Perception is funny. I am (obviously) “me” so I know the answer to all the questions about my finances people ask me every week on Twitter or Instagram. I’ve also written about all of these topics on this very blog, but that’s over 7+ years of posts so they’re spaced out across almost decade. My bad 🙂 . Well, this is an effort to put all that knowledge in one place.

First, let’s go through the things people ask me about all the time and then I’ll answer specific questions y’all asked me on social media. Below are all the details on my retirement money.

If you’re interested in how I got to this point I have all my numbers with links to more information on My Numbers Page. I also update my net worth on that page and Instagram monthly.

If you want more than the numbers, I wrote a “How Did I Get Here?” series with all my income, spending and what happened in my life during those years here:

- $5K to Retirement In 9 Years: Year 1 “Is This Adulting?”

- $5K to Retirement In 9 Years: Year 2 “Avoiding My Problems With Exercise & Consumerism”

- $5K to Retirement In 9 Years: Year 3 “Discovering FIRE…And Ignoring It”

- $5K to Retirement In 9 Years: Year 4 “Catching A Unicorn”

- $5K to Retirement In 9 Years: Year 5 “A Seattle Bait & Switch”

- $5K to Retirement In 9 Years: Year 6 “Searching for Bigfoot”

- $5K to Retirement In 9 Years: Year 7 “The Goldilocks Zone”

- $5K to Retirement In 9 Years: Year 8 “The Boring Part”

- $5K to Retirement In 9 Years: Year 9 “The Final Countdown”

Now let’s get into the present!

My Money

The Purple Investing Strategy

My investing strategy is very simple. All of my investments are in the Vanguard Total Stock Market Index Fund (VTSAX). I go into detail about Why I Own 100% Stocks in that post if you’re curious about my rationale.

Here is a breakdown of all my money accounts:

Investments

Vanguard

- Taxable Account

- Traditional IRA

- Roth IRA

Lively

Cash

- Credit Union Checking Account (for everyday expenses)

- Ally High-Yield Savings Account (to keep most of my cash cushion making money for me)

- Charles Schwab Investor Checking Account (for free global ATM withdrawals)

Credit Card

The Purple Withdrawal Strategy

When I quit my job in October 2020 I had:

- $500,000 invested

- $40,000 in a cash cushion for Year 1 and 2 spending

For a total net worth of $540,000. Since then, things have increased quite a bit 😉 :

Today I'm 75% of the way to being a single black female millionaire at 32 (actually closer since compound growth is exponential instead of linear📈). My brain cannot comprehend this🤯 🤣🤷🏾♀️ pic.twitter.com/G8ufoaaBFs

— A Purple Life (@APurpleLifeBlog) November 2, 2021

My retirement withdrawal calculations that I did in my favorite retirement calculator cFIREsim included:

- Increasing my spending with inflation each year

- No spending ceiling (I can spend more in up market years if I want or need to as well as more over time overall)

- Decreasing my spending from the $18K/year I spent living in Seattle to $16,500/year during down markets if necessary through geo-arbitrage

Backtesting those variables showed me that I would have had a successful retirement 100% of the time in the past 150 or so years of stock market data that exist, even if I retired on the eve of the Great Depression.

At the time I quit, I didn’t know if I was retiring into that exact type of scenario since it was the wild west of 2020. As a result, I decided to start by spending that cash cushion I had saved on top of my $500,000 investment goal and live on that for the first 2 years of retirement.

Well, because of a PTO cash out after I left my job, accidental income and taxable dividends that now go into my checking account, I still have about 2 years of a cash cushion. Yes, even though my first two years of retirement are up this October. I switched my taxable dividends to be deposited into my checking account, but that’s the only way I’ve touched my investments since retiring. My tax-advantaged dividends are still being reinvested.

However, I am still planning ahead 🙂 . Once I do run low on my cash cushion (in 1-2 years) I’ll sell some of the investments in my taxable account to fund the next year of retirement. After a few years, (at least 13 even if the market is stagnant that entire time), I will need a way to access my tax-advantaged accounts without penalty.

Enter the Roth IRA Conversion Ladder, which I’ve already started and outlined how I did it step-by-step in that post. By the time my taxable account runs out, I’ll have a large chunk sitting in my Roth IRA that I can tap into until I can access the rest of my money at 59.5.

The Purple Spending Plan

I spent about $18,000 a year living in the middle of Seattle and planned to spend $20,000 in Year 1 of retirement (I actually spent $20,415 As A US Nomad in 2021 😉 ) and increase with inflation yearly after that. Accordingly, this year I aim to spend $21,200 given high inflation. We’re half way through the year and I’m currently on track. I’m able to spend this amount because I have no house, car, kids or pets and don’t want any of those things right now (or ever in the case of kids). Luckily the life I want translates to savings.

Answering Y’all’s Questions!

As I mentioned, I put out the call on my social media for questions y’all have about my finances and here I’m going to answer them. So let’s see what y’all were curious about!

Spending💰

How do you keep your expenses so low? How much do you spend every month?

I spend about $1,600/month. I keep my expenses low by paying attention to my biggest expense: housing and otherwise not worrying about it. Geo-arbitrage has also helped (spending months in Thailand and México) even though I intentionally spent my entire housing budget to get SUPER fancy places, everything else was very cheap.

Even the flights were cheap since I used travel hacking for long-haul Business Class flights on Singapore Air and Etihad to and from Phuket. Check out the travel hacking deets and my review of those flights here if you’re interested:

- Review: The World’s Longest Flight – 19 Hours In Singapore Air Business Class

- Review: Singapore Air 737 MAX Business Class AKA “The Throne“

- Review: 21 Hours In Etihad Business Class (Part 1) – Phuket To Abu Dhabi On A 787 Dreamliner

- Review: 21 Hours In Etihad Business Class (Part 2) – Abu Dhabi To NYC On A 787 Dreamliner

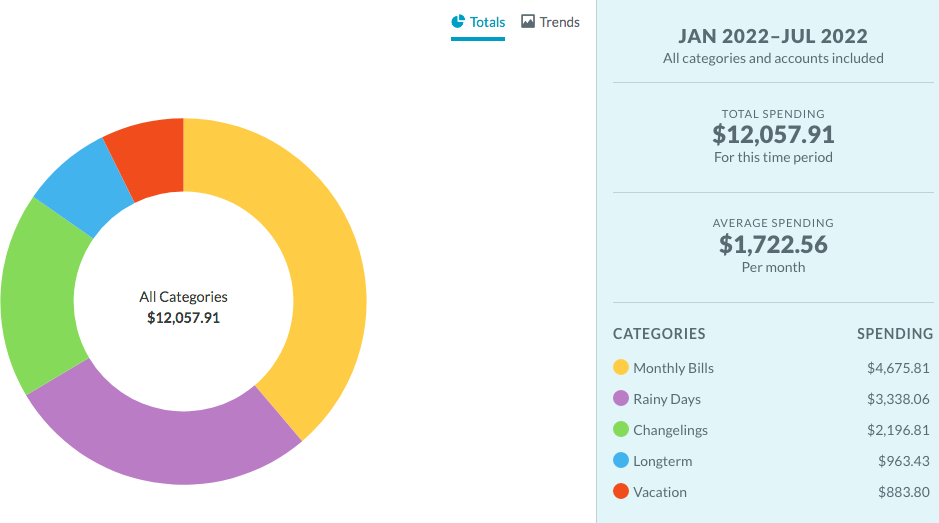

How much have you spent year to date?

I’ve spent $12,507.91 to date in 2022, but that includes pre-paying for almost all of our housing costs for the rest of the year so I’m not worried about being a little over $10,600 at this point 🙂 .

You have someone to share costs with. Your thoughts on doing this solo?

One thing I did intentionally was to plan my costs so that I could still stay retired if my partner and I broke up. I think that’s an important part of planning anyone’s retirement. I’ve planned to be self-reliant even if I no longer have someone to share costs with.

If I were doing this solo, my personal plan would be to get smaller places since I don’t need ones big enough for 2 people. These places are much cheaper in my experience. I would also do more geo-arbitrage since I wouldn’t have to stay around the US for my partner’s work schedule.

Investing💸

How do you pull money from your retirement accounts?

As I mentioned above, I don’t (outside of having my taxable dividends dropped into my checking account). However, when I do finally pull from my accounts in a few years, I’ll make a step-by-step guide of how I do it similar to my Roth post.

I’d like to know more about how you set up your investments to draw dividends

Broad based index funds usually give about 2% per year in dividends. I just chose those (VTSAX for me) and changed “reinvest” to “deposit” for my taxable account on the Vanguard website. Easy.

Inflation📈

Any changes in withdrawal strategy with bear market and inflation?

Nope. Inflation was built into my plan and if I was taking money out right now, I would take less out and go to more LCOL places, but I’m not currently withdrawing so it’s NBD for me personally. Also for the record, we’re not in a bear market yet. That’s defined by a 20% decline from a recent high for 2+ months – we’ve barely stayed 20% down YTD for 24 hours at this point 🙂 .

For this retirement amount, what destination replanning are you doing for inflation (if any)

None. I haven’t seen a big impact from high inflation on my spending yet, but I’m hoping doing my full annual spending report in December will illuminate where it changed my budget compared to previous years.

The Current Market Decline📉

Have you felt moments of panic recently or did you emotionally prep for times like these?

I haven’t had a reaction to the current market’s decline in my portfolio. I emotionally prepared for this for almost a decade through exposure therapy, and if I had no reaction when the market was dropping 10% per day in March 2020 only a few months before I planned on retiring, this current downturn isn’t going to do it🤷🏾♀️.

Are you taking advantage of the low prices in the stock market when you don’t have job money?/Are you still buying stocks?

Sadly no 🙂 . I’m not often jealous of people who are still working, but this would be one instance – getting stocks for 20% off. I’m not buying stocks actively, but my tax-advantaged dividends being reinvested buy a small number for me.

How do you know when the market has recovered? How many days of steady increase?

You can’t know from a few days. As I mentioned, a bear market is 20% decrease over 2+ months and recessions can only be called in retrospect since it’s defined as 2 quarters of negative GPD growth, which we obviously can’t know until the quarters are done. So basically: you don’t know, but for me it doesn’t matter. The market goes up and down and if I were still working, I’d be buying stocks every month regardless.

Conclusion

So that’s all my money information in one place! I hope that helps answer any questions you might have. As for me and my nomad retirement life, I’m still spending the same as before (aka not looking at my budget and buying whatever I want 🙂 ), but if this turns into an official recession, I’ll probably plan to live in more LCOL and international locations in 2023.

I’m just starting to think about what next year’s travel will look like, so that’s convenient I guess. I’m still living on my 1-2 year cash cushion so I don’t have to withdraw from my portfolio for a bit. And even with the current downturn, I still have way more money than when I quit so it’s all gravy 🙂 .

Do you have any more finance questions for me?

You wrote this article so fluid and natural that it appears so simple and easy: buy monthly for 9 years a VTSAX on IRA and on brokerage account, and let it raise.

I have to remember to appreciate the working hard discipline to spend under a half of your income, to be happy with simple life and your path.

This is what we have to appreciate: you are a hard working disciplined smart lady.

Oh wow – thank you so much! It’s not easy, but is simple so I’m glad that got across 🙂 .

Well-said! Handling money is simple but definitely not easy.

Love this! Thank you for putting all the deets in one spot. A few questions, 1 – are you still using the financial apps mentioned in your summary? Ex. YNAB, any new financial and non-financial tools you’ve been enjoying? 2 – what is geo-arbitrage? 3 – you mentioned using 1 CC, that one card can get you all those fancy flights? So neat! I’ll need to comb through the travel hack articles mentioned above.

Great post, thanks purple!

Of course! I’m glad you enjoyed it. As for your questions:

1) Which summary? If you’re talking about my favs list, yes. If I stop using something or no longer recommend it I remove it from that list. I’m not using anything additional financial besides what’s on there. I wrote a post about what I use for non-financial things to make my life easier – that’s here: https://apurplelife.com/2021/04/20/my-favorite-free-tools/

2) Geo-arbitrage is when you use the different costs of things around the world to your advantage. If you Google it it will be explained better with examples.

3) No that one card didn’t get me those flights. I mention in the posts what kind of points I used and they aren’t chase points. I accumulated those points over several years.

Thank you!

Your situation is different being a very early retiree while I was a only very slightly early one, but I share that mild regret that we can’t buy discounted stocks. My portfolio is pretty much fixed where I want it and we do not have any net income above our expenses so it takes us out of the investing game as far as new stock purchases go. You are such a good planner and such a gifted writer. What you’ve done so far is amazing, and I can’t expect it won’t continue to amaze going forward.

Yeah it’s a weird feeling 🙂 . And thank you so much! That means a lot.

It’s so clear and simple when laid out like this 🙂 Seems like things are working very well so far, which is great. Hopefully this will preempt some of those questions you get.

>>I’m just starting to think about what next year’s travel will look like

Ah the problems of the retired. Someone’s gotta have them.

Haha so true 🙂 . Thank you for reading!

Loved this as i had some of these questions as well eventhough I’ve read each of your money articles at least a dozen times each. Was really dying to know about that cash cushion and how you’ve been paying for stuff since retiring!

Well I’m so happy I wrote this then 🙂 !

Hey Purple,

Thanks for another open and honest article about your early retirement experience. The journey to FI is one thing, but hearing about how things go after is very helpful.

Not a financial question, but I’m curious about how you handle jury duty summons. My partner and I started a two year “sabbatical” in January of this year and I’ve already received a summons for jury duty. We are traveling so showing up for jury duty would be expensive. I would like to retain residence in my state, so I’m unsure on the best way to respond. Can you provide any insight on how you handle this?

Thank you!

Hi Craig,

Of course! Thank you for reading 🙂 . I actually got a jury duty summons in WA right when we were leaving the first time. I submitted an Excusal Request for saying I wouldn’t be on this side of the country (which was true) and it was quickly approved online. I haven’t been summoned since *knock on wood* – though I did go to jury duty about 2 years before that last request (I don’t know if that helped things). I’m not sure what state you’re in, but hope they have that kind of excusal system.

Thank you for the refresher.

Inflation: Do you have plans to go to Europe this year? The EUR is down and from what I saw from family who just came back from Italy, it was like prices from 20 years ago. Like 1 or 2 euros for cappuccino, 6-8 euros for casual pizza. Amazing!

Travel hacking: I am a hacker myself but I’m curious that now in retirement do you still regularly apply for credit cards? How often? I only do 2 per year as there are only a few outstanding deals. How do you meet the min spending if your expenses are so low? Do you try to work in tandem with your partner such as letting him use your referral code so you earn miles and both can book the same flights?

P.S. I noticed you have ads now. I’m happy to support your work except that annoying pop-up…

I don’t have any plans to go to Europe this year. Interesting to hear prices are lower though! I haven’t applied for any cards yet in retirement. I’m still semi-frantically trying to use all the points I got back from cancellations during the pandemic before they expire. Previously though I planned around larger purchases to make sure I met spending requirements. My partner doesn’t travel hack so we didn’t work together on that.

P.S. I’ve had ads on the site for about 3 years. Can you send me a screenshot of the pop up you’re talking about? I’m not seeing anything different on my end. Nothing should be popping up and covering the whole screen so if it is I’ll send the picture to my team to turn that off immediately. Thanks for letting me know!

Thanks for posting this, Purple! Lots of great information (as usual) and I am SO glad you answered the question about retiring early while sharing costs with a partner vs. solo. I’ve had that exact question for you for a while, but I couldn’t think of a non-rude way to ask it. And while I don’t think you’d take it wrong if I did ask… I was afraid my bitterness would come through and I’d inadvertently sound rude! (As an aside, it just really frustrates me how being single can be more expensive per person than being in a couple… I’m pretty much perpetually single, LOL, and while I’m usually happy with it, not being able to split rent can get really frustrating after a while, grrrr.)

Anyway, I am so happy you answered that and considered that aspect of your finances. Plus, it gives me hope that what you’ve done is achievable by a single pringle like me. 🙂 I haven’t kept an eye on Airbnb prices nearly as much as you have, so your view on being able to get smaller places for cheaper definitely helps.

Keep up the good work — I love this blog so much!

Haha people ask me that all the time and I don’t see it as rude so no worries 🙂 . Being single is definitely more expensive. If I hadn’t started living with my partner in NYC I probably would have continued to live with roommates because of the cost. Luckily it’s much more feasible to live alone in Seattle. And thank you so much! I’m so happy to hear you still love the blog 🙂 .

Love your posts, they are so insightful. And I have such admiration of your courage. You have done so many amazing things without a ton of financial backing. You have shown it really can be done. Thanks!

One small disagreement. I don’t believe a bear market is so much about being below 20% for 2 months but rather a decline has occured over at least 2 months and it has gone down at least 20%. This prevents a quick fall and quick recover (March 2020 for example – the S&P fell 34% but it recovered extremely quickly) from being called a bear. Most of the financial podcasts I listen to say we are in a bear market which started in January.

Thank you for your kind words

Great post, Purple! Thanks for sharing all this info in one spot 🙂

This post is getting bookmarked into my permanent collection! What a great reference post for so many personal finance topics related to early retirement.

It seems your timing was quite possibly perfect for your retirement date as you benefited from some great market returns immediately afterward.

Thanks for being such an inspiration for those of us pursuing FIRE!

I’m so glad to hear that!! And yeah – who knew 2020 would be a great year to retire?! Definitely not me 🙂 . Thank you so much!

Thank you for being so transparent with everything! Specific examples are hard to come by on some other FIRE blogs I read so I really find these types of posts useful. I was wondering how you decided to allocate money to each of your accounts – Taxable, Traditional IRA, & Roth IRA – during the accumulation phase? I am in the beginning of my accumulation phase and currently max out my Roth IRA, contribute enough to my employer’s Roth 401k to get their match, and the little I have left over to save I’ve been putting into a taxable account. As I am increasing my savings rate I am trying to decide whether to put additional savings into my Roth 401k or my taxable account. Did you max out all retirement accounts first before contributing to taxable? Or figure out how much you would need before age 59 and split contributions between all three accounts accordingly? Thank you!!

Yay! I’m so happy it was helpful! As for me I maxed all my tax-advantage account for the tax savings (which was substantial living in NYC) and then put money in my taxable accounts. Good luck!