This is part of a series about my journey to early retirement. In case you missed it, here are the previous parts:

- $5K to Retirement In 9 Years: Year 1 “Is This Adulting?”

- $5K to Retirement In 9 Years: Year 2 “Avoiding My Problems With Exercise & Consumerism”

- $5K to Retirement In 9 Years: Year 3 “Discovering FIRE…And Ignoring It”

- $5K to Retirement In 9 Years: Year 4 “Catching A Unicorn”

- $5K to Retirement In 9 Years: Year 5 “A Seattle Bait & Switch”

- $5K to Retirement In 9 Years: Year 6 “Searching for Bigfoot”

Year 7

It was a new year and I was becoming a bit of a badass 🙂 . My ballsy-ness started to extend beyond major work changes like declining clients. I started pushing back on clients if they proposed ridiculous schedules. In my previous jobs, we were taught to do whatever it took to hit the dates our client provided – and to not question it.

At all the companies I’ve worked with, doing this would lead to sub-par, rushed work, which in my mind would ultimately cause the opposite of the intended effect. Instead of the client being impressed we could hit a short deadline, they were underwhelmed because the work was sub-par. So I started pushing back and negotiating for realistic timelines that my team could actually deliver. As a result, our output improved, my clients seemed to have more respect for my opinion and my team was less stressed and frazzled. Wins all around!

Another first that occurred during this year was saying no to one of the heads of my company. Once again, previously, if a company leader said “Jump,” I asked “How high?” But no longer 🙂 . This leader had dropped a project with a new client on my lap via email the night before she left on vacation (Thanks for the heads up!).

It was a wild week after I discovered basically nothing she had told me about the client was correct. The scope, deliverables and timeline were all different than what she had sent me. Unraveling that clusterfuck took up almost all of my time (and I had other clients. I usually had 3-6 simultaneously).

So when she returned and started praising me for the great work I had done, I had already flagged her as someone that seemed to make unnecessary work for others because of disorganization. So when she tried to dump a project on me again, I told her no. She replied CCing my boss (good passive aggressive try!) and I repeated my decline. My boss never said anything about it. SUCK IT 🙂 !

While all this was happening, I continued to write my musings about work on this blog. I contemplated the questions “Do Vacations Rejuvenate You?” (Spoiler: No 🙂 ) and “Are Performance Reviews Useless?” (Spoiler: Yes 🙂 ). I also discovered why I don’t like modern work schedules and wrote down experiences, such as working over the weekend, so I would never forget why I was striving for retirement in the first place.

On the financial front, my money was chugging along on autopilot. I got a 4% raise (perhaps because of my new badass tendencies 😉 …) and calculated what that meant for my retirement timeline. I also reflected on the fact that we were in a flat market at the time, but at that point in my journey, market returns didn’t actually matter because I was saving so much. Even if the market remained flat, it would only add a year to my retirement timeline, which was surprising to me. It was awesome to see the power of my savings rate compared to the market at that time.

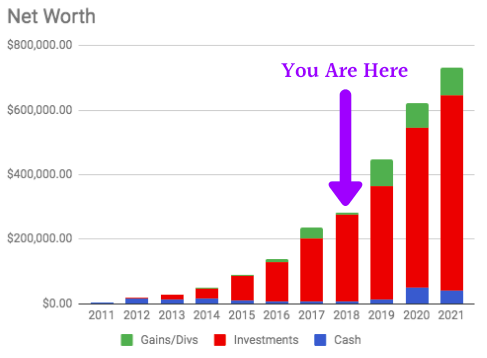

Similarly, I realized that my monthly contributions to my accounts were so big that they drowned out any market noise that did happen. I also kept receiving dividends (though after that dividend post, I moved those updates to my Instagram only). And finally, I reached a net worth of $275,000, which was a number too big for my brain to comprehend. The post about that milestone also marked the last time I did purely net worth update posts on this blog – those moved to Instagram as well.

While my money was growing, I was also looking at my spending. I was ruthless with my budget while living my best life. For example, I said no to a discount vacation to Mexico because I didn’t want to have a rushed weekend going to another country and would rather wait a little bit, stay way longer in Mexico and really enjoy it (and Current Purple reading this is laughing hysterically because I now think of a three week trip as short let alone a weekend 🙂 ).

I also had the goal of starting to try things that I had on my retirement to do list instead of waiting. For example, I got into Watercolor & Calligraphy. I also reflected on simple luxuries that bring joy to my life, such as buying expensive grapes at the grocery store or wrapping myself in warm blankets right out of the dryer (I learned that from my Mom 🙂 ) or sitting outside with dappled sunlight filtering through the trees while the wind blows through my purple hair.

I also reflected on the fact that I pay more in taxes than I spend annually and put into words why I like my weird transportation preferences, such as being carfree for life and walking home up a hill in Seattle with my groceries.

Another way I was trying to bring retirement into the present was with travel. I worked from home most of the time and didn’t often have to go to in-person meetings, so I started taking advantage of this fact and worked on the other coast with friends and family for a total of 6 weeks in addition to my vacation.

Instead of cranking away at work in my apartment by myself or with my partner, I got to be surrounded by the people I love, which helped me remember why I was working at all and why I was pursuing FIRE. I went to Ecuador for 2 weeks, Portland, OR for a week, Atlanta for a week in the summer and then back to Atlanta for 2 weeks around Christmas. I also went to Singapore for a two week vacation where I tested my retirement goal of slow traveling around a new country.

And during all of that fun, I sat down and planned out every aspect of my retirement based on the information I had at the time. I was a few years into my FIRE journey and had a better grasp on what I might want in retirement so it was time to get my latest plan in order! I started writing out my retirement strategy, came up with the projected retirement budget I’m still using to this day as a baseline, and created a to do list of everything I needed to check off in the remaining two years until retirement (and Spoiler: I did all of them 🙂 ).

I also did a few thought experiments about How I Imagine A Day In Early Retirement and Why I Pursue FIRE Instead Of Other Options (In summary: Based on knowing myself and the options available, going full steam towards FIRE was the best choice for me).

And finally, I updated this blog throughout the year with any change to my retirement plan while trying to explore how to beat the beasts of impatience and time distortion. These updates included a fun interaction where early retirement was mentioned at my work and our HR lead responded with “Why would you ever want to stop working?” My thought at the time was “You’re in the right profession” 😉 .

I also received my first 401(k) match ever in my career and locked in my retirement date for October 2, 2020 (which hilariously was only 24 hours off…) and solidified that date by starting to book my retirement victory lap trip to Australia, New Zealand, Argentina and Thailand.

Another big thing that happened was that I took this very blog public! After writing it as a private online journal for 3.5 years, I put all those words out into the world. The way that ended up happening is kind of wild.

I attended a meet up for the FIRE Drill podcast in Seattle. It was my second meet up ever and it was going to take me out of my comfort zone so it was a big deal 🙂 . I showed up, introduced myself to Gwen and J, chatted with Gwen about her experiences in Ecuador (we were flying there that weekend), discussed side hustles with a few out-of-town visitors, and then went home. It was an awesome and surreal evening.

A few weeks later, J reached out and asked if I wanted to grab coffee. I promptly fan-girled the fuck out 🙂 . I didn’t even freak out when I saw celebrities while living in NYC, but apparently having a Personal Finance hero DM me, turned me into a squealing 13 year old.

Anyway, I got it together enough to message her back. And during our Seattle coffee hang out, I mentioned that I had been writing a blog about my journey for years and asked her if she thought I should take it public. J helped me realize that there was nothing to lose by putting my weird thoughts into the blogosphere, so I did it. A random meet up encounter led me to this wonderful world of public blogging.

Back on the work front, things are still going well. So well in fact that I had the time and brain space to start tackling my biggest issue: Work/life balance. Client service isn’t built on ‘hard skills’ like programming, for example. People thrive in this career by being organized, social and available. The first two items I didn’t have an issue with (though the social part did pain my introverted nature), but the constant availability has always been a problem for me.

It was the opposite of the school schedule I described in the post below. There were no set hours or deliverables and there was no off button. Work was a constant in my life whether I was actively doing it or just thinking about it.

I had bought into the expectation that I need to always be available, be able to respond to an urgent question from another country in the middle of the night, and be able to drop everything and visit a client on short notice.

This was the year I started pulling back in ways that didn’t negatively affect my work, but allowed me to have a real balance. This was the year I got my life back. I stopped responding to emails I received late at night or on weekends. I was still reading them (because I was paranoid thinking “Oh no! What if I miss something important?!”), but nothing was ever important enough to respond to.

However, even though I wasn’t actually responding to these emails, just reading them made my brain think about them regardless and re-write the same email response in my head a million times. This didn’t give me the “off” time I was craving so I took it a step further. I started turning off my phone notifications on weekends and after hours. And shockingly, no one died! Nothing bad happened. Instead I felt calmer and more focused than I ever had before.

As many have noted before, the benefits of pursuing FIRE are not just monetary. It’s also not just about reaching financial independence or early retirement. Even incremental steps down the FIRE path seemed to have profound impacts on my life. Not only did I feel more financially secure each passing day, but through this journey, I was able to seriously reflect on what kind of career I wanted and strive for it instead of conforming to some worker bee ideal.

I’d finally figured it all out. I had a job I loved, an apartment I liked, a city I thrived in and now it was time to just live my life and…wait 🙂 . This is where we get into the slog that is the final march to early retirement.

I explored new hobbies, traveled and tried to live my best life while my finances worked in the background inching me closer to FIRE. It wasn’t a drama-filled year luckily (those are stressful!) and it was pretty low-key, which I think is a good example of how some years on this journey will be: just moving along 🙂 .

Here’s where I netted out financially:

Salary: $106,793

Spending: $19,191.55

Net Worth: $280,884

So what’s going to happen next? Will Young Purple get bored with her perfect life 😉? Will her job stop being wonderful like all the jobs before it? Will she like traveling and working remotely so much that she never comes back to Seattle? Tune in next time to find out!

Here’s the next post in this series: $5K to Retirement In 9 Years: Year 8 “The Boring Part”

Yay Purple! We are getting so close to the present day… I am enjoying reading about your journey! Was your partner also working remotely during this time as well? I can’t recall if you’ve said or not.

I’m happy to hear that 🙂 ! He was working remotely as much as I was (about 95% of the time). We actually both had office space in the same WeWork so we continued to walk to work together when we would rarely go in. It was nice 🙂 .

Hear here! So many non-essential client-facing industries suffer needlessly from this 24-hour availability problem. When my partner and I stopped looking at work emails after 7pm, we shouldn’t have been surprised but *gasp* nothing crashed and burned! And when I asked to stop working over most holidays, *gasp* my nightmare clients disappeared and only my favorite, cool clients stuck around.

Also more people NEED to start questioning unrealistic client demands. Sometimes they are arbitrary—and for what? Subpar results and loss of team morale.

It seems like it 🙂 . And yeah I was also surprised that…nothing changed. It was wild. That’s awesome your nightmare clients left after you were clear you wouldn’t break your work/life balance for them.

I’m totally with you 🙂 . For what? For bullshit it seems…

I love your closing notes, they crack me up 🙂

Based on your previous experience, plus mine, plus actually knowing how things went… Yes, even this fantastic job will eventually turn sour. Sigh. It took me longer than you I think, to learn that nothing lasts forever.

Yay!!! I’m glad they crack someone besides me up 🙂 . And that’s fair – realizing nothing lasts forever is a hard lesson to learn.

Good for you for pushing back! It’s taken me years to learn that I’ve trained people to know that I’ll jump when they ask. And it’s a hard one to unteach,

Haha yeah it took me a bit, but I got there! Definitely difficult to unteach.

Purple, you’re killing me with all the links to various posts!! I have a lot of catching up to do!

Haha oh no! That wasn’t my intention. I just wanted y’all to have a chance to hear what was happening “from the horse’s mouth” as it were. I summarize it all in these posts so no need to visit the links if it’s overwhelming 😉 .

💜 the updates, this is fun to see the path you took as you remember it. I thought you meant J Money when you met with with Gwen and J, but that’s not who you meant, was it?

Haha no it wasn’t – Gwen’s partner on the Fire Drill Podcast is a lady that went by J online. So happy you’re enjoying the updates!

This “year” after the previous years was actually quite relaxing to read! The other years were all so filled with drama and to just have a really nice year seems like a remarkably awesome way to go.

Hopefully, I’ll have one of those years soon.

I’m so happy to hear that! It did have a lot less drama than previous years, which I obviously appreciated 🙂 . I hope you do!

YES! Life balance has arrived! Fantastic. The internet is better for your decision to make this blog public, so thank you for taking that leap.

Haha indeed it finally did! And thank you so much – that’s very nice to hear 🙂 .