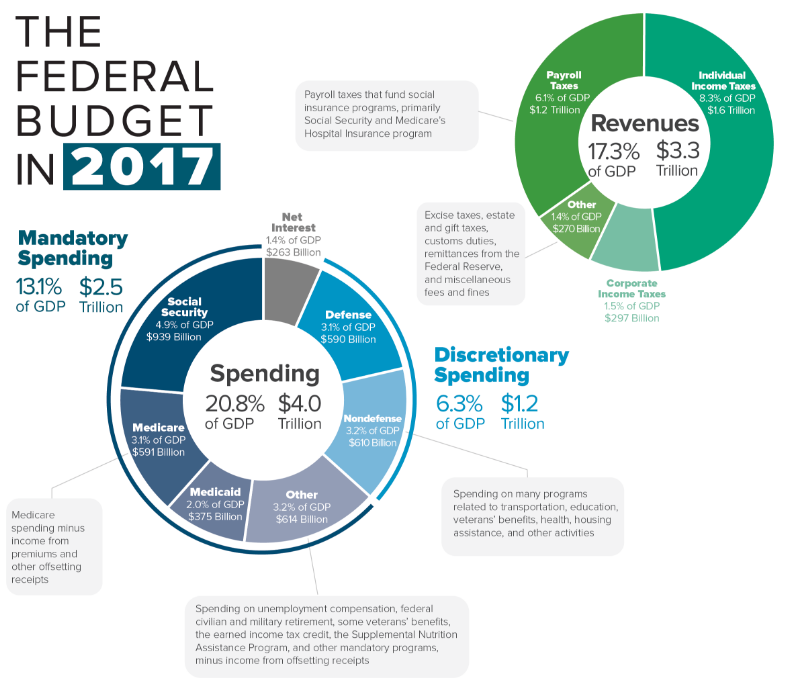

I love reframing how I view the world. A tax reform bill passed near the end of last year so taxes have been in the public eye for a bit now. Though I don’t agree with exactly how my tax dollars are spent I do not mind paying taxes. Every time I’m on a public road or see one of our public transit lines expand I think about how my money helped build that for myself and the community. This feeling is heightened when I learned that a 4 lane highway costs over $1 million PER MILE to build. Wowza. That’s a lot of cheddar. Continue reading “I Pay More In Taxes Than I Spend Annually”

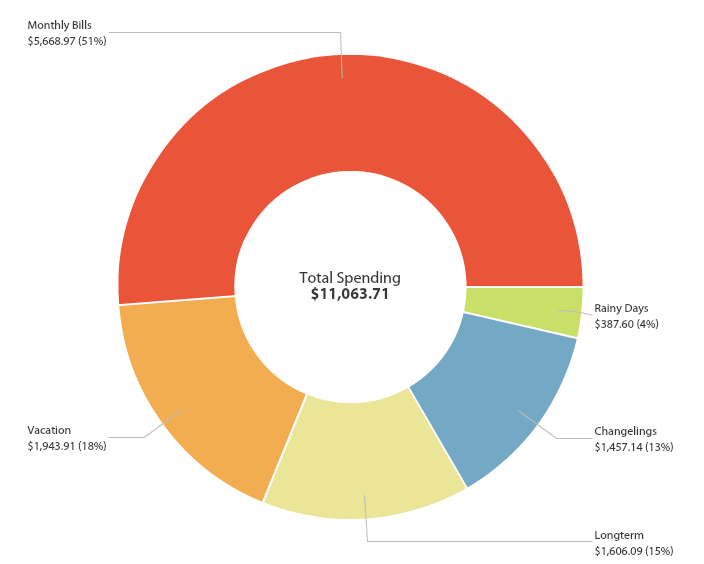

We’re halfway done with 2018 and this year is both crawling and flying by. Let’s check in on my goal to decrease my spending to $18,360 this year ($18K + 2% inflation).

We’re halfway done with 2018 and this year is both crawling and flying by. Let’s check in on my goal to decrease my spending to $18,360 this year ($18K + 2% inflation). It’s that time again: Dividend Season! I look forward to it like I imagine people look forward to Christmas, but this happens 4 times a year! Let’s see how we made out this quarter. I received $881.27, which is awesome. That’s 42% more than last year! Since I started investing in 2014 I’ve received $7,380.32 in dividends – that’s almost a full month of my current salary without having to work that’s just dropped into my lap. Insanity! Let’s see if we can top that next quarter (Spoiler: I think we can 😉 ).

It’s that time again: Dividend Season! I look forward to it like I imagine people look forward to Christmas, but this happens 4 times a year! Let’s see how we made out this quarter. I received $881.27, which is awesome. That’s 42% more than last year! Since I started investing in 2014 I’ve received $7,380.32 in dividends – that’s almost a full month of my current salary without having to work that’s just dropped into my lap. Insanity! Let’s see if we can top that next quarter (Spoiler: I think we can 😉 ). This milestone feels weird to me and I’m not sure why. In January of this year I quickly hit $250,000 net worth thanks to a crazy market, which then entered a correction. It’s taken a few months to get back to where I was now. After adding in my latest paychecks and the market being up 3% we have arrived here.

This milestone feels weird to me and I’m not sure why. In January of this year I quickly hit $250,000 net worth thanks to a crazy market, which then entered a correction. It’s taken a few months to get back to where I was now. After adding in my latest paychecks and the market being up 3% we have arrived here.

I’ve always been fairly frugal. I’ve always bought generic brand everything – maybe it’s because I was in advertising, but I knew that the only difference was the label. I didn’t see the point. When I cracked down on my budget at the end of 2014 and started paying attention to what I was spending and trying to reduce it I discovered that the one place that wasn’t out of control was my grocery budget…possibly because I didn’t cook 🙂 .

I’ve always been fairly frugal. I’ve always bought generic brand everything – maybe it’s because I was in advertising, but I knew that the only difference was the label. I didn’t see the point. When I cracked down on my budget at the end of 2014 and started paying attention to what I was spending and trying to reduce it I discovered that the one place that wasn’t out of control was my grocery budget…possibly because I didn’t cook 🙂 .