Well, the fastest 12 months of my life are at an end. I usually do annual recap posts in December that outline my spending, income, net worth etc, but I thought it might be fun to see what just the early retirement portion looks like instead of each calendar year.

I retired in October 2020 and these numbers go through September 2021. After this Year 1 retirement spending/income post, I’ll go back to just reporting this info in my annual December posts. So how did my first year of retirement go?

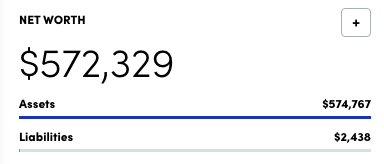

Net Worth

After I left my job and received all of my residual money from my career, this was my net worth:

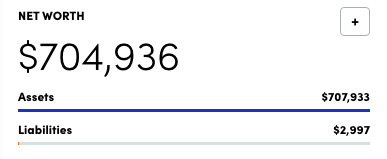

And this is my net worth one year later:

Yeah, it’s bonkers. And that’s after the stock market decided to decrease 5% in September. Overall, though, the stock market has been on a tear that I never could have predicted and the fact that I have a 100% stock portfolio has allowed me to capture all of that growth. I wouldn’t have suspected I would have this much in my portfolio at this point in retirement, especially after retiring into a pandemic and possible recession, but that’s the market for you. It basically just says “Fuck your plans” 🙂 .

If you’re interested in keeping up with my monthly net worth updates, I post them on Instagram and my Numbers page at the end of each month.

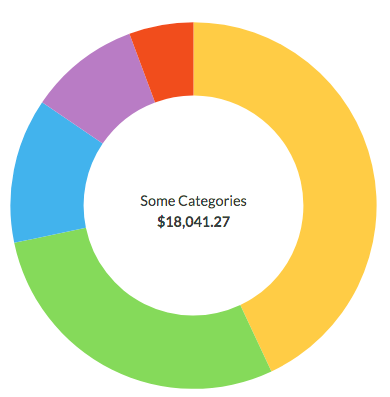

Spending

Retirement Spending Goal: $20,000

Actual Year 1 Spending: $18,041

Obviously this has been a weird year. I was originally going to be galavanting across the world throwing money at any food and experience that sparked my fancy, but instead, all that travel was understandably cancelled and countries had no interest in letting us American yahoos within their borders given how poorly we are handling this pandemic.

So I shifted to a year focused around the US and being near family. Unsurprisingly, that is way cheaper than jet setting across the globe in first class. My goal for the first few years of retirement was to spend $20K/year and then increase it as I want or need once I passed the major sequence of return risk of the first few years.

Below is a breakdown of all the categories within the above. I’ll do a deep dive into each line item for 2021 in my December annual spending report:

Monthly Bills

- Rent + Utilities: $7,331.99

- Phone: $333.75

- Transit: $105.63

Changelings

- Groceries: $1,607.53

- Eating Out: $2,873.93

- Alcohol: $703.75

Long Term

- Giving: $1,532.83

- Blog: $500.64

- Subscriptions: $134.62

- Mail: $109.59

- Electronics: $26.60

Rainy Days

- Medical: $1,040.99

- Dental: $240.16

- Personal Products: $179.60

- Entertainment: $147.84

- Clothing: $82.45

- Grass 😉 : $50.00

- Household Goods: $25.49

Vacation

- Travel: $1,026.85

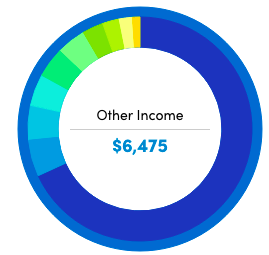

Accidental Income

Y’all caught me. I declared that I would become a complete sloth in retirement and never make another dime and like with many things, I was completely wrong 🙂 . Turns out after lying facedown for a few months, I felt refreshed enough to, well…actually want to do stuff and that apparently translated to making some money accidentally. This is all the income I made after leaving my 9 to 5:

Obviously I will have to pay self-employment taxes out of this money (I’m conservatively estimating 30%) and it’s also not a huge chunk of change, but this is more than the $0 I accounted for in my FIRE calculations, so that’s cool. Once again, I’ll go into each line item within my 2021 annual income report in December.

Lack Of Drawdown

Because of the income I mentioned above plus the taxable dividends that have been deposited in my account, I’ve barely touched my two years of annual expenses I had saved in cash and I definitely haven’t needed to touch my portfolio.

My cash cushion currently sits at $43,095. It was supposed to sustain me for 2 years until October 2022, but instead, even if I don’t earn another dime, this cushion will take me through to October 2023 – a whole 3 years after I retire. Weird!

What’s Changed?

I learned there’s adventure all around me

When I dreamed of retirement it always involved far away lands, trying unique food and meeting new people. Then I retired in 2020 in the middle of a global pandemic. All my lofty travel plans were cancelled and after a time, we decided to lay low in one spot instead of doing the every 3 month nomad location rotation we’d originally planned.

Having to let go of my original plans of being a global jetsetter was difficult and definitely sad. My Mom and I had been saving up airline miles, planning and booking these trips for 3 years, so it was difficult to say goodbye even though we knew it was what needed to be done. So then I was faced with living in my home state of Georgia for an indeterminate amount of time – a state I promised after leaving for college that I would never return to outside of a fairly quick visit…life is funny like that sometimes 🙂 .

Instead of gorgeous sandy beaches, I was greeted with the woods and humidity I had always known. Living in the state where I grew up and having the time that retirement allots me to reflect, and the energy to be curious about the world around me made me realize: adventure is everywhere. I did not need to fly halfway across the world the see something beautiful. There is beauty everywhere, even in my previously despised home state 😉 – I just had to look for it:

As a part of this revelation, I started learning about the flora and fauna around the south. I had lived here almost 20 years and never noticed or cared about any of this before and it’s opened a whole new world for me. I don’t need far away places because I can learn and grow and enjoy being anywhere. I’m glad the monster year of 2020 could teach me one good lesson at least 🙂 .

I’ve become way more curious

When my partner first mentioned the idea of financial independence, I was one of those people that retorted “But what would I do all day?” It was almost like a reflex – and maybe it literally was. A mindless work ethic and the necessity to “be productive” is hammered into our society and our heads as a result. Well I’m embarrassed those words ever slipped out of my mouth. It’s been an entire year and I haven’t had one SECOND of thinking “I’m bored.”

Instead, I get to do whatever I want, nap when I want and learn whatever tickles my fancy. It’s the life I’ve always dreamed of and I almost can’t believe my brain was so clouded that I couldn’t imagine that before. There is so much to learn and explore in this world and even though I have (hopefully) 70 more years to do it, I know I still won’t have enough time to complete the task despite my infinite curiosity.

I’m now completely present and have an open mind to focus on the world around me. While working sometimes I would think, “I wonder why X does Y?” and promise to look it up when I had a spare moment…only for that moment to never come. Or if it did, I would have forgotten why I was interested in that in the first place and fall back into some mindless TV show or YouTube rabbit hole to distract myself from the upcoming work week.

That’s no longer the case. I learn something new about our world every day and have been recording those things in my Monthly Retirement Recaps. I have a better understanding of how our world works every day.

I stopped being tired…eventually

I used to wake up and think “I just slept 9 hours – why am I exhausted?!?” I would marvel at people who had the same job I did while having a house, a car, kids and pets and wonder “How the fuck do they do that?!” to which my hindbrain responded “Cocaine”….I mean probably right 😉 ?

So I was curious if feeling tired is just a constant of adult existence or if it would ever go away after I had hit the #SlugLife hard enough. Well, it took almost a year but I’m now sleeping better than I ever have. I had labelled myself as someone who was bad at sleep, but apparently that’s not true – I’m just bad at it when I have a shitton on my mind from a challenging high school workload or a heavily mental career.

I now fall asleep easier, stay asleep and awaken refreshed. There aren’t a million things in my brain that won’t quiet when I lay down to sleep. I don’t jerk awake in the middle of the night worried I forgot something for work. I just sleep – what a novelty 😉 .

I’ve become infinitely more calm and patient

I love my plans. I plan way in advance and used to get anxious when things went wrong – even if I (as usual) had a back up plan for my back up plan. Separate from my regular anxiety, I pinpointed that this especially flared up when a delay or detour would take away some of the precious little time I had away from work: a flight delay on the way to see my Mom for the weekend, a blown tire on a bus that I was taking to visit a friend etc.

Well, I’m happy to report that now when things go wrong, I don’t even flinch. I now see the journey as just as interesting as the destination. If something happens, it’s an adventure and a challenge to solve instead of an inconvenience that spikes my blood pressure. This has led me to be a lot more chill when the unexpected happens and I’m really happy about that 🙂 .

I’ve found hedonistic balance

While working, I used to use weekends and vacations as an incubator to let loose – to grab all the snacks for a movie night, try that new ice cream place and visit breweries. Well now, everyday is a weekend and everyday is a vacation so that indicator doesn’t work any more. This challenge was exacerbated by the fact that we move every month and a huge part of experiencing a new location for me is about eating and drinking what’s unique to that place.

For example, there are now no limitations like when I was working and I didn’t want to have wine in the evening during a movie night because it would affect my (already sucky) sleep and make the next workday worse. Without those kinds of guardrails, I found myself living for the pleasures of life until realizing that everything needs balance.

I started to enjoy the endless takeout meals less because it was such an often occurrence. I also did not love what was happening to my body as a result – I was getting bigger, less comfortable and I imagined my internal organs weren’t happy with me either. This approach had led to me living like every day was Saturday and that was not a good thing for my waistline or health.

So I had to find a balance. Since I realized this, I’ve made a few changes:

- Plan keto weeks: I plan ahead when I’ll go back to keto and calorie counting during our travels and stick to it. I usually enjoy eating everything at restaurants for 2 weeks and then go keto for 2 weeks if we’re staying somewhere new for a month. If it’s somewhere we’ve been before, I usually do 1 week off and 3 weeks keto. This allows me to enjoy a new place, but also not let it affect my waistline or health too much.

- No junk food or alcohol in the house: I’m now a social junk food eater and drinker. If we’re going out with friends, I’ll have whatever, but keeping my house clean has helped remove the temptation of “me hanging on this porch would be even better with carby snack and a cold glass of wine” impulse.

I found community everywhere

As a result of the prevalence of the internet and exacerbated by the pandemic: communities are virtual now. I joined several new ones after the smashing success of sneaking into the personal finance community 😉 . These communities included bird and science twitter and I was surprised that both were just as wonderful and welcoming as personal finance twitter despite everyone meeting on the ‘dreaded’ bird app 🙂 .

I’ve been really surprised with how many wonderful people I’ve met online that have turned into real life friends. It’s the opposite of a stereotypical high school lunchroom and I wish I had jumped into these communities sooner. I haven’t felt a lack of human connection once during retirement – it’s much more my speed than pretending to smile for 8-12 hours a day in an office surrounded by (in my experience) fake friends.

I confirmed that the life I want doesn’t include corporate work

My Mom often commented during my career that she’d never worked as hard or for as many hours as I had. I took this to mean that our work lives seem to be bleeding into ‘real’ life more than ever these days. Industries seem to be getting faster and more demanding without the corresponding increase in wages.

Those facts combined with my perfectionist nature meant that when I was working, it was all consuming – even in the evenings, on the weekends and on vacation. I was either actively working because that’s what was expected of me, or thinking about work. There was no escape.

It would probably be different if I chose a totally different career or was the type of person that could compartmentalize well, but I’m not and other careers didn’t interest me so here we are. Corporate work wasn’t for me, but retirement is.

I feel more fulfilled, happier and calmer than ever before. I have my curiosity and love of life back. I stop and smell the flowers (literally – it drives my partner nuts 🙂 ). And yet I still don’t get to everything I want to do in a day – or in a year! It’s been 365+ days of freedom and I feel like I’ve just dipped my toe into what my life could be like despite having learned, read and explored more than any previous year of my life.

I learned boredom doesn’t exist

I have been WAITING to feel bored. It was a goal of mine actually – and it hasn’t happened. When I was working, sometimes I would be so focused and keyed in that it would take me days after Friday ended to remember what I like to do in my free time. I had forgotten that part of myself.

Hilariously there were obviously only 48 hours before I had to go back to work so that was a sucky cycle 🙂 . In between Friday and remembering what the hell makes me feel joy in this world, would be boredom because I wasn’t interested in anything, I couldn’t muster up passion for the mysteries of life. I was tapped out.

In comparison, curiosity and passion are what I’m running on now and as a result, there is nothing I can’t see (such as the stars) or hear (such as a new bird call) or even smell (such as baking bread) that doesn’t make me wonder about that mechanism or creature or skill, which leads me down a new avenue for learning and growth. Boredom doesn’t exist because there’s so much to learn about the world.

Is FIRE Worth It?

I didn’t take the most straightforward route to FIRE – at all. When I first learned about the concept from my partner, I made the silly comments I mentioned above and then proceeded to ignore the idea of FIRE for 2 years.

I finally got onboard in 2015 and decided to move across the country from NYC to Seattle for financial and other reasons. Then in 2016 when I got my last job, I decided to stay there for 4 years instead of job hopping despite the fact that job hopping is how I’d gotten so many salary increases in the past and that my salary stagnated after inflation as a result of this decision. I really liked my boss, enjoyed the variety of my work and LOVED that it was remote – so I stayed, even though my journey to retirement could have been faster if I had jumped ship.

I didn’t take the fastest route to FIRE and I tried my best to make my life as enjoyable on the journey as possible. I started spending 2 months of the year working from elsewhere, I saw family and friends more and started trying out hobbies I had previously been saving for my FIRE life. Instead of being my main focus, saving for FIRE was in the background as I went on with my life.

Saving for FIRE wasn’t a sacrifice. It was just what I did with the extra chunks of money my semi-frugal lifestyle leftover as a result of moving from NYC to Seattle so I could have the same standard of living for half the cost. There are a multitude of ways to gain your freedom and I wasn’t sure if the one I took – straight up FIRE instead of semi-retirement earlier or entrepreneurship – was the right one, but after a year, I can confidently say that it was the right choice for me.

What’s Next?

My first year of retirement has been a whirlwind – and not just because I retired during a pandemic. Retirement has allowed me to do some wild things, such as driving from Georgia to Connecticut at the drop of a hat to help care for my baby cousin for 3 weeks and flying across the country to see an art exhibit.

In our first year of nomad travels (that only really started after we got fully vaccinated this spring), we’ve lived in the below places. Links are included for the ones I’ve done Slow Travel Reviews on:

- A tiny house in rural Georgia

- Decatur, GA

- Portland, ME

- New Hampshire

- New York State

- Saratoga Springs, NY

- Catskill, NY

- NYC

- Paso Robles, CA

- Austin, TX

- ABQ, NM

For the rest of the year, I want to focus on completing NaNoWriMo in November for the second year in a row, finishing my 52 non-fiction books in 52 weeks challenge, and continuing our nomad travels. We’ll be living in Arizona, New Mexico, Austin TX, Connecticut and then returning to NY State to finish up 2021.

In 2022 we’re (pandemic pending) planning to visit:

- Phuket, Thailand

- Merida, Mexico

- Phoenix, AZ

- Seattle, WA

- Puerto Vallarta, Mexico

- Buenos Aires, Argentina

Basically we’re going to be traveling and seeing loved ones, which would not have been possible with my previous job. So thank you FIRE 🙂 !

Conclusion

This is the calmest, happiest and healthiest I’ve ever been – mentally and physically. Instead of seeking a distraction or substance to push down feelings in the moment so I can try to enjoy my weekend without thinking about work or avoiding an issue in my mind, I have the time to take a breath and face it head on. I also don’t have the excuse of “I’ll deal with this later” 🙂 because there is no later – this is my life.

So despite the fact that I never thought of FIRE as a sacrifice – because it straight up wasn’t, given my income and weird spending preferences – saving quietly towards this goal for almost 6 years was indeed worth it to me. So far it’s gone way better than forecast (*cough* pessimist *cough*) and I’m excited to see what the next year brings!

Do you have any questions about my first year of early retirement?

I loved reading this! I semi-retired about four months after you retired so I have gotten a lot of inspiration from your weekly and then monthly updates. It seems you really are living a fantastic life and even though we don’t know each other, I am so, so thrilled for you! I can’t wait to see how year two goes!

Yay! I’m so happy to hear that 🙂 and thank you so much. I hope your retirement is going well!

Fantastic roundup! YEAH! Thank you as always for sharing!

Thank you for reading 🙂 !

VERY interesting post Purple. So glad you have enjoyed your year off and are finding the time stimulating and relaxing at the same time. Between you and FireDownUnder you have both inspired me to start to grasp time now and learn to slow travel. So, thank you for your inspiration.

That’s so awesome! And stimulating and relaxing at the same time is a great way to put it 🙂 .

Great read, Purple! Sounds like you have some fun adventure ahead in the next year. Also cool to see how much your portfolio has grown after a year out of the workforce. There will be down years along the way, but hopefully way more up years to keep it growing!

Thanks! And yep – either if there are down years I’m way ahead compared to where I thought I would be (cash cushion and portfolio wise) so bring it on 🙂 .

You are doing it right Purple, I’ve rarely been bored in my now almost 6 years post 9 to 5. But I will admit there are times in the last 6 weeks I have almost been, because being laid up after surgery and having my favorite active hobbies declared off limits until I fully healed up wasn’t particularly fun. However I should get my freedom today because it’s six weeks to the day today! Yay me! Back to tennis and fishing and longer harder runs and more aggressive pickleball. Great first year for you, and I’m not a bit surprised!

Haha thank you. I’m so happy to hear your 6 weeks are over – congratulations! That must have been tough. I hope you get back to all those awesome things soon!

Congratulations on an amazing first year or retirement Purple! It’s been so fun to watch your journey and all the adventures you’ve had. Saving some of your travel reviews for our own slow travel adventures (we’re planning to hit up parts of New England next summer break).

It’s wild how much your net worth has grown over that time, and I have no doubt your accidental income will continue. Look forward to reading all about year #2, and if you ever want a coffee or drink companion while in Phoenix I’d be happy to meet up 🙂

Thank you! And New England in the summer sounds awesome – that’s so exciting 🙂 .

I’ll actually be a little north of Phoenix for a hot second next week. Are you free the morning of Wednesday, October 20 for an outdoor coffee? If so, email me at APurpleLifeBlog@gmail.com and we’ll set it up!

I’ve vacationed a couple of times in Puerto Vallarta, it’s lovely although quite touristy – I would totally recommend taking the bus up to Sayulita or some of the other smaller towns a bit north!

Yeah I’ve been to PV before and enjoyed it (we stayed away from the tourist parts), but I’m adding that to my list – thank you!

So inspiring! Congratulations on building and then living the life you want!

Thanks so much!

I loved that you are going with the flow – pandemic / spending / flexibility. I think that is a very important skill in early retirement. Money gives you options and you are taking full advantage of it. It also allows you to see things in a different way – like Georgia. You enjoyed it this time around since you were not “forced” to be there but not it’s a way to re-connect with family and maybe your childhood.

Cheers to many more years of retirement!

Flexibility has definitely been key 🙂 and that’s a great point! Thank you 🙂 .

Hiya! Thank you for sharing this. Moreso then any other blogger, you make me *excited* to get to FI already!

I do have a question for you though, sometimes I wonder how genuine/real you’re being with it all.. You never seem to post on the downsides of Financial Independence, or the times when life is tough? Do you have any thoughts on this?

Thanks – I’m happy to hear I help make you excited for it. I actually do post about that stuff. I haven’t found any downsides to FI, but I do talk on the blog about the challenges of life. Usually they’re in monthly recap posts – or my posts on death or addiction. Feel free to check them out.

Thank you! And my apologies for not being aware of that content.

No worries

Wow, great recap Purple! It’s been fun following your journey this year on twitter and instagram. 🙂

I’ve especially liked the beautiful pics of the places you’ve visited and of course – the food!

Looking forward to hearing where life takes you next! 🙂

p.s. I really need to read The Psychology of Money. Really good quotes you’re sharing from that book on twitter!!

Haha so glad you’ve been enjoying it! I’ve found the curation aspect super fun 🙂 . And yes – definitely check it out. It’s great!

Thank you for sharing all that you do. I have been considering stepping away myself but like most people I am always concerned of do I have enough money.

Seeing how you can live and spend while finding all kind of exciting opportunities is very reassuring.

Keep up the great posts.

Of course! Thank you for reading 🙂 . And yeah that’s a common concern and one I definitely shared. I’ve been surprised with how little things can cost with some flexibility. Thank you and will do!

I was smiling the whole time I read through this post. 🙂 It’s pure joy to have watched you make the most of this first year of retirement! While I get bored writing my own monthly recaps, I love reading yours and savor them when I do. This one year recap is such a pleasure as well, so it is giving me some motivation to keep up some of that writing on my blog haha.

Kudos on the hedonistic balance. It’s something I’ve been thinking about a lot, especially after a summer of more indulgence that has left me feeling like there was a bit too much of readjusting to be made health wise in September. I wish I didn’t go as far in the opposite direction lol, hopefully there will be next summer to readjust.

Finally, I’m just loving the fact that your passion and curiosity just seem to be continuing to grow now that you have the mental space for them to flourish! Cheers to your first year of retirement friend!

Side note: they are talking about opening up the borders in November so if you are finishing up the year in NY state, depending how close to the border you come, let’s look into a quick meet-up if at all possible!!!

Awww that makes me so happy lady 🙂 ! And haha to each their own – I love keeping track of this stuff luckily. Happy to chat about hedonistic balance! It was a challenge after ‘living for the weekend/vacation’ for so long, especially since there were ‘vacation’ triggers everywhere I went (e.g. new cities, visiting people etc).

Thank you so much lady and cheers to you!! And YES I would love to see you when borders open up. I’m even willing to drive hours in the snow (I don’t know how to drive in snow…) do to so lol! I’ll message you my dates so we can figure something out 🙂 .

Love the update, and love your take on finding the beauty everywhere. Likewise the pandemic really helped us to explore our home state further, and realize that there is so much more to it than I could have ever imagined.

So while I still want to travel far and wide, I know I can be happy staying here and doing more local adventures.

Most excited to hear about your trip to Phuket! Cheers!

So glad you found that too! I was so ready to burst out internationally that I neglected this beautiful country I’d only seen a small fraction of 🙂 . And I’ll be sure to keep y’all updated all about it 😉 .

A cenote in New Mexico.

Cenote. C-note. https://www.investopedia.com/terms/c/c-note.asp

🤣

I’m a dork 😛

Haha you are and I love it 😉 .

For real, it looks like a blast though! It’s great that you’re finding so much to see and do right here in the US 🙂

Yeah there’s so much to see here – who knew 😉 ?

Hi Purple, happy 1 year FI-versary!! I remember so clearly when you posted that you were quitting, because I was still deep in pandemic anxiety/uncertainty and I remember thinking I would have been too anxious to quit. I feel like it deserves a special shout-out that you hit FI and moved forward in a PANDEMIC and still trusted your plan, pivoted, adjusted and had an incredible year as a result. Others in your shoes (probably me, lol) would have gotten too scared and a year later would still be stuck at work thinking they’ll just keeping waiting to see what happens.

FI definitely has an emotional/psychological component too, so I really appreciate that you (and others like you) show the whole process of not just coming up with the plan and the backups, but also what it looks like to trust the plan enough to execute it.

Thank you! And yeah…that was a wild decision haha. And I’m so glad you enjoyed it! I try to show all sides if possible and I’m glad that came through.

Oh, the earnings are a tease- I’m dying to know what windfalls came your way. While you certainly don’t need the $$$, it’s nice to have and nice to know it’s an option.

So much easier for us mere mortals to know we CAN quit if there is a chance of earning a tad in the future.

Haha I’ll get into it in December I promise (and that’s basically only a month away!) It was nice to see it rolling in and also know I didn’t need it and didn’t care if it kept coming 🙂 . And yeah if someone as lazy and anti-productivity can do it without trying it seems anyone can 😉 .