I was reading Mr. Money Mustache the other day – about his anti-consumer ideals and alongside it, his promotion of the stock market as a wealth building tool when a strange thought hit me. How could this man critique our consumer lifestyle on one hand and consciously use that same system to make money through the stock market on the other? Continue reading “A Moral Dilemma: Anti-Consumerism and the Stock Market”

I was reading Mr. Money Mustache the other day – about his anti-consumer ideals and alongside it, his promotion of the stock market as a wealth building tool when a strange thought hit me. How could this man critique our consumer lifestyle on one hand and consciously use that same system to make money through the stock market on the other? Continue reading “A Moral Dilemma: Anti-Consumerism and the Stock Market”

My Inspiration: My Mom

I started this blog by crediting Mr. Money Mustache with finally shaking me out of my default consumer habits and helping me realize that a different life was not only possible, but fairly easy to achieve. But this wasn’t the whole truth. After thinking about it more I realized that my actual inspiration for retiring early is my Mom. She retired herself last week at the age of 55. Her husband retired a year ago at 59. After a lot of hard work they were able to retire almost 10 years earlier than social security and medicare allow. Continue reading “My Inspiration: My Mom”

I started this blog by crediting Mr. Money Mustache with finally shaking me out of my default consumer habits and helping me realize that a different life was not only possible, but fairly easy to achieve. But this wasn’t the whole truth. After thinking about it more I realized that my actual inspiration for retiring early is my Mom. She retired herself last week at the age of 55. Her husband retired a year ago at 59. After a lot of hard work they were able to retire almost 10 years earlier than social security and medicare allow. Continue reading “My Inspiration: My Mom”

The Curious Case of My Heart During A Job Search

I found myself falling into a familiar trap last night. I had talked to a friend who mentioned a large company in Seattle that she has recruited for that pays very well, but is almost notoriously difficult to work for. It is said that your experience there completely depends on the team with which you’re placed, which is not that different from most companies. However, when reading reviews of the company by actual employees the overwhelming feeling is very negative. Continue reading “The Curious Case of My Heart During A Job Search”

I found myself falling into a familiar trap last night. I had talked to a friend who mentioned a large company in Seattle that she has recruited for that pays very well, but is almost notoriously difficult to work for. It is said that your experience there completely depends on the team with which you’re placed, which is not that different from most companies. However, when reading reviews of the company by actual employees the overwhelming feeling is very negative. Continue reading “The Curious Case of My Heart During A Job Search”

Unexpected Expenses and Releasing Worry

Today I arrived home after a full, but surprisingly stress free day at work to find a “not a bill” from my insurance company. This document which stated that it was “not a bill” on the front page said that I owed $361 and change for a procedure I had in November that the insurance company assured me was completely covered. This made me unreasonably angry and resulted in me calling the insurance company and emailing/texting several people for information. Apparently I can’t contest this document, its supposed charge and the multiple pieces of incorrect information it holds until I receive the “real” bill. In the grand scheme of things even if I was lied to and end up having to pay these charges this seemed to represent a larger problem that’s been in the back of my mind: unexpected costs. Continue reading “Unexpected Expenses and Releasing Worry”

Today I arrived home after a full, but surprisingly stress free day at work to find a “not a bill” from my insurance company. This document which stated that it was “not a bill” on the front page said that I owed $361 and change for a procedure I had in November that the insurance company assured me was completely covered. This made me unreasonably angry and resulted in me calling the insurance company and emailing/texting several people for information. Apparently I can’t contest this document, its supposed charge and the multiple pieces of incorrect information it holds until I receive the “real” bill. In the grand scheme of things even if I was lied to and end up having to pay these charges this seemed to represent a larger problem that’s been in the back of my mind: unexpected costs. Continue reading “Unexpected Expenses and Releasing Worry”

Frugality and Weight Management

Interestingly I have found that frugality and weight management seem to go hand in hand. My original motivation to decreasing my time spent at restaurants and bars in NYC was because I wanted to stop paying people to serve me: to pour my drinks, cook my food and literally wait on me hand and foot. Instead I’ve sought to do it myself to save money until I am rich enough to pay people to do my bidding as MMM implies. So my partner and I eat and drink at home and we buy and make food and drinks ourselves. Continue reading “Frugality and Weight Management”

Interestingly I have found that frugality and weight management seem to go hand in hand. My original motivation to decreasing my time spent at restaurants and bars in NYC was because I wanted to stop paying people to serve me: to pour my drinks, cook my food and literally wait on me hand and foot. Instead I’ve sought to do it myself to save money until I am rich enough to pay people to do my bidding as MMM implies. So my partner and I eat and drink at home and we buy and make food and drinks ourselves. Continue reading “Frugality and Weight Management”

My Surprising Consumer Mindset

New York City seems to be the consumer capital of the US – everything seems to be defined by outward symbols of wealth. This might be a result of the industry I’ve chosen to work in and the type of people that are usually attracted to it, but even outside of my profession I have seen this trend. The default here is always to do things that cost money to enjoy life: go to a bar for a drink despite having a bottle at home, go out to a diner to eat regardless if you have the same bacon and eggs sitting in your fridge, go to a movie for $15 instead of watching something slightly older on the huge TV in your living room. I wasn’t even aware that different behavior was possible until I visited my partner’s family and they seemed to have a much happier life without a lot of these outings that have become normal for me. Not only do they often have people over for home cooked meals instead of being served in a room full of strangers, but they also obviously value people over things — time over money maybe. Continue reading “My Surprising Consumer Mindset”

New York City seems to be the consumer capital of the US – everything seems to be defined by outward symbols of wealth. This might be a result of the industry I’ve chosen to work in and the type of people that are usually attracted to it, but even outside of my profession I have seen this trend. The default here is always to do things that cost money to enjoy life: go to a bar for a drink despite having a bottle at home, go out to a diner to eat regardless if you have the same bacon and eggs sitting in your fridge, go to a movie for $15 instead of watching something slightly older on the huge TV in your living room. I wasn’t even aware that different behavior was possible until I visited my partner’s family and they seemed to have a much happier life without a lot of these outings that have become normal for me. Not only do they often have people over for home cooked meals instead of being served in a room full of strangers, but they also obviously value people over things — time over money maybe. Continue reading “My Surprising Consumer Mindset”

Challenge: Maxing My 401K in 6 Months

I just received my first paycheck of 2015. I was so excited to see it that I accidentally awakened at 5am to view the paystub that’s sent at 4am. I wasn’t excited to see all the money I could spend, but how much that would be left with after trying to max my 401K in 6 months and the challenge of living on the remainder. After I opened it I was excited to see how much was going into my 401K. It was over $1,500 in one pay period, which is about how much I would input into my IRA every few months. A few months of work done in two weeks because of the miracle of tax-advantaged accounts. I was so excited. Continue reading “Challenge: Maxing My 401K in 6 Months”

I just received my first paycheck of 2015. I was so excited to see it that I accidentally awakened at 5am to view the paystub that’s sent at 4am. I wasn’t excited to see all the money I could spend, but how much that would be left with after trying to max my 401K in 6 months and the challenge of living on the remainder. After I opened it I was excited to see how much was going into my 401K. It was over $1,500 in one pay period, which is about how much I would input into my IRA every few months. A few months of work done in two weeks because of the miracle of tax-advantaged accounts. I was so excited. Continue reading “Challenge: Maxing My 401K in 6 Months”

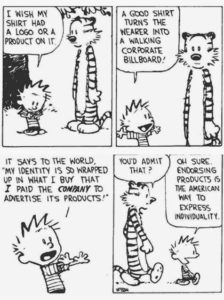

Advertising: The Anti-Consumer Nightmare

I have a difficult relationship with advertising – and not just because I currently work in it. Originally I simply understood that advertising was a necessary and even welcome evil simply because it allows a lot of content to be provided free: websites, magazines and originally television shows. And I appreciated that ad agencies were the first major industry to embrace the idea of creativity being vital to their work and trying to encourage it in the office culture and environment. However, once the fact that happier employees are more productive employees spread the idea of working to attract employees has become almost mainstream. Even older institutions are taking this onboard. Continue reading “Advertising: The Anti-Consumer Nightmare”