This is part of a series about my journey to early retirement. In case you missed it, here are the previous parts:

- $5K to Retirement In 9 Years: Year 1 “Is This Adulting?”

- $5K to Retirement In 9 Years: Year 2 “Avoiding My Problems With Exercise & Consumerism”

- $5K to Retirement In 9 Years: Year 3 “Discovering FIRE…And Ignoring It”

- $5K to Retirement In 9 Years: Year 4 “Catching A Unicorn”

- $5K to Retirement In 9 Years: Year 5 “A Seattle Bait & Switch”

- $5K to Retirement In 9 Years: Year 6 “Searching for Bigfoot”

- $5K to Retirement In 9 Years: Year 7 “The Goldilocks Zone”

- $5K to Retirement In 9 Years: Year 8 “The Boring Part”

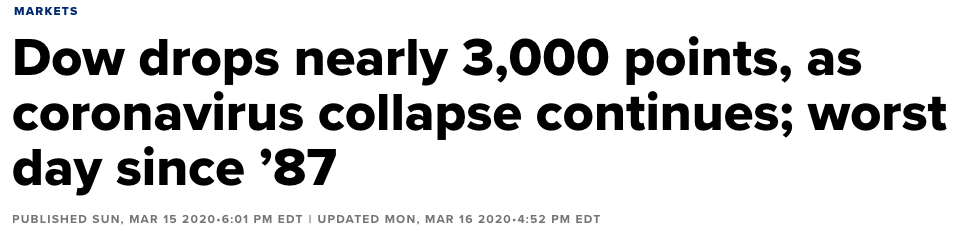

We all remember 2020 – in fact, my brain still thinks we’re living in it 🙂 . But in case you’re better at living in the present than I am, here’s a refresher:

So, obviously, 2020 was off to a great start 😭.

I went from dealing with mundane issues of mentally framing my job, my FIRE to do list and the reality of my impending retirement, to wondering if I would even be able to retire at all.

My Mom and I started pushing back and then cancelling all our travel plans for the year, which included her coming to visit me that spring and then obviously the retirement victory lap we had booked around the world for that fall.

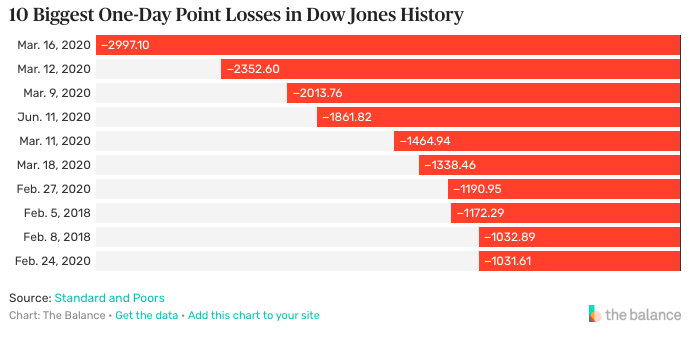

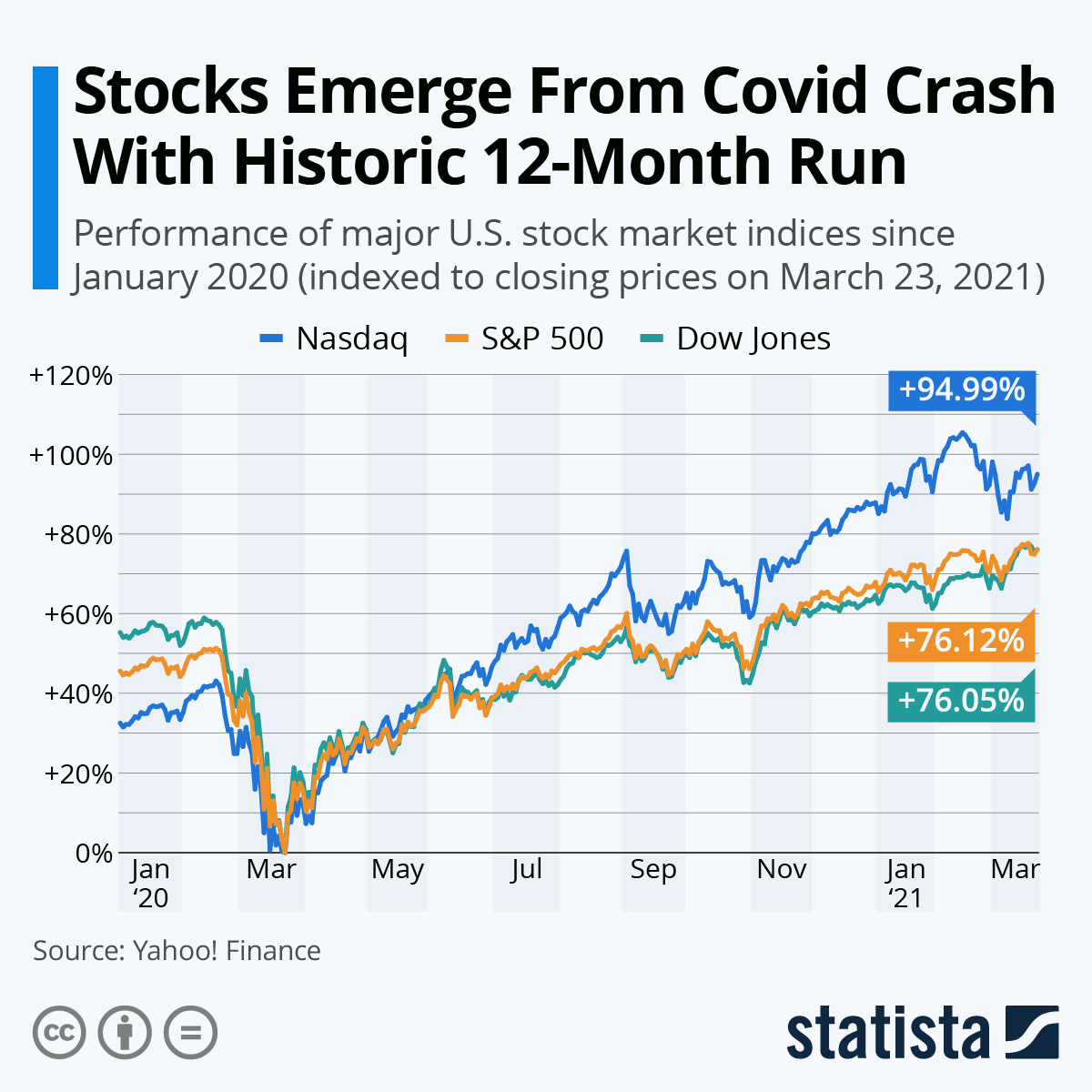

While I was shockingly not emotionally affected by the stock market dropping a ridiculous amount within 24 hour periods (as shown above), I still wasn’t sure if it was a good idea to actually pull the trigger and give up our apartment as planned and quit my job in the middle of this new reality we were trying to come to terms with.

I took a hard look at my plans and finally decided that Yes I’m Still Quitting In September. Check out that post to see my entire reasoning, but basically I was willing to quit and see what happened.

I found freedom from work more important than ever because we were in the middle of a global pandemic and I didn’t know if I or the people I loved would even be alive by the end of the year. Now more than ever, time was my most important commodity. Fuck money – I could make more of that later.

So I went full steam ahead trying to understand this new pandemic world while trudging through the last few months at my job. In the meantime, since I didn’t leave my house for months, I obviously had the opportunity to reflect on how lockdown was for a hardcore introvert like me and the only time that being carfree sucks (Spoiler: it’s a pandemic).

And since my life seems to attract drama, my work life started to deteriorate in new ways. I experienced several microaggressions that led me to finally give up on my company. I had mentioned cracks that were showing in previous years, but this was the final straw.

This DGAF attitude led me to reflect on what would happen if everyone stopped being fake at work and to be honest in a blog post I wrote for my company about how useless meetings are, which led to me winning $1300 because so many people related to it 🙂 .

And the grand finale, my lack of caring led me to share my salary with my colleagues, which basically started a revolution. It turns out that I was one of the highest paid people in my job title and others that had been there longer and did higher level work, were paid tens of thousands less. In my last few months, I worked with my underpaid colleagues on strategies to get them more money and all of them succeeded 🙂 .

While I was fanning the flames of revolution at work, my money continued to pile up despite the bear market we were now officially in. I accumulated enough credits to qualify for social security even though I don’t even factor that money into my retirement plans. Regardless, it was a fun milestone to hit.

I also decided to be even more real on this blog and come out online as bisexual while also spitting truth about how little most blogs make and celebrating two years of this blog being public!

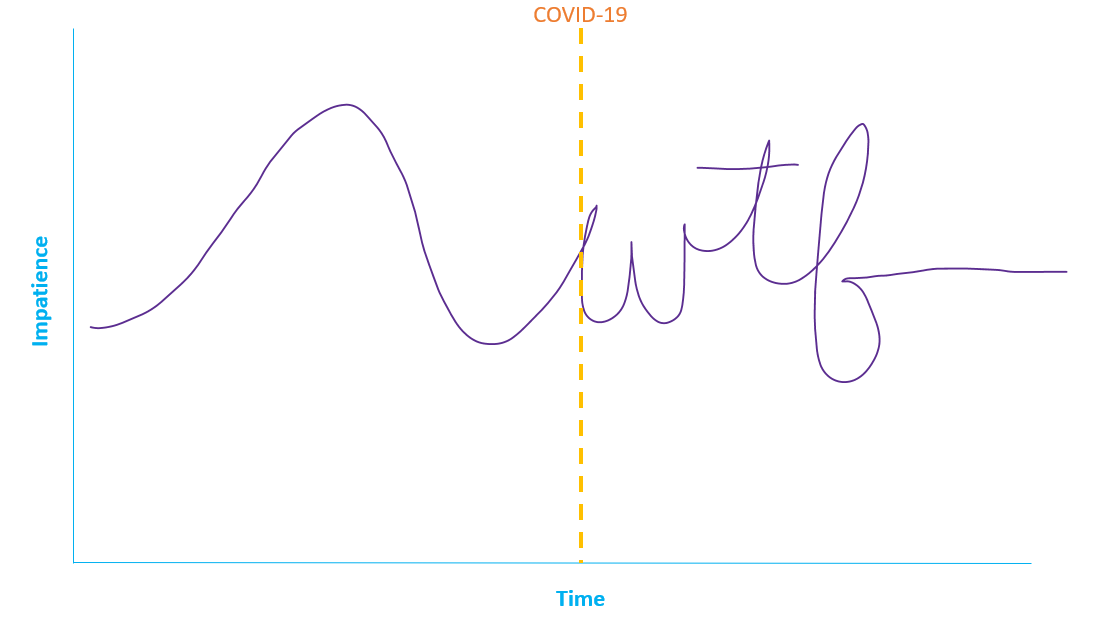

On the job front, I realized that my overall stages of impatience, from the beginning of this FIRE journey in January 2015 to now, looked like this:

I went from not even believing early retirement was possible, to realizing it was real and wanting it immediately, to liking my job enough to want to stay indefinitely, to this latest COVID stage, which I lovingly called “OMG I NEED TO QUIT NOW.” It was like while the world was collapsing around me, it also wanted to remind me that jobs can still suck 🙂 . For example:

A client just requested that we move a meeting to 6am on a Monday morning. You can't make this shit up. pic.twitter.com/tbIXJkeCea

— A Purple Life (@APurpleLifeBlog) May 12, 2020

Woke up to an email that was sent at 8pm, marked URGENT❗️ and asked me to email someone else ASAP…..Why can't you just email them? And how is that urgent🤔? I've decided instead of getting mad at this stuff to keep a running list to laugh at in the future🤣. It's all I can do.

— A Purple Life (@APurpleLifeBlog) May 14, 2020

It was moments like these that my impatience flared up and I remembered why I didn’t want to continue this work life indefinitely. Despite feeling immensely grateful that I still had a job while 114 million Americans lost theirs, thoughts such as, “Well if I rage quit now, that’s one more job for someone else who needs it…” would still surface when I was faced with bullshit like the above.

And my emotions would change minute to minute in reaction to the uncertain world I lived in. I went from thinking, “Maybe I should keep this job that’s pretty easy and pad my investments more to ride out this pandemic” (*cough* one more year syndrome *cough*) to “WTF do you mean I have to wake up for calls with Europe at 6:30am every day for the foreseeable future?!?!”

Meanwhile, it was finally summer and we had to get rid of all our stuff and leave our Seattle apartment! I set up my nomad mail and healthcare plans and set out into our new home: Airbnbs! After that stressful process, time kept ticking and my months left to retirement continued to pass by, which I wrote about on this blog monthly:

- 4 Months To Retirement: Trying To Find Silver Linings In A Pandemic

- 3 Months To Retirement: Are My Global Travel Plans Changing?

- 2 Months To Retirement: Shifting From Nomadic Packing To A Micro-Move

- 1 Month To Retirement: AHHHHHH!!!

While all of this was going on, the stock market had decided that the pandemic was less of a big deal than it originally thought and started a ridiculous upward trend. As a result, after 5 years of effort and in the most surprising year of my life, I hit my FIRE Number!!!

Shortly after that, I gave my notice at work to retire at 30 years old. Feel free to check out those posts I wrote at the time detailing what happened if you’re curious for more info 🙂 .

However, I didn’t even have much time to celebrate because shortly after that, we flew across the country during a pandemic to move into a tiny house in rural Georgia (our new pandemic-friendly ‘Wait It Out’ plan).

So while in a tiny house in a state I had promised never to live in again after being born and raised there, I had my last day of corporate work and my first (and last) exit interview. I decided to not tell my company I was retiring, quietly shipped back my laptop to Seattle, and walked into the sunset!

2020 was not at all what I had envisioned or planned, but I made it through alive and with my sanity (mostly) intact. Despite all odds, I completed my long held goal of amassing more than $500,000 in investments to retire at 30, and pulled the trigger. I WAS FREE!!!!!!!!

At the end of 2020, here were my numbers:

Salary: $114,229.45

Side Income Profit: $5,350.84

Spending: $15,886

Net Worth: $620,767

And that’s it 🙂 . I’ve been retired for a little over a year now and can confirm it’s the best decision I’ve ever made – despite doing it in the middle of a pandemic and possible recession. I hope you enjoyed this blast from the past. Feel free to let me know what you thought of this series below and thank you for reading!

And to follow the tale of what happened next, check out my Early Retirement updates below:

Weekly

- Early Retirement Week 1: The Freak Out

- Early Retirement Week 2: The Vacation

- Early Retirement Week 3: The Whiplash

- Early Retirement Week 4: The Heartbeat

- Early Retirement Week 5: The Election

- Early Retirement Week 6: The Trophy

- Early Retirement Week 7: The Train

- Early Retirement Week 8: The Challenge

- Early Retirement Week 9: The Question

- Early Retirement Week 10: The Game

- Early Retirement Week 11: The Recharge

- Early Retirement Week 12: The Holiday

Monthly

- The Month Of Rest: Early Retirement Month 4 (January 2021)

- The Month Of Birds: Early Retirement Month 5 (February 2021)

- The Month of Change: Early Retirement Month 6 (March 2021)

- The Month of Atlanta: Early Retirement Month 7 (April 2021)

- The Month of Portland, Maine: Early Retirement Month 8 (May 2021)

- The Month Of New Hampshire: Early Retirement Month 9 (June 2021)

- The Month Of The Northeast: Early Retirement Month 10 (July 2021)

- The Month Of New York State: Early Retirement Month 11 (August 2021)

- The Month Of City Hopping: Early Retirement Month 12 (September 2021)

And if you’re looking for even more info, my latest updates are in my early retirement update blog category here. Thank you for again for being here!

Discover more from A Purple Life

Subscribe to get the latest posts sent to your email.

Quite a journey, Purple. And very intentional. Many drift through life without a compass. You aren’t like that.

Thank you!

Nice recap! Super satisfying. You made it! And off the back of a pandemic market no less. Crazier things have happened. It’s so reassuring to see that it can be done and that you have no regrets a year in.

I know what you mean about your brain still being in 2020. Same here. The past two years have curdled together like a badly-poured slippery nipple. I’ve forgotten what it’s like to just go places without checking restrictions/rules and having extra masks on hand. Hopefully 2022 is a brighter year on the pandemic front. Keep us updated on how things go for you and how travels work out!

I’m so glad you liked it! And that is a fantastic way to describe the last two years 🙂 . I’ve also forgotten that – and not starting a conversation by asking what someone’s preferred covid protocol (outdoor distanced, indoor with masks etc). I hope so too and will do!

Purple, thanks to you I’ll be spending some time this weekend determining my ‘quit’ date from my full time job. I’m 28 but hope to end full time work by 33. Your blog is inspiring me to go even sooner if possible (if the numbers work).

Also- what are your plans for international travel?

That’s so exciting!!! You’ve got this 🙂 . Currently we have our first international travel booked in February and if we’re still allowed to go we will be doing so. Those countries are handling the pandemic a lot better than the US so after staying here for 2 years we’re getting out.

Wait there isn’t another post in the series? But there’s still another bar on the graph where you could put “you are here”…. 🤔

That’s when you pick up with early retirement updates 🙂

https://apurplelife.com/category/early-retirement/early-retirement-updates/

Exactly 🙂 . Thank you for answering for me!

I really enjoyed reading this recap series. It’s been a great way to learn your backstory since I’m relatively new to your blog. Thank you for sharing your journey and finances publicly. I’m impressed with how you’ve cut through all the b.s. out there by figuring out what really matters to you. You set a goal and in the face of a worldwide pandemic stuck to your plan. Congrats!

I’m so happy you enjoyed it 🙂 and thank you!

Congratulations! Good on you for sticking to it and pulling the plug instead of waiting around for some kind of cosmic permission to quit that will never come. Live every day to the fullest.

Thank you and that’s the plan!

Really loving this series, you are one of my fave FI blogs (from someone who has been reading them for about a dozen years!) I keep forwarding links to my husband, he is on track to quit his corporate job in a few years, but has only been aware of the early retirement idea since we met about 3 years ago (at age 40). We don’t have a blog but maybe I should start one because I would love to meet some of you IRL once we are free and able to travel more!

Oh wow – thank you! That means a lot 🙂 . And that’s so exciting about your husband! I’d totally suggest starting a blog if you enjoy writing – there’s always room for more perspectives. However, if you’re just looking to meet FIRE people IRL you can do that without a blog by just reaching out. I meet up with non-blog having readers regularly. Good luck!

Great for you! I’m excited to catch up on some of the early retirement posts to see how it went. I think it would take me a little while to ease into it.

It was a surprisingly quick transition for me, but I know I’m weird 🙂 and that’s not everyone’s experience. I hope you enjoy!

2020 was such an insane year. The updates on the blog were so enjoyable. I was wondering what you were going to do but assumed you weren’t going to push back retirement with what you went through. Even though I’m not FI or going for FIRE, your posts showed me how much you can push the envelope at work and actually get awarded for it. I’ll always be thankful for that.

I’m so glad those updates made 2020 more enjoyable for you – they helped me too 🙂 . And I’m super happy my experimenting at work helped you as well!

I’ve really enjoyed this series Purple, thanks for sharing! I found your blog back in early 2020 when I was looking for more FIRE people that actually looked like me/whose experiences that I could relate to and I am forever grateful that I came across your site! 🥰💃🏾

I’m so glad you enjoyed it 🙂 ! And that’s amazing – I’m smiling wide over here 🙂 .

I really enjoyed this series of posts. In my experience job hopping is the best way to get a raise as well (20%+, even 50% in one case!). However, I valued the relationships more so I stayed longer in each place. I made ok in terms of salary but I only learned about FI later. I’m well on my way to FI now so it all worked out.

I’m so glad you enjoyed it! And SAME 🙂 . That’t so awesome you were able to make those jumps by job hopping! And totally same – I stayed at my last place for that exact reason. Good luck on your journey!

Hi Purple,

Thoroughly enjoyed this series! Congratulations on being able to retire during the pandemic, and being able to read through this series is mad inspiring, because it feels super empowering to know that even if I were to start all over, I’m ~9 years from retiring at maximum.

Luckily, I’m currently close to retirement and hopefully can pull the trigger within the next 2 years so I can also make a post on how I gave my manager a notice. That’ll probably be the most enjoyable post I’ve ever written lol.

That makes me so happy to hear 🙂 ! And thank you. Also I’m so excited to read that post – you’ve got this!!

Although I’ve been following you on instagram for a while I just yesterday found your blog and have been binge reading this series. Thanks for sharing your nine year journey. I thoroughly enjoyed following along with your progress.

So, I have to ask, and maybe you answered already and I missed it, but did your partner also FIRE?

Ah, I just found your partner’s answers to all the questions I had. Nice job guys. You’re an inspiration to us all.

Perfect 🙂 and thank you!!

That makes me so happy that it’s binge-worthy 🙂 !

I find your story inspirational. I’m starting my FI journey later in life then you did (started at 30 and now I’m 33), but reading your original “Start Here” post and then reading this, I feel more motivated. Thank you!

Thank you so much for telling me that Zach! 30 is still super early to start – that’s awesome! So happy I could help with motivation. You’ve got this!

OMG, I’ve never read a blog that exactly describes the bullshit employers put people through! I’ve laughed and teared up reading through your detailed retirement series. I found the FIRE movement much too late in my life, if only I could be granted a “do over”! However I do have a hefty FU account and after the week I’ve had I’m mulling over giving my employer the middle finger soon!

Thank you for this treasure of a blog!

Oh WOW – thank you so much for telling me that! And yes if you can I’m all for giving that middle finger in a bad situation. You’ve got this 🙂 . Thank you for reading!