I sat up abruptly in bed and started coughing into the mountain of tissues I now routinely kept on my nightstand. My partner rolled over sleepily and started patting my back. Once I stopped coughing and had caught my breath, he said sternly “You’re going to the doctor.” Continue reading “That Time I Resisted Going To The Doctor Like An Idiot”

Category: Finance

How To Negotiate With A Spendy Partner Or Family Member

I have a dilemma and I was hoping you could help me figure out the best solution. I’ve heard from several couples that it can be a challenge to plan trips and events when each of them makes a vastly different income. Continue reading “How To Negotiate With A Spendy Partner Or Family Member”

How To Teach A Curious Friend About Financial Independence

This post was inspired by the wonderful Ms. Mod over at Modest Millionaires. She recently helped a friend with their finances and asked if I had any tips to help the meeting go smoothly. After being on this path to financial independence for over four years you better believe I do 🙂 ! Continue reading “How To Teach A Curious Friend About Financial Independence”

Q1 2019 Budget Check-In

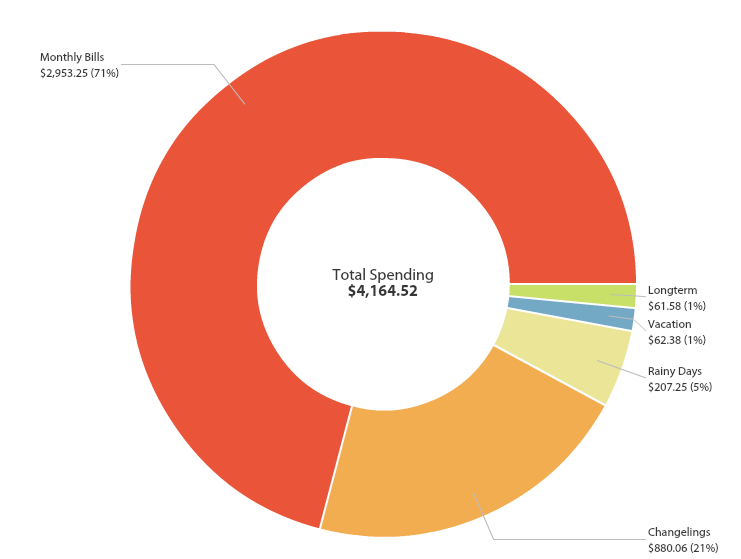

How is 2019 25% gone?! I feel like Christmas just happened! I guess time really does speed up as you get older…and while you’re having fun. Above is a snapshot of my Q1 spending from YNAB. Let’s get into what happened: Continue reading “Q1 2019 Budget Check-In”

I Haven’t Sacrificed Anything On The Road To Financial Independence

I keep getting this question from people outside the FIRE community: “What have you sacrificed to try and achieve this goal?” It kept ribbing on me hours and days after I heard it and I couldn’t figure out why. Continue reading “I Haven’t Sacrificed Anything On The Road To Financial Independence”

How I Saved 85% On A Cavity Filling

So I’ve been a little too familiar with dentists in my life. When I was young, all my baby teeth were perfectly aligned in my mouth, which was great for my child acting career (kidding), but apparently not great for my future dental care. Continue reading “How I Saved 85% On A Cavity Filling”

How I Made Six Figures By 27

My Mom spent her 30 year career working for giant companies – big conglomerates that are household names. They had a strict dress code: heels, pantyhose, and stuffy suits. I would see her come home every day, instantly change her clothes and breathe a sigh of relief. Continue reading “How I Made Six Figures By 27”

How I Spend $125 A Month On Groceries

After publishing my 2018 spending a few people have asked me what exactly I buy and eat to hit that spending level. Obviously groceries is only one part of the food equation with eating out on the other end, but I wanted to try to explain what it is I buy and eat in case it could help others decrease their grocery bill. Continue reading “How I Spend $125 A Month On Groceries”