Today I’m happy to introduce the first guest post on this site with a very special guest: My Mom! As I’ve mentioned a few times on the blog, she was my main inspiration in starting my journey to financial independence. She actually retired the same month I started writing this blog. Hopefully her story can help inspire others and show that it’s never too late to begin your journey. She didn’t start investing in stocks until she was 40 and still retired at 55 with 3 kids and 2 paid off houses. If she can still retire early basically anyone can. Let’s see what she has to say. Continue reading “How My Mom Retired At 55”

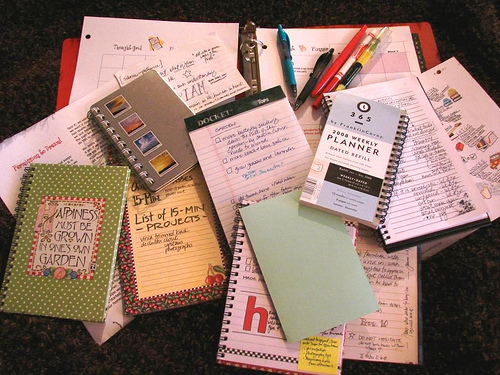

It’s time to bring out my planning materials! *rubs hands together maniacally*

It’s time to bring out my planning materials! *rubs hands together maniacally*

2 years, 4 months until I retire. That timeframe at once sounds short because I began this journey thinking this goal was 10 years away. And it is at once long: multiple years – almost two and a half more years of this. This stress, this tiredness, this sense of ineffective wastefulness. I know I have the cushiest job situation I’ve ever had, but 2.4 years still feels like a long time. However, looking back at what I was doing 2.4 years ago I remember it vividly like it was not that long ago.

2 years, 4 months until I retire. That timeframe at once sounds short because I began this journey thinking this goal was 10 years away. And it is at once long: multiple years – almost two and a half more years of this. This stress, this tiredness, this sense of ineffective wastefulness. I know I have the cushiest job situation I’ve ever had, but 2.4 years still feels like a long time. However, looking back at what I was doing 2.4 years ago I remember it vividly like it was not that long ago.