So let’s talk about something fun: the surprising amount of money I made in retirement this year. It’s surprising because outside of dividends, I expected this amount to be $0 after I quit my job in October 2020, but like a lot of things in life, I was wrong 🙂 . Let’s get into it!

Income

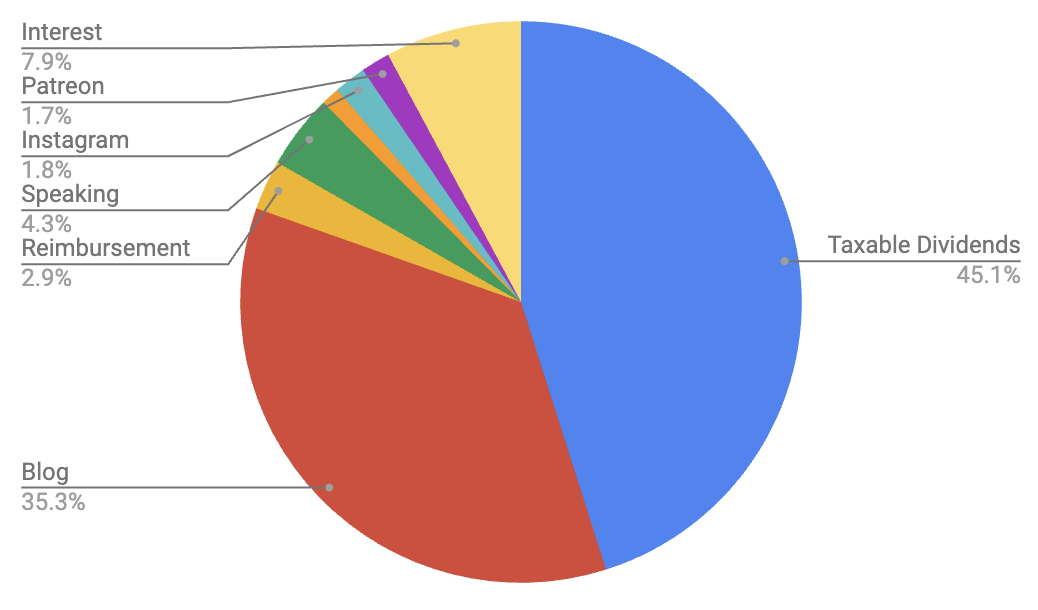

Here’s where my money came from in 2023:

Yes, yes – as I said, I was totally wrong. I assumed I would never make another dime after quitting my job (unless some serious unforeseen situation arose that required it) and instead, the universe threw that idea in my face. I made a little money from this blog and in opportunities that arose from it, such as someone asking me to write an article for their site.

However so far, despite all my jokes about spreading birding knowledge because it’s somehow a pyramid scheme, my other hobbies have not accidentally created any income. Phew! Let’s try to keep it that way 😉 . Anyway, here’s all the money I’ve received this year:

Taxable Dividends

Income: $4,234.75

This is the only income I knew I would have in retirement (in addition to capital gains when I sold my stocks). The above amount are the dividends I received in my checking account from my taxable brokerage this year.

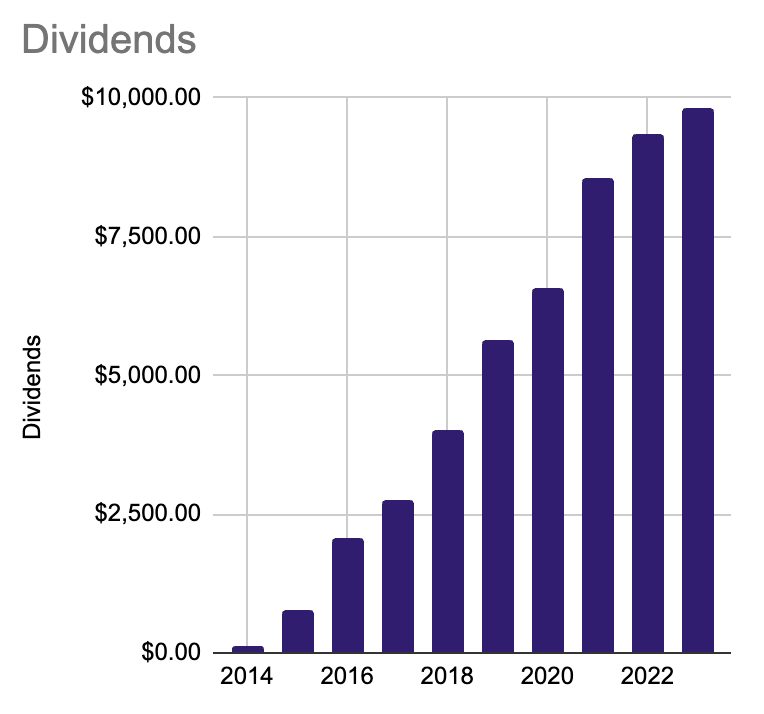

The total amount of dividends I received (though the rest were automatically reinvested in my Traditional IRA and Roth IRA accounts) was $9,816.30. And here are how my dividends have grown since I started investing:

Interest

Income: $737

This is interest I received from my high-interest Ally High-Yield Savings Account. I use them to store most of my retirement cash cushion and have been excited to see their interest rate growing exponentially and now sits at 4.25% currently.

Utilities Reimbursement

Income: $269.29

This was a surprise 🙂 . Apparently the utilities company I used in Seattle overcharged customers and were sued as a result. They lost the lawsuit and had to pay their customers back and it turns out I was one of those customers. I had previously included this amount in my spending so I’m putting this here to even everything out.

Blog

Income: $3,314.68

Estimated Taxes (15%): -$497.20

Expenses: -$296.94

Profit: $2,520.54

Hourly Wage: $4.85/hour

It is once again a surprise to me that this blog made money this year. And because I didn’t have a lot of large expenses, such as conferences I’ve attended in previous years, my profit was also larger than I expected.

However, before you think blogging is the path to riches, please check out the above hourly wage and the below posts I’ve written on the subject (Spoiler: It is definitely not). Still, it’s nice that this site is paying for itself and bringing in a little extra on top of that.

- I Found My Dream Job And It Pays $225 A Year

- The Meta-Weirdness Of Making Money From A FIRE Blog In Retirement

Speaking

Income: $500

PayPal Fees (4.5%): -$22.50

Estimated Taxes (15%): -$75

Profit: $402.50

I was asked to speak at a black woman’s investing club called “The Stocks & Stilettos Society.” About 200 people joined the virtual meeting live, which was cool. Interestingly, when I was originally asked to speak for this private group that pays membership fees, I wasn’t offered any compensation.

I find it strange when a company doesn’t offer the people providing a talk money for their time when they are being paid by the people that are attending the event. Since they didn’t mention payment at all, I just nicely asked if they had a budget for speakers and it turns out yes they did and this is what they offered me. It’s wild what one, small question can do 🙂 .

Writing

Income: $125

PayPal Fees (4.5%): -$5.62

Estimated Taxes (15%): -$18.75

Profit: $100.63

I wrote a guest post for Women’s Personal Finance. I think writing one freelance article every two years for a company I want to support is a good cadence for me 🙂 .

Income: $203.55

Estimated Taxes (15%): -$30.53

Profit: $173.02

Now this was kind of funny 🙂 . For about a year I’d been seeing pop ups on my Instagram saying they would pay me for videos I was already posting for free. I would ignore these pop ups like I do with all of the many pop ups that happen on Instagram. I assumed it was something suspicious and scammy…like a lot of their pop ups 🙂 .

However, earlier this year, this pop up came up and I actually clicked on it to see what it was about. It turns out it was an “IG Reels Play Bonus” invitation that’s meant to incentivize people to make Reels on Instagram, I assume so they can better compete with Tik Tok. Instead of the scammy agreement I expected, they were just claiming to pay people for videos they were making anyway. I looked at what people were saying on reddit and Twitter and it sounded like you don’t make a lot of money at all and Instagram doesn’t pay you anything unless you make more than $100. Fascinating.

Out of curiosity, I turned this feature on and these were the results. It was interesting to get money for something I was already doing and after barely hitting the $100 payout threshold the first month, I learned that Instagram was shutting down the program the next month. That sounds about right 🙂 .

Patreon

Income: $192

Fees: -$6.60

Estimated Taxes (15%): -$28.80

Profit: $156.60

After a few threats from friends, I created a Patreon for the 11% of recipients of my Accountability Beast tweets who want to pay for the service (the rest are on the free.99 plan 😉 ). Every Wednesday I take to Twitter and remind people of their goals…and bother them until they accomplish them 🙂 . Not bad for a weekly tweet thread that I happily did for free for many months!

Hello My Lovelies💜! I hope you're having a wonderful day. These are the things you asked me to remind you about: pic.twitter.com/kZzeb3nzab

— A Purple Life (@APurpleLifeBlog) December 20, 2023

Total Profit

So in 2023 I received $4,234.75 of taxable dividends and I made $4,359.58 of profit for a total of $8,594.33. That sounds like a legit chunk of change! Not bad for a lazy retired bum 😉 .

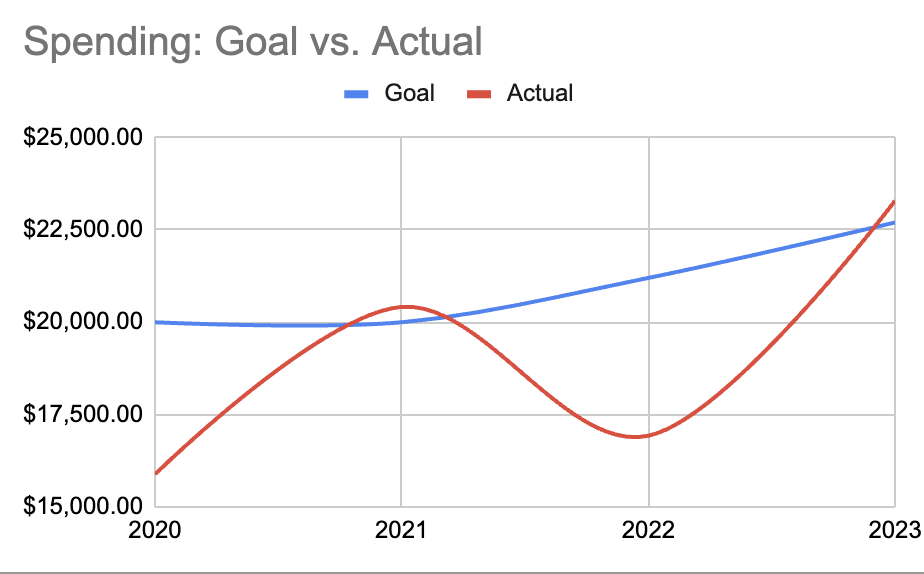

Spending

This year I spent $23,290.26 and this amount is 2.6% above my goal of $22,700 for 2023. I’m not surprised given all I’ve been doing and I’m not worried since I was 20% under budget last year and also in 2020. I’ll be going into full detail about all of this in my annual spending post next week so stay tuned for that 😉 .

My current withdrawal rate is still 0% since I’ve been living off my cash cushion, but in 2024 I’m going to finally spend money from my portfolio. I sold investments for the first time recently, after completing 3 years of retirement without selling any investments – nice 🙂 .

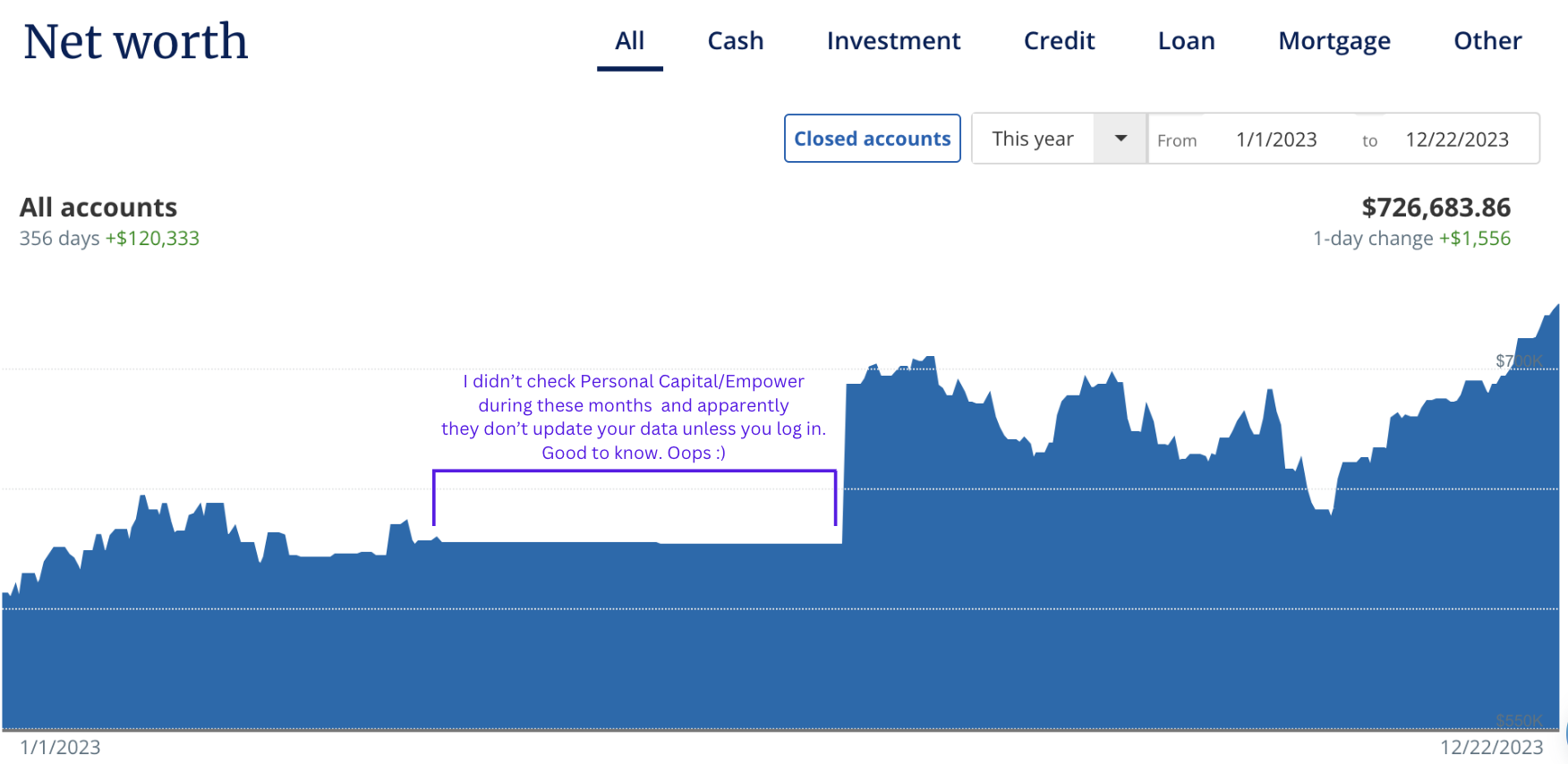

Net Worth

My 100% US stock portfolio is currently up 24% and as of this writing my net worth is $726,683.86. Since October 1, 2020 (the day I retired) my net worth has risen $186,683.86 or 34.6%. Lovely 🙂 .

I must admit that this was not the financial outcome I was expecting when retiring into a pandemic and possible recession, but here we are. Another lesson that I cannot predict the future and should never try!

If you’re interested in monthly net worth updates throughout retirement, feel free to follow me on Instagram or check out my Numbers page. I’ll be posting my final net worth of 2023 on there once the markets close for the year.

Conclusion

And that’s it! My goals for next year are pretty straightforward. I’m going to increase my spending target to $23,400 to account for 2023’s 3% inflation and keep enjoying retirement 😉 . So let’s see what 2024 brings!

How was your 2023? Did you hit your monetary goals?

Shocking how much you do and experience for $23k something! I feel a sucker at work with what I pay in taxes etc. Anyway, thanks for posting and looking forward to the net worth update and spending 2023 numbers.

By the way, did you pick an arbitrary date to sell from your investments and just park it in money market/savings?

Yeah – not having a house, car, kids or pets seem to go a long way 🙂 . When I worked I paid more in taxes than I spent on myself each year. Wild. And thank you!

As for when I sell my investments, JL Collins suggested in a post or his book picking a date so you don’t feel the urge to market time and I’ve followed his example. I sell once a year on the anniversary of my retirement and then park the money in a high yield savings account with Ally.

I love this post especially the chart tracking your dividends over the years. It’s something I track and geek out about too 😆

Haha I love that chart! It’s so cool to see how things can grow. I’m glad you enjoy it too 🙂 .

Nice!

Curious – How does the accountability beast tweets work? I would like to join and help people.

Thanks! For the accountability beast stuff, I send out tweets reminding people to do things every Wednesday. Feel free to do that with your friends that ask you to if you’d like to help people in that way.

Why are you reinvesting only in the tax advantaged accounts? Maybe the taxable account dividends go into your cash reserve, but was curious.

Also, while Ally’s interest has come up, you could be making 25% more for the same risk at a brokerage in their money market account. Vanguard’s VMFXX is paying 5.3% and when I need money from them, it arrives within 2 days (I am sure, slower than Ally, but I would never need it that fast).

Love what you do, thanks for sharing!

Yes my taxable dividends go into my cash reserve. I don’t see the point of reinvesting them and then taking out money from my taxable account anyway. It seems simpler.

I looked at VMFXX for that exact reason and decided to stick with Ally for now.

Thanks for reading!

Thanks Purple for your transparency and wit 🙂

I wish I were as organized with finances as you are…

Thank you for your kind words 🙂 . As for organization, I enjoy making the spreadsheets to track this stuff, which does make it a lot easier.

I love this. The accountability beast/patreon is my favorite subscription haha. It’s helped me so much keeping on track with things and explore what I want to do and focus on.

It’s so fun to follow along with all the fun things you do on $23k in expenses. So many people that retire early focus on monetization, coaching, courses, books, etc that it just becomes another job but working for yourself. I lose interest in their posts because it becomes self promoting. You always keep it fresh and interesting. Thanks for another entertaining year!

Haha you are so kind for saying that 🙂 . I’m happy it’s helped.

Yeah I’m not hurting for fun over here lol. I have seen a fair number of people do that and to each their own – that just doesn’t sound like fun to me personally.

I’m glad you think my random posts are fresh and interesting 🙂 . I’ll keep them up. Happy New Year!

another person here that loves your articles. Never knew how to handle that dividends- you did it simple and transparent. You are an inspiration for me: numbers + calculus shows that is posible to live under budget, to retire early, enjoy life, just with discipline and hard working. And you are still a disciplined person even retired.

Personally, my 2023 passed the 50% of my biggest milestone: invest in my taxable brokerage account ( this country has no 401k nor IRA so I am simple oriented to reach 25 x annual spending in ETFs , what else? ). I have to be grateful to the market raise – that played a lot, the market added more than I saved in 2023. If I can repeat 2023 for 2 more years, that will fill this 25 x annual spending 🙂

Thank you Claudia! That’s so nice to hear. And congratulations on that 50% financial milestone! That’s amazing. You’ve got this!

When you have enough to live on, making a little extra money is fun. It feels like a pleasant bonus, instead of a necessity.

I like how my dividends went up in 2023. The economy is doing well!

100% agree 🙂 .

If the org that asked you to speak said that they didn’t have a budget, would you have spoke anyway? 🙂

Most likely – I usually do those things for free. Getting paid for it is the outlier for me.

Why am I not surprised that you are doing so well? You just are very good at living your life intentionally. Congratulations on the unplanned income and keeping expenses in check.

Haha no idea 🙂 . And thank you!

So great to see this breakdown. Amazing that over a third of your spending is covered by this accidental income!

Would love to see the inclusion of points, miles, and referral bonuses and how that ties in to your income/spending. It’s always weird because it’s not “money,” but it definitely alters experience and I’m sure you have a great way of tracking and thinking about it. (Maybe you’ve already done this sort of thing, and I just missed it?)

Yeah it’s pretty accidentally wild 😉 . As for the points and things, you have more faith in me than is warranted in this case lol. I’ve dug up all the points used in the specific posts reviewing my travel hacked flights, but I don’t have a spreadsheet of all that have been used for flights I’ve taken or anything like that.

In 2024 (and possibly going forward) I’m not planning to take any travel hacked flights so we’ll get to see how my spending is without that (Spoiler: it’s still looking on budget 😉 ). I’ll think about how I can mention that going forward if I start using points again though.

So inspiring, you are a model for me in regards to the ways you are organized physically and mentally.

Love your posts on finances for sure but you are so good on storytelling your days, runs, reads, etc.

Have an amazing 2024, fun, adventures and health!

Thank you so much 🙂 ! Also thank you for your kind words about my writing. I really appreciate that and hope you have an amazing 2024 as well!

Hi Purple! I have been following your progress for over a year now and truly inspired. I’m just curious if you worked long enough to be eligible for social security or if this was factored into your retirement plan?

Hi! Thank you 🙂 And yes – I intentionally worked long enough to get those 40 credits and wrote about that below. I didn’t factor that money into my retirement plan intentionally so it’s just going to be gravy when I start pulling those funds.

https://apurplelife.com/2020/02/04/not-counting-on-social-security/

Thanks for this post! My sister-in-law is going through a divorce right now. She has never invested. Brother-in-law did the money things AND it turns out he has not been very good at investing it – although he has been good at earning it so some has accumulated anyway.

(So yeah, yet another call to stay involved, people, even if your significant other loves managing money more you still gotta know what’s happening and why)

So now I’m here wondering whether I should show her your post and tell her about dividends as an easy first step into the topic of what you can gain from investments.

Thank you for reading! I’m sorry to hear about your sister’s situation. It’s definitely important to always stay involved in your finances no matter your relationship status. That’s one of the reasons my partner and I have completely separate finances.

Feel free to share my post if you’d like. I’d also suggest she check out JL Collin’s Stock Series, which he made into the book The Simple Path To Wealth. That’s way more comprehensive than my little dividend chart, but I know that amount of information about investing can be overwhelming. Your call 🙂 . I hope it helps!

https://jlcollinsnh.com/stock-series/

I like the hourly wage you included on blogging:) I know the feeling:)

Haha yep 🙂 .

Hey, who doesn’t love unexpected bonus money? The financial picture is looking fab, keep doing what you’re doing!

Haha exactly. And yeah it’s looking pretty good 😉 . Will do!

Hi Purple!

Looking forward to the end of the year spending report. I have one question though. I get excited when I see your figures, but I don’t have a partner, and certainly am not going to spend any time with a friend in a one bedroom airbnb. To get an accurate comparison, would I just double your airbnb allowance to get an idea for someone not splitting costs? I’d have to pad a bit more because in my case, enjoyable retirement definitely only includes friends with smaller homes and not family🤣

Hi! I wouldn’t double it for myself, but for you that depends on your plans. If I didn’t have a partner I would be living abroad a lot more in LCOL places where my overall costs would be about the same even if I’m not splitting accommodations. Also in the US I would pick smaller places that are less expensive since there would be one less person around and no need for a separate workspace for my Partner. It all depends on your plans 🙂 .

Great stuff – congratulations on your unexpected income! 😀

Thank you!