I’ve lived more in these months than I did in literal years while working. Time is a strange thing, but I am so SO glad that I took this leap, that I had the courage to quit my job despite the pandemic and recession happening around us. And I am also SUPER glad that my partner discovered this wonderful financial independence idea…and that after 2 years I decided to listen to him 😉 .

I’ve made great progress on all the goals I had going into retirement. They were amorphous and mostly mental and emotional goals so I’m curious to see what new ideas I’ll come up with now that I’m closer to the person I want to be 🙂 . Let’s see what the next 6 months bring!

How were your last six months?

Discover more from A Purple Life

Subscribe to get the latest posts sent to your email.

Hi! Congrats on the retirement journey thus far and the impact it has had on your life in other aspects too! That is so encouraging to hear.

From reading through some of your posts going back a ways, I know your target was $500k before you could retire. Could you share a little bit about how your “total assets” are made up? For example, is most of that in a taxable brokerage, cash, or is part of it in a 401k/IRA/Roth tax advantaged account? When you start tapping into your portfolio should you need to after the cash position is depleted where will you draw from first?

Thanks for all that you share – really inspirational! Cheers!

Thanks so much! And sure – here are the deets when I retired:

$40K cash

$500 invested

-> approx $250K taxable account

-> approx $250K tax-advantaged accounts (Trad and Roth IRAs)

I won’t be touching my tax-advantaged accounts until I can do so without penalty so I’ll be using my taxable when I do need to withdraw money. I’ll also be using a Roth IRA Conversion Ladder to move money tax free from my Trad to my Roth. So I have access to that sooner.

Your last six months sound wonderful. Mine? My job is slowly draining me of my will to live. But I’m getting there. I do hope to join you in the next 12-14 months. Can’t wait!

I’m sorry to hear that. I’m excited for you to join me on this side. You’ve got this!

Hi just wanted to say thanks also for your blog, it’s a valuable resource – and I’ve been on the FIRE train since… well since Jacob from Early Retirement Extreme was still writing! But after going through a divorce, being a single mom, and getting remarried, still trying to sort out my plan!

In the past 6 months I have made progress in convincing my new husband that FIRE is achievable for us, putting together spreadsheets showing the math, organizing our combined assets, making sure they are balanced risk appropriately. Although our situation isn’t complicated, it can get to be a lot of work.

I also read Quit Like A Millionaire, which I will definitely be recommending to young people in my life, along with my other two favorites Simple Path to Wealth and Work Optional.

Of course – thank you so much for telling me that! And wow you’re a FIRE OG – that was a bit ago. I sadly only joined after he stopped blogging.

Great job convincing your spouse and getting all of that in order! Great book suggestions too – I love those.

I don’t think any other FI blogger makes me as jealous/envious of the post-FI life than you, so thanks… I think…

Seriously though – congrats… I hope when I hit the achievement in approximately 5 years it’ll be as good as you make it out to me. Well done to you for being happy with what you have – some people never figure it out!

I’m…sorry? I’m surprised my journey is the one to make you envious though to be honest. Someone called my life “excitedly mundane” and I think of it as strangely normal compared to the retirees I saw gallivanting around the world pre-pandemic, but thank you for making me see my happily mundane life in a new light 🙂 . Good luck on your journey!

As the author of the stress level question (7-8 most days, thanks for asking), I am truly happy for you leaving your stress behind. Gives me something to shoot for!

Now, is my happiness for tinged with envy? Yeah, a little bit…

It was a great question 🙂 . I hope your stress decreases and that you can join me on this side soon. I’m sorry about the envy – that wasn’t my intent. Honestly I expected people say something like “She’s turned into an 80 year old woman after retiring at 30 – who thinks watching birds all day is fun?!?” 😉

This is so true – fog of work.

When I was working, it just took up such a huge part of my brain. I couldn’t relax.

Many FIRE bloggers say quitting work won’t solve everything. I guess that’s true, but it solved a ton of stuff for me. The extra time and clarity gave me the chance to fix other problems.

Enjoy!

I’m sorry you were like that too – I thought it was just me. I wonder if this is a more pervasive problem than I assumed. And yeah FIRE doesn’t solve everything, but it solves a whole hell of a lot for me 🙂 . And exactly what you said – it allows you to have the time to tackle the rest. Thank you!

Three months into retirement, I agree with you about the stress disappearing.

I don’t think I’ve ever been so chilled in my life. It’s a nice, but initially slightly weird, thing to get used to.

That’s awesome!!! And yeah it is weird after a decade or more of being stressed out 🙂 .

Wow, this was a great and encouraging read! I still likely have multiple years to go (at $350k and saving about $1k/week), but I relate to your numbers because I have a similar target living budget to yours. If anything, the last 6 months have been good from the standpoint of my investments growing well. I find it harder to be motivated at work sometimes though as I get closer to a FI number (which for me is probably going to be somewhere above $500k, maybe $525-$530k depending on inflation). Did you find it especially tough when you had a couple years or so left to go? It is hard to be getting closer but still feel so far away (vs. something like 3 months to go).

I’m so glad you enjoyed it 🙂 . And congratulations on moving towards your goals! As for if it gets harder the closer you are: Absolutely! I wrote a couple of posts with “Impatience” in the title about this very subject. It gets harder and harder, but looking back the years of my journey flew past. Hang in there!

I love your posts! You’ve really opened my eyes to making FIRE feel like a real possibility. I am trying to get my husband full on board, but if not, I’ll be FIRE’ing by myself which means I’ll only need half of our expenses.

I am still unsure of what to do after I calculated my number. Do I just open a Vanguard account and dump money? lol

Thank you so much – that’s awesome! And I love the single FIRE plan – that’s what my partner and I are doing as well. And yep – that’s a great way to put it. You just keep dumping money into the market and wait 🙂 . Good luck!!

“For example, instead of hearing birdsong in the morning and wondering what kind of bird that might be and if they were native to the area or just passing through, I was just pissed I was awakened by a noise and wanted them to shut the fuck up 🙂 .”

Laughed so hard at this, because I’ve lived exactly this!

Haha glad I’m not alone!

“I was just pissed I was awakened by a noise and wanted them to shut the fuck up” this is me and always has been lol

The job fog is so real. Whenever I have holidays from work, there’s always an afternoon or an evening (or multiple) where I find myself churning over work issues. I have to mentally stop myself. it sucks that work intrudes no matter what. And you’re saying there’s a state of being where that doesn’t happen?!?! MADNESS. CRAZYTOWN. I wanna be there so bad!

What a great update! You’re painting a grand picture here. Life seems idyllic, though I’m sure there are other things you can’t share publicly. This is so reassuring to read. And this is YOUR LIFE, it has to be an amazing feeling. I hope everything continues going well for you!

Haha yeah retirement has really made me less hostile to random nature noises that’s for sure 🙂 . And ugh I’m sorry the fog of work is there for you as well. That sucks. I’m glad you enjoyed the update – life is pretty sweet right now 🙂 . Thank you!

Hey Purple, long time reader here. So glad to hear you are loving early retirement (not that I had any doubt you would, tbh, based on your posts before retirement!).

I just wanted to touch on this:

“The constant meetings combined with constant pings meant no time for deep mental work so that had to be done after hours when those two things would mercifully stop”.

This is SO FREAKING true. I completely recognise the need to work late in order to do one’s actual work after 5pm.

Interestingly, I am only 9 (I think) years older than you, but I can honestly say, that the constant interruptions and endless meetings leaving NO TIME for the doing of Actual Work, have got noticeably worse since I started work in 2006. These days 2006 seems like prehistoric times, with meetings IRL and really basic (if any) videoconferencing facilities.

2020 Pandemic working has thrown things even further out of whack, into another stratosphere of excessive Zoom calls.

Anyway. I always enjoy your posts. I’m on a slower-path to FI, partly because I didn’t discover the concept til I was 30 something (!!), and partly because I’m not a higher earner in a job which I really enjoy some aspects of.

Hi Maria! Thanks so much for commenting 🙂 . I’m sorry you experience those same distractions. It’s wild. I’m sorry the pandemic has only increased the unnecessary meetings. I hope you use that decline button to its full potential 😉 . So glad you like the posts! Good luck on your journey.

Purple—it’s nice to read some positivity surrounding early retirement 🙂 Congrats! Glad it’s going well for you and yours.

I wonder if, in a way, the pandemic is kind of helping us slowly dip into early retirement with a more limited set of options. For you, it’s been the impetus to spend more quality time with family out in GA rather than hitting the nomad life right away. I’d imagine it’s given you some time to take care of some nagging things in the background of life you’d been putting off. Hopefully, it sets you up to have an even more successful trip on the nomadic road once that’s reasonable and safe to take on. I’d like to think it’s the silver lining we’ve found, too.

Congrats on 6 months!

Thank you Chris! I do think the pandemic has let me take a slower and more methodical approach to early retirement, which is indeed a silver lining.

Stress and lack of sleep are the two biggest things that come with working a standard 9-5 corporate job. It’s kinda scary for me to think about. I have really bad eyesight and I can only imagine how worse my eyesight will be after staring at a screen for 40 hours per week.

I’m scared what will happen after 10 years of constantly doing that. I hope I reach financial independence way before 10 years so that I can stop worrying about that and enjoy life the way it was intended to be enjoyed.

Yeah it’s pretty wild what our bodies go through. I’m sorry about your eyesight and hope you can escape sooner rather than later!

Great article as always. I think early retirement is a good thing for many. I know of people who worked until they dropped and did not really enjoy all they worked for.

Thank you!