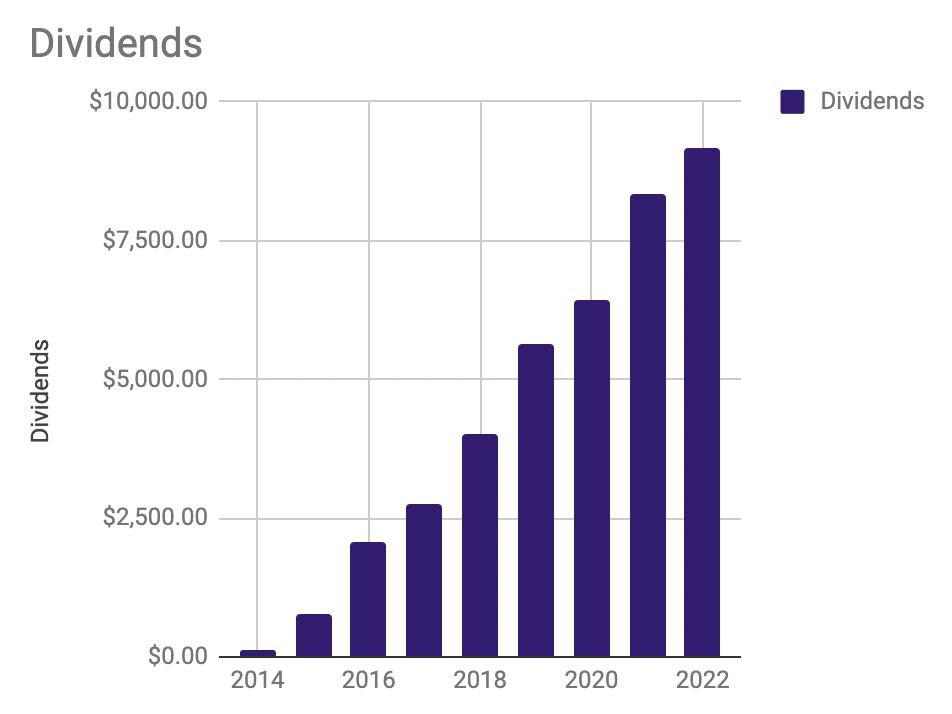

So let’s talk about something fun, the surprising amount of money I made in retirement. It’s surprising because outside of dividends, I expected this amount to be $0 after I quit my job in October 2020 to retire at 30. But like a lot of things in life, I was wrong 🙂 . Let’s get into it!

Income

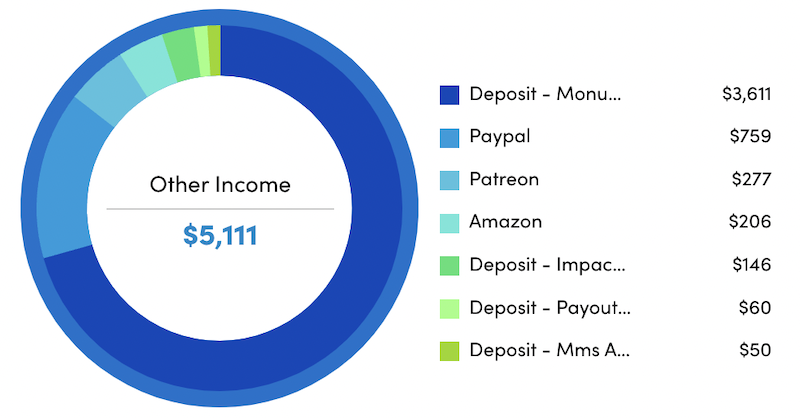

Here’s where my money came from in 2022:

Yes, yes – as I said, I was totally wrong. I assumed I would never make another dime after quitting my job (unless some serious unforeseen situation arose that required it) and instead, the universe threw that idea in my face. I made a little money from this blog and in opportunities that arose from it.

However so far, despite all my jokes about spreading birding and running knowledge because it’s somehow a pyramid scheme, my other hobbies have not accidentally created any income. Phew! Let’s try to keep it that way 😉 . Anyway, here’s all the money I’ve received this year:

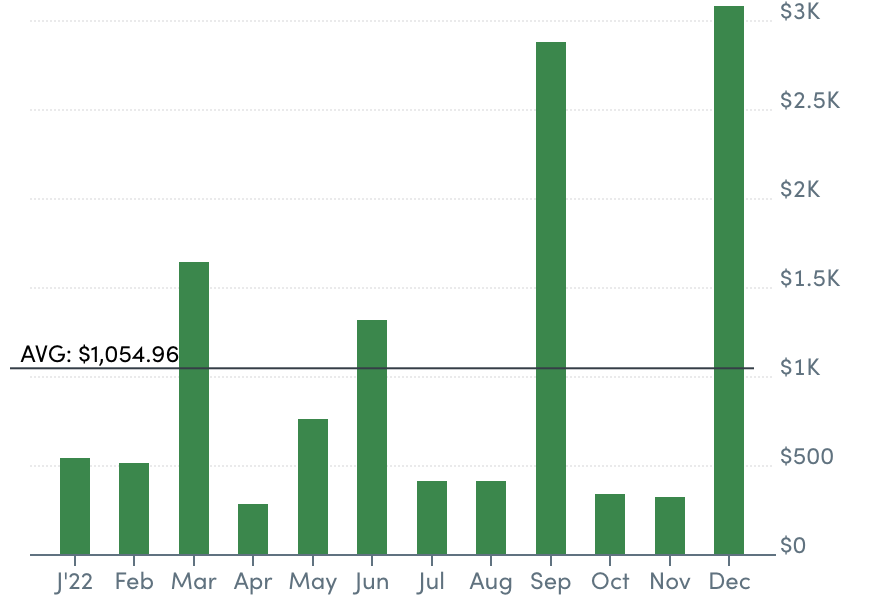

Taxable Dividends

Income: $4,099.83

This is the only income I knew I would have in retirement (in addition to capital gains when I sold my stocks). The above amount are the dividends I received in my checking account from my taxable brokerage this year. The total amount of dividends I received (though the rest were automatically reinvested in my Traditional IRA and Roth IRA accounts) was $9,319.14.

Blog

Income: $4,477.38

Estimated Taxes (15%): -$671.61

Expenses: -$37.47

Profit: $3,768.30

Hourly Wage: $6.63/hour

Shockingly, this blog made money this year. And because I didn’t have a lot of large expenses, such as conferences I attended in previous years, that profit was way larger than I expected.

However, before you think blogging is the path to riches, please check out the below posts I’ve written on the subject (Spoiler: It is definitely not). Still, it’s nice that this site is now paying for itself and currently bringing in a little extra to boot.

- I Found My Dream Job And It Pays $225 A Year

- The Meta-Weirdness Of Making Money From A FIRE Blog In Retirement

Speaking

Income: $360

PayPal Fees: -$4.50 (4.5% on one $100 transaction)

Estimated Taxes (15%): -$53.33

Profit: $302.17

I accidentally did two speaking gigs this year. I was asked back to be a guest at the African American Finance Book Club that I had been a guest speaker at last year, but this time they offered to pay me for my time, which was nice.

The other opportunity I accepted was a request to be a speaker at the Financial Feminist Summit that Bravely Go puts on every year. I had to send in a pre-recorded talk, which was basically me talking to myself for 40 minutes 🙂 .

I don’t understand how YouTubers talk to themselves all the time because it was a very strange thing for me to do, but more props to them! Anyway, after that talk was available I went on a Facebook Live on the summit’s Facebook Group to answer any questions people might have. It was a fun time that convinced me that I might want to accept similar offers in the future. It’s fun to try new things 🙂 .

Patreon

Income: $372.65

Fees: -$95.65

Estimated Taxes (15%): -$41.55

Profit: $235.45

After a few threats from friends, I created a Patreon for the 8% of the recipients of my Accountability Beast tweets who wanted to pay for the service (the rest are on the free.99 plan 😉 ). Every Wednesday I take to Twitter and remind people of their goals…and bother them until they accomplish them 🙂 . Not bad for a weekly tweet thread that I happily did for free for many months!

This is a Packing Purple🧳 who is getting ready for a quick trip to another state🚆. We'll see how this goes in the winter weather❄️. It's always an adventure in the Northeast🤣. While I'm braving that, here are the things you asked me to remind you about💜! pic.twitter.com/ns1yIT1Kot

— A Purple Life (@APurpleLifeBlog) December 14, 2022

Interest

Income: $304

This is interest I received from my Ally High-Yield Savings Account. I use that account to store most of my retirement cash cushion and have been excited to see their interest rate growing exponentially along with the interest that’s deposited in my bank account. Their current interest rate is 3.3%. Here’s the fun email I received when we hit 3% in September:

Damn @Ally! Let's do this🙌🏾 pic.twitter.com/9Q2si1lQXP

— A Purple Life (@APurpleLifeBlog) November 21, 2022

Settlement

Income: $5.21

I received a small settlement from the 2019 Equifax data breach. Sweet 🙂 .

Tax Refund

Income: $2

Basically this:

Just filed my taxes for 2021 and am surprised to see that I'm getting a refund. I guess it's time to make it rain🤑🙌🏾🤣! pic.twitter.com/ak6bj57hzU

— A Purple Life (@APurpleLifeBlog) January 28, 2022

Total Income

So I made $9,621.07 in 2022, $8,716.96 of which was profit. That sounds like a legit chunk of change! Not bad for a lazy retired bum 😉 .

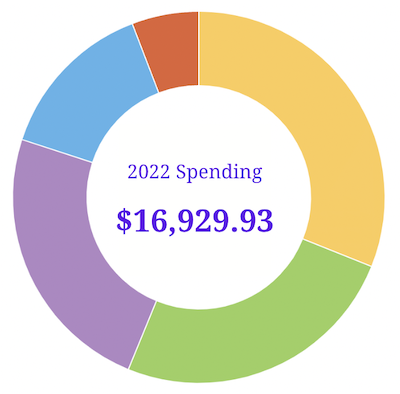

Spending

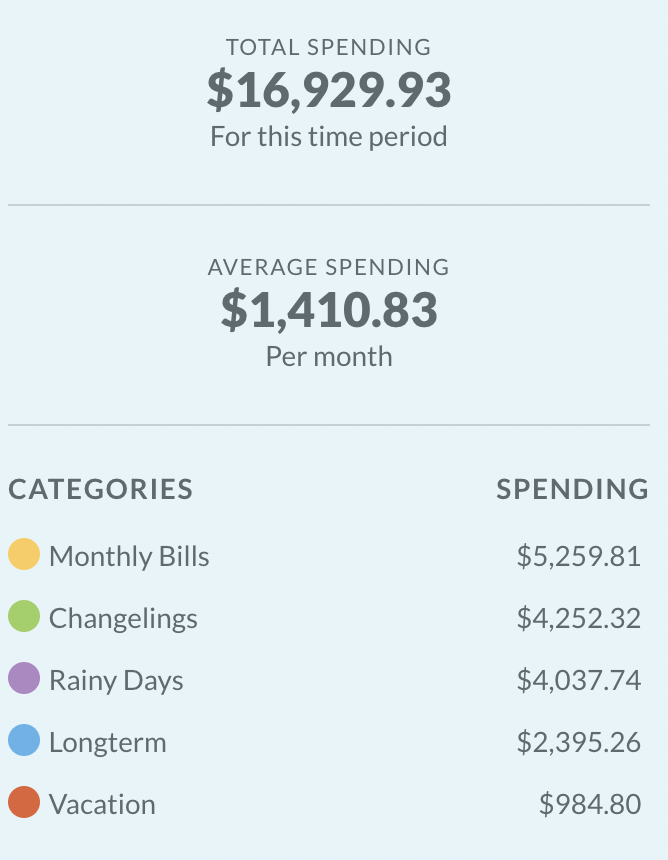

This year I spent $16,929.93, which is only 80% of the $21,200 I budgeted for this year. I was surprised to see this to be honest, since I’ve been traveling all over the US and the world and eating everything in sight. I’ll be going into detail about all of this in my annual spending post.

Withdrawal Rate

Interestingly, if I were pulling from my investments instead of still living on my cash cushion, my withdrawal rate this year would be 1.5% of my original investment portfolio when I quit…Sweet! And since I am still living on my cash my actual withdrawal rate is still 0% going into my 3rd year of retirement, which is even sweeter 🙂 .

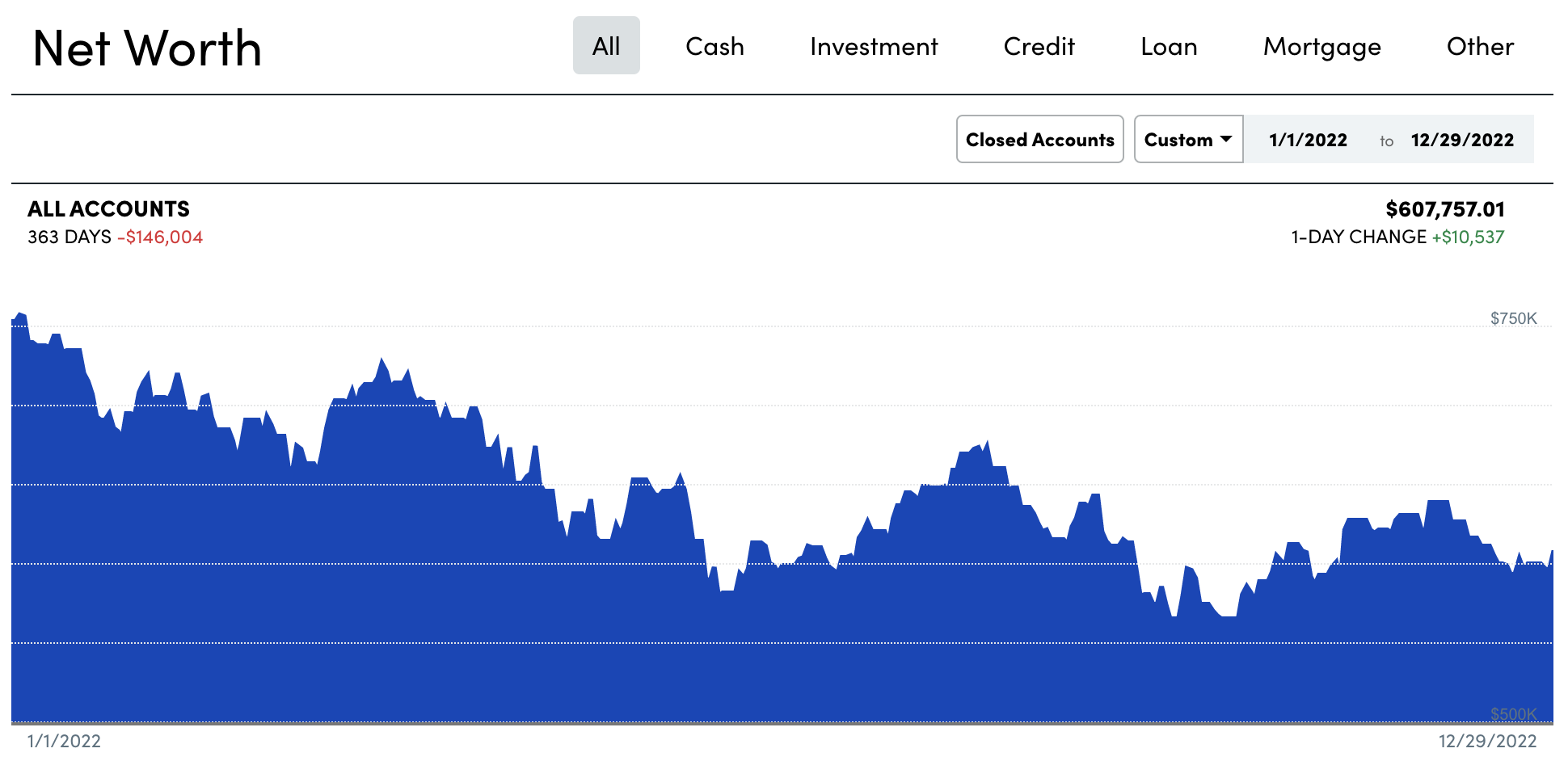

Net Worth

My 100% US stock portfolio is down 19% from 2021 and as of this writing my net worth is $607,757. However, since October 1, 2020 (the day I retired) my net worth rose $67,757. I must admit that this was not the financial outcome I was expecting when retiring into a pandemic and possible recession – it’s way better 🙂 . This is another example of how I cannot predict the future and should never try!

If you’re interested in monthly net worth updates throughout retirement, feel free to follow me on Instagram or check out my Numbers page.

Conclusion

And that’s it. My goals for next year are pretty straightforward:

- Increase my spending target to $22,700 to account for 2022’s 7% inflation

- Keep enjoying retirement 🙂

So let’s see what 2023 brings!

How was your 2022? Did you hit your monetary goals?

Discover more from A Purple Life

Subscribe to get the latest posts sent to your email.

Congratulations for the numbers! another great year for you. You deserve this, you worked hard and did it best possible.

You keep the track as organized and disciplined you used to be during working time. I should learn this from you 🙂

My case is still classic: during accumulation phase, work, save, invest, hope the market will raise and shine, I am at the half of market investments wanted, still going on 50% if not more savings, no clear idea as not keeping track as you, plus having a mortgage that I don’t calculate in my net worth as is not producing anything but will be great when will end as the spending will go down at the level my stock market investments will cover.

Thank you so much 🙂 . And that sounds like a solid plan – you’ve got this!

Wait….did you even earn enough to have to pay taxes???

Self employment taxes are 12.4%-15.3% on any income over $400 so yes.

Amazing! Love reading about the unexpected income that’s come for you so far. This is what success looks like!

Thanks for the transparency. I need to read more of your past blogs to figure out how to get our spending down to under $20,000!

Great job! I always feel the anxiety bubble up when I think about retirement, but seeing how you break it down by the numbers helps to reduce that fear.

Thank you! It was a lovely unexpected surprise. I’m glad seeing these examples helped with that anxiety. The unknown is scary 🙂 .

Love this! My goal this year was to hit $1 million in net worth. I did hit it for about a day but then the market wasn’t so friendly. I’m sitting at $870k but still not bad! Maybe next year…

That is WILDLY impressive 🙂 !

Congrats Purple on a great year from a financial perspective! A good reminder that retiring early and living on such a minimal budget can actually be a blessing in the sky, especially when the economy is not doing great and people have expense they can’t really reduce where everything else seems to be going up.

Would you mind sharing a rough breakdown of your earnings from your blog in term of blog income categories. I believe you have some of this coming from affiliate marketing partners but I am also curious to know what other source of income you generate from the blog!

Happy Holidays!

I work two jobs, side hustle and my net worth went from 489k to 491k in a year lol. I only spent 14k this year. What an awful year for stocks. Feels like the world doesn’t want me to be a half millionaire. That 500k marker is close now. I just hit 499k. I’m hoping I can finally reach it. It’s all thanks to watching your confidence that I feel good about leaving work at 40. I’m still in my early 30s so I’m not planning to leave until I’m a millionaire but I admire your courage and love your positivity especial seeing someone black like me. I wish you nothing but prosperity and happiness. 🙂

Oh wow – that’s an amazing net worth! Are you a half millionaire now with the latest increase in the market 🙂 ? I’m so happy following my journey helped! You’ve got this 🙂 . I wish you prosperity and happiness too!