This is part of a series about my journey to early retirement. In case you missed it, here are the previous parts:

- $5K to Retirement In 9 Years: Year 1 “Is This Adulting?”

- $5K to Retirement In 9 Years: Year 2 “Avoiding My Problems With Exercise & Consumerism”

- $5K to Retirement In 9 Years: Year 3 “Discovering FIRE…And Ignoring It”

- $5K to Retirement In 9 Years: Year 4 “Catching A Unicorn”

- $5K to Retirement In 9 Years: Year 5 “A Seattle Bait & Switch”

- $5K to Retirement In 9 Years: Year 6 “Searching for Bigfoot”

- $5K to Retirement In 9 Years: Year 7 “The Goldilocks Zone”

Year 8

Riveting title right 🙂 ? Well, I don’t want to lie to y’all and I think it properly represents what’s going on here. I guess I could count myself as lucky since I have usually heard about “the boring middle” of a goal. I didn’t have a boring middle – there was too much drama and change for that 😉 . Instead I had a bit of a boring second to last year of my journey.

On one hand I am very grateful for that because constant change and drama is exhausting 🙂 , but a drama-free year can also be a boring read. However, I think it’s important to talk about because it’s a pervasive part of the journey.

At one point it will get boring after you dove in, read everything you can and come up with a bulletproof plan. Before the final countdown, there is a section where everything is on autopilot and you just have to…live your life 🙂 while your money keeps piling up.

I continued my trend from last year of trying to make my day-to-day life while I was working, as close to my dream retirement life as I could. I continued to explore new hobbies and generally just live my life as much as possible.

I tested out my retirement schedule on a vacation to Costa Rica and tried to find ways to stay motivated on this journey (in a word: Spreadsheets!) I also reflected on if this journey has been a sacrifice (Spoiler: Nope!) and the real reason I want to retire early (Warning: it’s a morbid one):

Financially, I started dabbling in fun gamified apps to make a little extra cash while having fun, went to an annuity dinner to live tweet the experience, and reflected on my decision to own 100% stocks. I also did a deep dive on how I spent $125/month on groceries and how I saved 85% on a cavity filling.

Meanwhile, my job was becoming a bit of a turbulent monster 🙂 . It was nothing like I had experienced at my previous jobs, but it was more than I was used to at this company. Basically what happened is I was put on my first long-term, large project with other people since starting this job in Year 6.

Previously I had been very clear with my boss that I prefer to work alone and that I think larger teams lead to wasted time and work 🙂 . Well in this case, he said he needed my expertise and that there wasn’t another project in the wings (…I would happily take a paid vacation if you’re asking 😉 ).

Anyway, not only was it a large group project, but a long-term one. Another situation I do not prefer – I like projects that last 1-3 months at the most so I can keep moving on, learning and not get bored like I have in my previous jobs. Well this was going to be a year-long project. Blerg!

I tried my best to find any positives I could in this situation and sadly…I couldn’t. Having a larger team meant that most of my time was spent in meetings coordinating what we were GOING to do – and not actually doing it 🙂 . The actual work was done after hours, the only time I wasn’t in meetings. I was getting flashbacks to my ad agency days.

One of the reasons I loved this new marketing career of mine was that each individual person was an ad agency in our own right – no one was in a box and I didn’t have to wait for another person in some other role for me to complete my job. I just did it all 🙂 .

Well now I was back to bureaucratic hell. Days spent in meetings talking about other meetings, emailing about emails to other people. Just meta bullshit. I was here to actually get things done people! My frustration came to a head a few months into the project, which led me to write this post:

I was seeking help from y’all to try and find a way to get through this situation and both kick ass at my job and not let it negatively affect my mental health. That time in my work life also made me start considering if there are downsides to working from home.

I let my growing frustration at my job out on this very blog 🙂 . Writing these posts helped me clarify my thoughts and understand my emotions. In addition to all that, this was a big year for the blog. I celebrated a year of public blogging, recorded my first podcast interview, decided if I should reveal my identity and even won an award!

This blog became a wonderful sanctuary from the madness that my job was becoming with this new project. Instead of venting to coworkers or my partner, I asked y’all about the things I was experiencing and got a whole range of responses based on your varied experiences, which I really appreciated (and still do to this day)! Y’all helped me get through ‘the boring part’ 🙂 .

Also during this year, in addition to taking a week-long vacation to Costa Rica, I spent several months in total, working from outside our Seattle apartment. We went to three waterfront Airbnb retreats with my Mom for a week at a time, and I even walked a half marathon on one of those islands (….we barely made it back before they closed the finish line, but that’s not the point 😉 ).

I also finally got off that horrible project! And all it took was asking my boss for a LinkedIn recommendation (after I had expressed interest in leaving the project and he did nothing about it…I guess the hint that I might be looking for another job was enough to change his mind 😉 ).

I've been trying to get off a horrible project for 6 months without success. Then I asked my boss for a LinkedIn recommendation…less than a week later I'm off the project… pic.twitter.com/dR668dMILz

— A Purple Life (@APurpleLifeBlog) May 3, 2019

I also started to get serious about my countdown to retirement and wrote monthly updates about what was going on in my life and how I was feeling, which you can find here:

- 17 Months To Retirement: Apartment Drama

- 16 Months To Retirement: Discovering Cracks In My Favorite Company

- 15 Months To Retirement: Exploring The Many Different Types Of Stress

- 14 Months To Retirement: Battling The Impatience Beast

- 13 Months To Retirement: Prioritizing Loved Ones

- 12 Months To Retirement: Recognition and Combating Self-Doubt

- Should I Lock Myself Into Quitting My Job In 11 Months?

- It’s Official! I’m Quitting My Job In 10 Months. Here’s The Plan!

- 9 Months To Retirement: I’ve Achieved DGAF Status

The TL;DR version of the above links is that my company continued to deteriorate by promoting toxic colleagues and I experienced impatience with this retirement goal and found ways to distract myself from it.

I also had to decide if I was going to go forward with my original plan of pulling the trigger in October 2020 in order to book my retirement victory lap trip to Australia and New Zealand. As of 2019, I decided to go for it…but I bet you know the metaphorical fly in the ointment that’s coming in March 2020 🙂 .

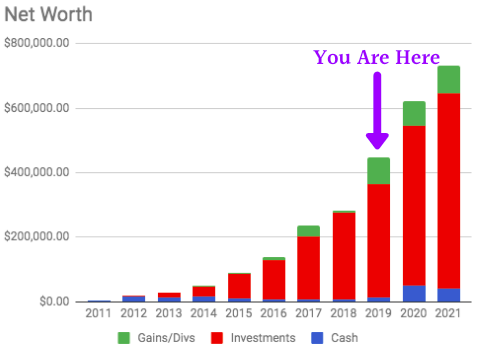

Anyway, at the end of 2019 here’s where I stood financially:

Salary: $110,034

Spending: $17,896

Net Worth: $448,230

So what do you think will happen next? Will Young Purple collapse from boredom 😉 ? Will some Black Swan event sweep the globe and change our way of life as we know it? Who can say… Tune in next time to see what happens 🙂 .

Here’s the next post in this series: $5K to Retirement In 9 Years: Year 9 “The Final Countdown”

Not so boring that I wanted to stop reading 🙂

Great series, and it’s helpful to see someone’s notes of going through the journey. That way, people can see if it’s a journey worth taking, if it aligns with their personal preferences, etc.

Similar to how you didn’t want to manage that whole team–some people thrive on that! But if it doesn’t fit with what you want, it’s best not to waste your time pursuing it.

Likewise, early retirement isn’t for everybody. But it’s good to get the perspective of someone who’s done it! I think you’re providing a valuable service here! [Of course, I suspect that most people who find their way here will probably agree that early retirement is worth pursuing!]

Haha I’m glad! And yeah I don’t think anything is for everyone so it’s nice to be able to make an informed decision.

I remember that year’s posts clearly and I am very glad you documented it as you did because it truly is valuable to know that it’s not all roses getting to the exit point. Though I guess hindsight does make it look different, especially with what was to follow ….!

Oh wow you remember that?! That’s amazing 🙂 !

I think I’m absolutely at this stage right now. Travel happily distracts me too, resources for your best travel hacking?

Nice! I don’t really use resources, but when I was getting started I read The Points Guy a lot.

The best part of these posts is that you refer to yourself as Young Purple even though it was like 3-4 years ago.

I’ve aged 100 years in the last two so it seemed appropriate 🙂 .

I was in the boring part of my FIRE journey for a long time. It’s pretty remarkable that your boring part was so short. Well, I guess due to all the dramas from previous years. Your industry was crazy. It’s good to have a slow and steady period to reflect. Although, this year wasn’t great either due to all the meetings. I hate meetings.

Haha yeah I had too much going on sadly and would have welcomed more boring 🙂 . Marketing is indeed crazy.

There’s always a boring part. Another great read and thanks for posting all the links to past posts. That answered many of the questions that I had about your “why’s”.

I’m glad you’re enjoying it and that the past posts were helpful 🙂 .

“Boring” is great. The best investing and financial results come from ‘boring’ strategies.

Boring is very profitable, and boring is quite inspiring.

Hopefully my finances can be just as boring soon.

So true 🙂 !

“Boring” is awesome. I will take “boring” over “drama” ANY day. 🙂

Besides, who really wants a myriad of global Black Swan events messing up our “deer in a sunny meadow” calmness anyway??? 😉

Boring is underrated. And this year sounds less “boring” and more “banal”. Crappy project, lots of little things to keep life ticking over, and progress towards FIRE. Nothing wrong with any of that, except the soul-numbing job 😉 Progress is progress. I personally found this year’s posts super relatable, on account of similar job nonsense and that feeling of endless drudgery. It’s a nice example of how life keeps going no matter what else is happening.

Haha thanks for the re-frame 🙂 . And that’s so true – progress is progress and life does indeed keep going.

Do you have the number for any of the bars on the graph? What I really mean is that they blue/cash portion of the bar seems so small. I save quite a bit of money in cash because I’m always nervous I’ll need it for an emergency but I feel like you put almost all of your money in investments and that allowed it to grow quick. So, I am curious how much cash you usually kept saved.

Yep – I didn’t keep a lot of cash when I was working. Usually I had about 3 months saved up, which is only a few thousand. That was just in case I got laid off. I didn’t have any other big expenses that could come up since I didn’t own a house or car or have kids or pets. In 2019 I had a larger amount in cash: $13,540.62. I think I was starting to save for my retirement cash cushion.

you’re Black? That was icing for me (I am too). I discovered you yesterday on the journey to launch podcast and I’ve been a little obsessed with your blog ever since. I began at “start here” and have made it to year eight of nine for retirement. I click embeded links as they interest me along the way. I’m not sure why your story grabbed me in a different way than people I’ve previously come across online, but thank you for all of the work that you’ve put into this. I think, in part, I was curious about how you’re living and feeling satisfied on $20,000 per year. I’ve enjoyed reading and learning that truly you do it all Kudos, Purple 👏🏾👏🏾👏🏾

Haha – I am! And oh wow – that’s a lot of reading. I’m glad my story resonated with you! As for the $20K/year I have posts every year breaking down all of my spending if that’s helpful. You can find them all on my Numbers page. Thank you for being here!