I originally turned away from

YNAB (You Need A Budget) during my time using Simple (before the dark days) for a few reasons when I compared it to Simple:

1. YNAB costs money ($60 one time fee per household) while Simple is free (outside of holding your money like a bank)

2. YNAB requires that I input all of my transactions manually which takes a fair amount of time while Simple aggregates all my transaction information when I use their debt card

3. YNAB seems complicated and forces me to constantly reconcile and check my different bank accounts while Simple and even Mint.com compiles that information without my involvement

Continue reading “Finance Tracker Review: YNAB” →

I first decided I was interested in advertising in college, before Mad Men became a runaway success and brought the profession into the light of pop culture. Originally I was looking for a fun, less stuffy profession compared to my mother’s 30 years working for various Fortune 500 companies full of pants suits and colorless, cubicle filled offices. Through job fairs and speaking with the lovely Alums in my college’s alumni network I first became interested in advertising and thought it would be a wonderful way to explore the creativity I was looking for in an office environment while using my main set of skills: organization and persistence.

I first decided I was interested in advertising in college, before Mad Men became a runaway success and brought the profession into the light of pop culture. Originally I was looking for a fun, less stuffy profession compared to my mother’s 30 years working for various Fortune 500 companies full of pants suits and colorless, cubicle filled offices. Through job fairs and speaking with the lovely Alums in my college’s alumni network I first became interested in advertising and thought it would be a wonderful way to explore the creativity I was looking for in an office environment while using my main set of skills: organization and persistence. I first decided I was interested in advertising in college, before Mad Men became a runaway success and brought the profession into the light of pop culture. Originally I was looking for a fun, less stuffy profession compared to my mother’s 30 years working for various Fortune 500 companies full of pants suits and colorless, cubicle filled offices. Through job fairs and speaking with the lovely Alums in my college’s alumni network I first became interested in advertising and thought it would be a wonderful way to explore the creativity I was looking for in an office environment while using my main set of skills: organization and persistence.

I first decided I was interested in advertising in college, before Mad Men became a runaway success and brought the profession into the light of pop culture. Originally I was looking for a fun, less stuffy profession compared to my mother’s 30 years working for various Fortune 500 companies full of pants suits and colorless, cubicle filled offices. Through job fairs and speaking with the lovely Alums in my college’s alumni network I first became interested in advertising and thought it would be a wonderful way to explore the creativity I was looking for in an office environment while using my main set of skills: organization and persistence.

I had a bit of a revelation today. For months I’ve been running numbers and scenarios as a result of our New York City to Seattle moving plans. I’ve calculated how much less we will pay in rent each month after moving. And on an abstract level knew that we’d save money by not paying state or city income taxes since Washington doesn’t have state income tax while NYC has one of the highest in the country. But today I looked at this information in a different light.

I had a bit of a revelation today. For months I’ve been running numbers and scenarios as a result of our New York City to Seattle moving plans. I’ve calculated how much less we will pay in rent each month after moving. And on an abstract level knew that we’d save money by not paying state or city income taxes since Washington doesn’t have state income tax while NYC has one of the highest in the country. But today I looked at this information in a different light.  Learning about Personal Capital was another result of reading the amazing Mr. Money Mustache blog. Personal Capital, which I’d never heard of, is basically Mint.com but for investments. It also includes features similar to Mint.com that allow you to review your spending and income, but it is actually more difficult to add accounts to Personal Capital than to Mint.com and for that reason I haven’t added all of mine. In fact originally I only tried Personal Capital for a grand total of five minutes before closing my account because it was so unnecessarily difficult to add my accounts.

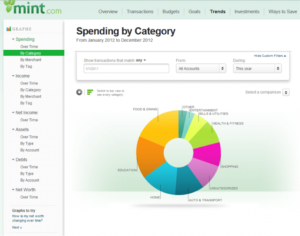

Learning about Personal Capital was another result of reading the amazing Mr. Money Mustache blog. Personal Capital, which I’d never heard of, is basically Mint.com but for investments. It also includes features similar to Mint.com that allow you to review your spending and income, but it is actually more difficult to add accounts to Personal Capital than to Mint.com and for that reason I haven’t added all of mine. In fact originally I only tried Personal Capital for a grand total of five minutes before closing my account because it was so unnecessarily difficult to add my accounts.  Mint.com has been a lifesaver. For what it is, I completely love it. However, it does not deliver on its product promise, which is to help you understand where your money is going and as a result save money. Mint.com is wonderful for learning where your money is going. It makes it very easy to track every digital dollar and provides a colorful and clear explanation of your spending month to month and year to year. It’s seamless in that it draws information directly from your accounts like Personal Capital instead of you inputting it like in YNAB.

Mint.com has been a lifesaver. For what it is, I completely love it. However, it does not deliver on its product promise, which is to help you understand where your money is going and as a result save money. Mint.com is wonderful for learning where your money is going. It makes it very easy to track every digital dollar and provides a colorful and clear explanation of your spending month to month and year to year. It’s seamless in that it draws information directly from your accounts like Personal Capital instead of you inputting it like in YNAB.  I originally turned away from

I originally turned away from  Speaking of simple, this new age bank is unfortunately everything but. The original idea was a wonderful one: to do away with the old banks that we all have to deal with and replace them with one that puts customer service first and has no overdraft fees or minimum balances. I loved the concept and once I had heard from a few early adopters that their experience had been almost seamless decided to dive in.

Speaking of simple, this new age bank is unfortunately everything but. The original idea was a wonderful one: to do away with the old banks that we all have to deal with and replace them with one that puts customer service first and has no overdraft fees or minimum balances. I loved the concept and once I had heard from a few early adopters that their experience had been almost seamless decided to dive in.  I originally became a member of TD Bank because it was one of two banks in my college town and the only bank that also had locations in other parts of the country. So when leaving college I moved all my money to TD Bank and never looked back. And I believe I lucked out enormously. When compared to all the other banks in NYC TD Bank is consistently wonderful whether I’m visiting a location or calling customer service they are always there for me. In NYC at least they are also always building new stores – they seem to be taking over. And they even built one directly in front of my apartment in what seemed like weeks.

I originally became a member of TD Bank because it was one of two banks in my college town and the only bank that also had locations in other parts of the country. So when leaving college I moved all my money to TD Bank and never looked back. And I believe I lucked out enormously. When compared to all the other banks in NYC TD Bank is consistently wonderful whether I’m visiting a location or calling customer service they are always there for me. In NYC at least they are also always building new stores – they seem to be taking over. And they even built one directly in front of my apartment in what seemed like weeks. Whenever I see a press release, demo or review for a new fun technology my heart starts racing. Something ignites within me and in that moment I believe I need that new shiny toy. My brain tries to provide seemingly good reasons why I ‘need’ it.

Whenever I see a press release, demo or review for a new fun technology my heart starts racing. Something ignites within me and in that moment I believe I need that new shiny toy. My brain tries to provide seemingly good reasons why I ‘need’ it.