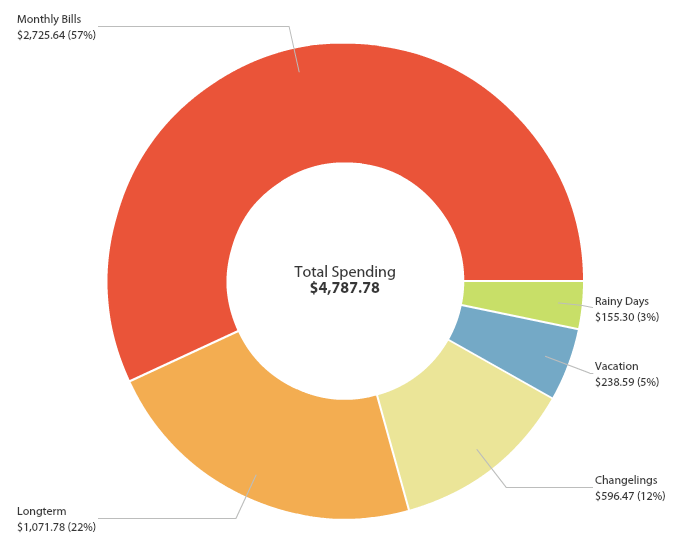

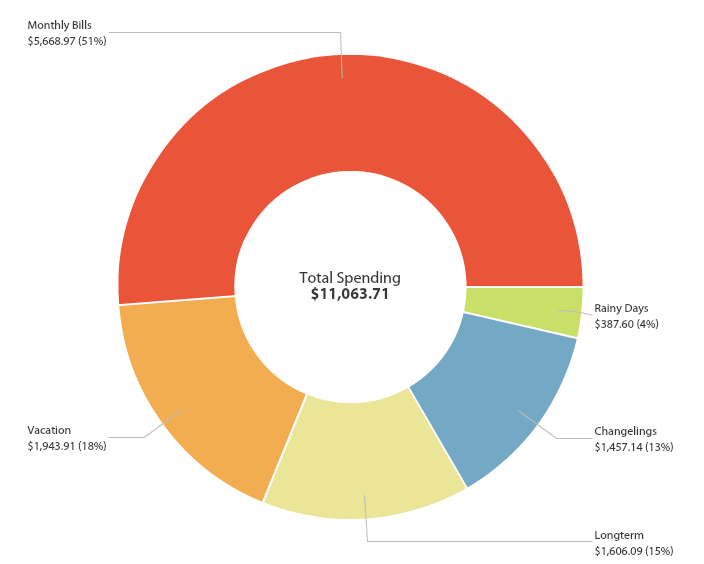

Well, somehow 2019 is 75% over and yet seems to have gone on for several years. How our brains perceive time is weird so let’s tackle something more tangible: every dollar I spent this quarter! Above is a snapshot of my Q3 spending from YNAB. Let’s get into the nitty-gritty:

Continue reading “How I Live On $1,600/Month In Seattle: Q3 Budget Check-In 2019”

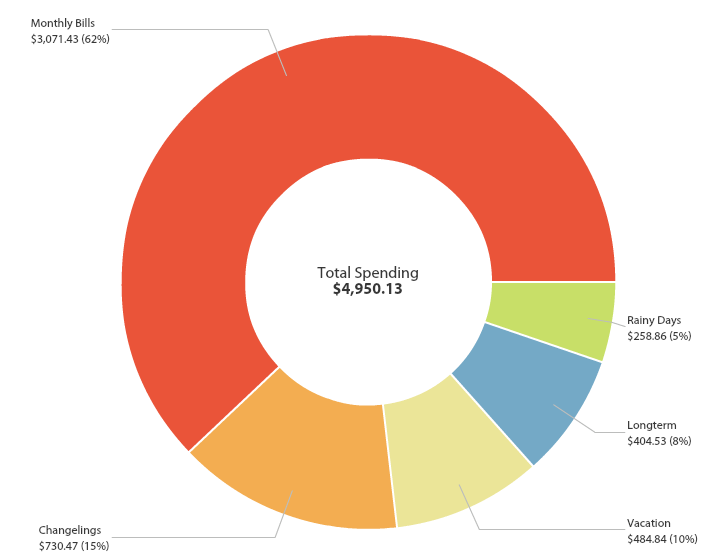

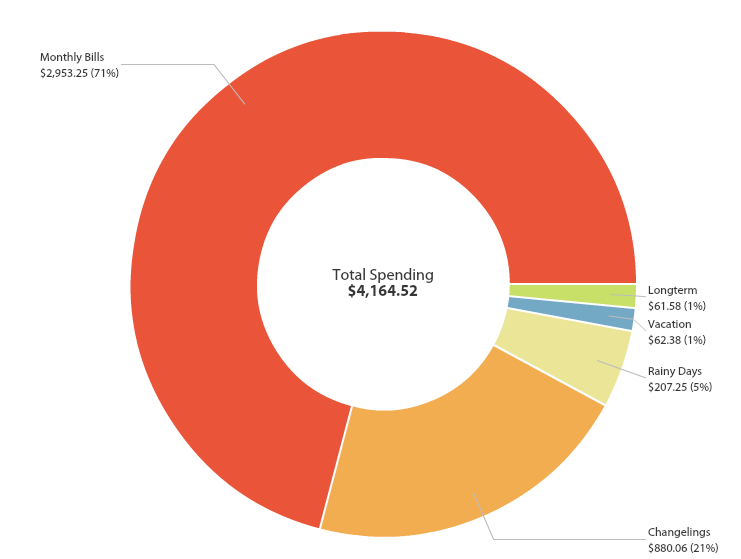

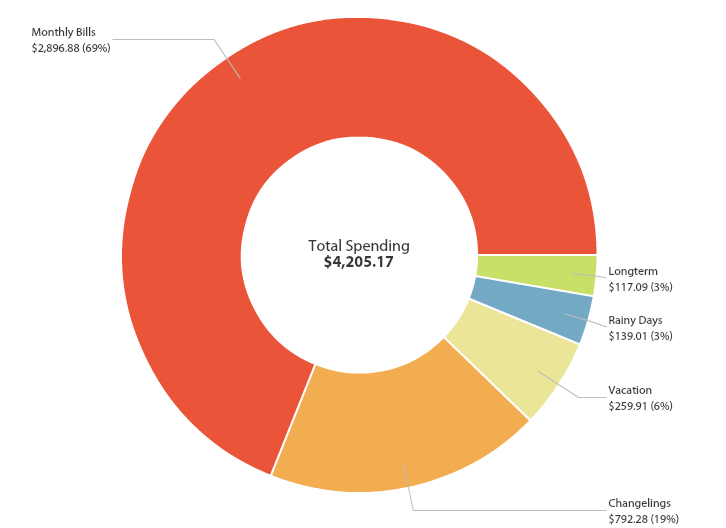

We’re halfway done with 2018 and this year is both crawling and flying by. Let’s check in on my goal to decrease my spending to $18,360 this year ($18K + 2% inflation).

We’re halfway done with 2018 and this year is both crawling and flying by. Let’s check in on my goal to decrease my spending to $18,360 this year ($18K + 2% inflation).