Welcome friends to weird-times! Usually when I write these updates I’m shocked that a whole 3 months has gone by, but given everything that’s going on in the world, specifically the coronavirus pandemic and all the changes happening around the globe as a result, I for once totally believe it’s been 3 months!

In fact, I texted a friend a few weeks ago saying “Monday was a hell of a year.” So for once, me and the clock are more on the same page. Let’s see how these weird-times were reflected in my spending.

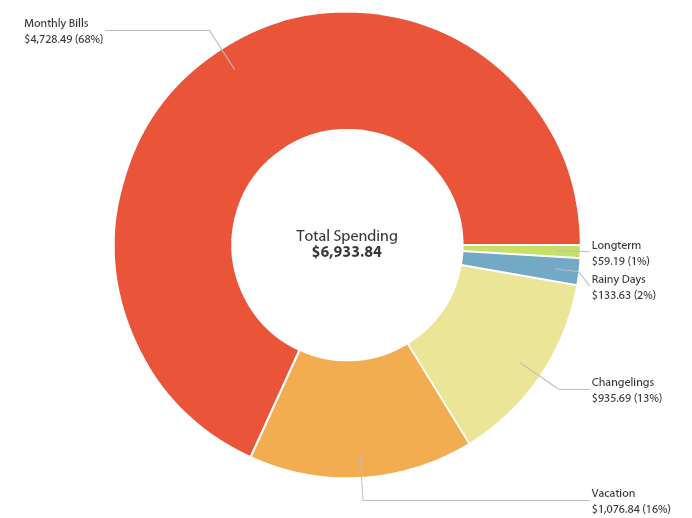

Above is a snapshot of my Q1 spending from YNAB. It was a very abnormal quarter not only because of how life in Seattle has completely changed, but also because I booked a lot of lodging and travel for when I’m traveling later this year (fingers crossed we get our shit together before then, but if not: hello an additional benefit of travel hacking – losing points instead of money!)

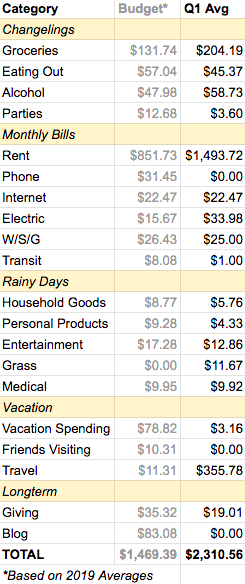

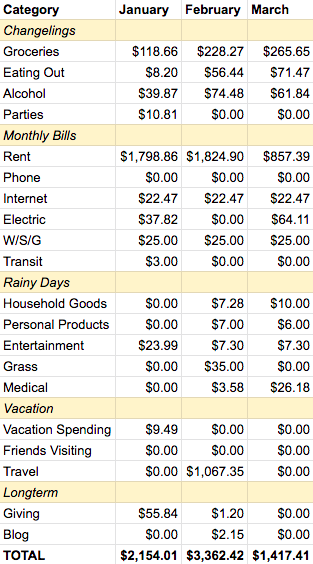

Anyway, here’s how everything shook out:

And for a month by month breakdown:

CHANGELINGS

I call this section “changelings” because they’re the items that change the most month to month. So what happened this quarter? I (knowingly) let the changelings get out of control!

Groceries – $204.19/month on average

After being gone for the month of December, I started stocking up on groceries and then after that, I stocked up even further on nonperishable items based on urging from my smart and prepared friend Angela who writes over at Tread Lightly Retire Early. She recently wrote about her badass COVID-19 preparedness techniques – feel free to check that out here.

So as a result of those two actions, my grocery bill was well over my usual $125 a month and I’m fine with that. As you’ll see, this amount was easily made up in other areas due to you know…being self-quarantined for…*checks watch*…6 weeks and counting.

While being home a lot more hasn’t turned me into the michelin star chef I’ve seen others become on Instagram, we have been getting wild by cooking even more with our awesome Sous Vide machine and seeing how we can eat everything on hand to decrease the number of times we need to visit the grocery store.

Eating Out – $45.37/month on average

Another change due to Seattle’s (smart) self-quarantine measures is that restaurants and bars were closed about half way through March. Because one of my main loves is food and I greatly appreciate all of our delicious, local food slingers I decided to spend more on takeout and delivery than usual to help them in this difficult time (obviously I also got amazing food out of the deal, but you know…not all heroes wear capes 😉 ). One of those takeout meals involved the below deliciousness:

Alcohol – $58.73/month on average

Before the world exploded, my partner decided to do a dry streak for an unknown amount of time while he starts looking for a job (he’s been on a sabbatical for 9 months after almost a decade of nonstop work).

I decided to join him with the goal of stopping right before we had a string of visitors. During this time the global pandemic we are now facing caused Seattle to basically close AND the stock market tanked and I….didn’t feel the urge to turn to a glass of wine to deal with the stress. Woohoo!

However, after that month, it became clear that all visitors, travel and social interaction would be cancelled for the foreseeable future and I decided to end my unofficial dry period. I had learned that even when the world felt like it was LITERALLY collapsing – when my city is the epicenter of a pandemic in the US and the stock market is crashing faster than it ever has into bear market territory – I found ways to get through it without the sauce…and that felt awesome.

Parties – $3.60/month on average

We had a few fun, frugal hangouts this quarter in January and February but that came to an understandable end in March so this amount is quite low. Instead, I’ve been hanging out with friends over vid chat (almost one per night – WOAH NOW 😉 !) and catching up on all the reading I wanted to do before sharing my books with the world in this way (which I stopped once we retreated inside):

MONTHLY BILLS

Pretty self-explanatory. This section doesn’t normally vary a lot month to month, but this was not a normal quarter.

Rent – $1,493.72/month on average

This section is way higher than normal because we booked 2 separate AirBnBs in new Seattle neighborhoods for us to stay in during the months of August and September. We’ll see what happens with those…

Phone – $0/month on average

Last year I signed onto the new Republic Wireless annual plan so I won’t pay another dime until June.

Internet – $22.47/month on average

I split this bill with my partner since we both work from home (or use the internet when he’s on sabbatical to play super fun video games during the day that I’m totally not jealous of 😉 ). Every year I call our provider to reduce our rate, which I for some reason find a very nerve-wracking experience. Two years ago I discovered that you can request multi-year contracts to lock in the same rate so I didn’t have to make the same call every year. So much unnecessary stress saved 🙂 .

Electric – $33.98/month on average

Pretty normal – our electric spikes in the deep winter and summer when we’re using the heat and A/C more.

W/S/G – $25/month on average

This is for water, sewer and gas. After changing to the 3rd…or is it 4th?…management company we’ve had handle our building over the last 5 years, they’ve switched to a monthly set-rate situation for these items and we are not complaining 🙂 .

Transit – $1/month on average

As I mentioned, Seattle has been in lockdown for 6 weeks, but prior to that, I did walk and take the bus a few places, but as you can see – not that many places. We basically just took an Uber home from our 11th Anniversary Dinner and it saved us a surprising $5 out of the $10 it would have cost with Freebird (feel free to use promo code l3575 to get $10 back after your first 2 rides). Otherwise, our transit usually looks like this:

RAINY DAYS

This section is named based on a principal in YNAB: saving a little for inevitable things that don’t happen monthly so when a rainy day hits you have the funds.

Household Goods – $5.76/month on average

We bought a bit of toilet paper (but not a hoarding amount…) and a few rolls of paper towels this quarter. Nothing wild.

Personal Products – $4.33/month on average

While I’m stuck inside, I’m working to moisturize my hair since it’s perpetually in a messy bun these days and bought some Aussie 3 Minute Miracle to help with that. Otherwise, I bought some nail polish remover because being stuck at home has given me more time and motivation to paint my own nails. So fancy!

Entertainment – $12.86/month on average

To entertain ourselves during self-quarantine, my partner and I have been spending more on renting films in our living room. For example, we rented the AMAZING film Knives Out on YouTube, watched Frozen 2 on a Disney+ Free Trial and I started an HBO Now subscription with the express purpose of watching the new season of Westworld (one of my favorite shows ever). Game, Set, Match streaming services – yeah, I know you own my soul for now 🙂 . Touché.

Grass – $11.67/month on average

Yep – weed is legal in Washington. Deal with it 🙂 .

Medical – $9.92/month on average

I bought ibuprofen and sugar free cough drops this quarter and also had this shockingly lovely (and covered) medical experience:

VACATION

Travel – $355.78/month on average

I bought a flight to Argentina for November and was surprised to realize that this is the first full priced ticket I’ve bought in over a year. The rest have been travel hacked!

Vacation Spending – $3.16/month on average

I’m a hardcore nerd and I tag every place I visit on vacation in YNAB so I know how I might spend per city when returning. This amount of spending was just an uber around Georgia.

Friends Visiting – $0/month on average

I also separate out spending that I only do when a specific friend visits so I can estimate how much I should set aside when they come back. This has been accurate and helpful so far, but now all of my visits have been cancelled for understandable public health reasons…so this is zero. To help cope, I’ve been sending out these kinds of tweets trying to see the good in life:

Morale has been down in the Purple Household due to long-held social plan cancellations, but the new #Brooklyn99 episode is just what I needed. Doug Judy is BACK🙌🏾!

— A Purple Life (@APurpleLifeBlog) March 20, 2020

LONGTERM

This category is for, you guessed it, “longterm” items that come up rarely.

Giving – $19.01/month on average

Pretty low over here – I’ll see what I can do to up this next quarter. I bought a few gifts for friends and am thinking about how I can do more.

Blog – $0/month on average

Nothing here, but I’m planning to change hosting providers for this site and need to save up $500 to pre-pay for that so let’s see what happens 🙂 . I may postpone that if the site doesn’t keep going crashing regularly (like the example below) until I can save that without messing up my 2020 savings goals before I quit in September 😉 .

Hi @bluehostsupport – my site has been crashing weekly for the past two months. Previously it was crashing monthly, which is still not cool but this new frequency is ridiculous. What's going on?

— A Purple Life (@APurpleLifeBlog) March 4, 2020

OVERALL

So far this year I’ve spent $6,933.84 – that’s 34% of my $20,000 goal. A little higher than expected, but all accounted for in that August, September and November rent are now pre-paid. Let’s see what the next quarter holds!

What about you? How has your spending been lately?

I did not know you could rent movies from YouTube. Between that and the Sims, you’ve really expanded my isolation entertainment 😉

I really love reading these. I am soooooooooooooo far off, but find your low numbers so inspirational!

Haha – so happy I could help expand your entertainment! I know all kinds of introvert/isolation activities so let me know if you need more. So happy you enjoyed reading it and THANK YOU for the comment 🙂 . It made my day. And there’s no such thing as far off since personal finance is personal. You got this!

Hi! I am a brand new reader. I found you through an interview you did on one of my new favorite podcasts. Just wanted to drop a line and say how much I enjoy your posts. No fluff and nonsense, you get to the point with some witty banter. Content is spot on. Your spending is inspiring, my take out budget was also increased but my utility bills are infuriatingly high. Thanks for your post.

Hi Lori! Welcome. Thank you so much for telling me – that really makes me happy to hear! I’m sorry about your utilities – is winter dragging on where you are? Thanks for stopping by!

Hey Purple, check out Web Hosting Canada (whc.ca). Their prices for pro hosting are remarkably affordable. I don’t know what you usually pay for with your $500 pre-pay, but I switched from a similar plan to WHC and my bills on that front have been way less

Awesome – thank you for the suggestion!

Loved Knives Out too! Rian Johnson is working on a sequel — it will feature the Daniel Craig character solving a brand new case.

Our groceries bill is high b/c I’m coordinating our household but also my mom’s groceries in NYC — she usually does her own shopping but it’s lockdown there, and I need to make sure she stays inside. Still, the drop in travel, restaurant dining and entertainment expenses will still help for the next couple of months probably.

Cool – excited for the sequel! Makes sense about groceries. Mine are high too. That’s awesome you’re helping your Mom! That’s fair on travel and entertainment. I’ve increased my eating out budget to help local businesses through takeout, but overall I think it will level out over time. I hope you’re well!

It’s been wild. I stocked up on a 3 month supply of everything for our dogs because I wasn’t gonna risk them running out of any essentials, and our old boy has a lot of essentials. We also spent quite a bit more on eating out than usual and March was our grocery stock up to ensure that we could stay home and out of the stores for a couple weeks at a time.

Thankfully, our childcare bill being out of the picture for the moment offsets a bit of that but it’s definitely been a weird ride intentionally spending so much all over the place.

Sounds like smart moves! And yeah I can only imagine how much not having a childcare bill would offset all of that. Hang in there 🙂 .

Have you explored TrustedHouseSitter or similar to reduce your lodging expenses? There’s tons of lets in Aus / NZ as well as UK and EU.

I’m was planning to visit Seattle for the 4th of July (hopefully still am) and was looking at housesitting. If you build your reputation before you travel it would be easier to get sits.

The sweet spots are really long term sits. Multiple weeks is not uncommon.

Yep I’ve looked into it and am not interested personally. I don’t have an interest in taking care of pets (which seems to be most of the sits) or having to respond to anything immediately (new sits, questions etc). That’s part of why I’m quitting my job – to not have to be “on” all the time. Looks like a good deal though for my friends that do it.

I am a new reader of your blog. Really enjoying the posts and the content so far. Reading posts like this make me realize that I really need to find ways to cut down on food expenses (over $500 a month on average.

Hi Jack – Welcome! I’m so glad you’ve been enjoying it. And hey if you can cut down the cost and still be happy with the outcome I say go for it!

hi purple? your budget article is very inspiring and amazing. .but l really don’t know if it can apply here in my country. one thing l like about your articles is that they are connected to you in one way or another, very unique.

am new here, l found out about your blog on google article best finance blogs .

just a small question though, would this kind of budget apply to the nomad’s life you are living now?

Hi There – Thank you. I actually spend less as a nomad – just out my later post “How I Lived On $15,866 in 2020.” I’m not sure how applicable my budget is in other countries, but I wish you luck!