Time once again has no meaning 🙂 . Somehow, I have now been retired 3 years. HOW?! Time has been flying and life is going even better than forecast. So to commemorate the end of my third retired year and get pumped for the 4th, I wanted to go over where I’ve been, what I’ve spent, any revelations I’ve had, and what’s next in retirement 🙂 . Let’s get into it!

Year 3: Where In The World Is Purple?

In case you want to catch up, here are the recaps from previous years:

- 1 Year Of Early Retirement: Spending, Accidental Income, What’s Changed And What’s Next?

- 2 Years Of Early Retirement: Finances, What’s Changed And What’s Next?

Retirement Year 3 was the second year I ventured outside the US after the pandemic completely changed my retirement plans. Unlike the (very fun) US extravaganza of Year 1 and international tip-toeing of Year 2, I spent a little over 3 months of Year 3 in Argentina🇦🇷, Canada🇨🇦, Singapore🇸🇬 and Australia🇦🇺.

I went to Buenos Aires, Argentina🇦🇷 to visit my college roommate who I hadn’t seen in person in 10 years and I had a lovely time exploring for 5 weeks.

I also spent a month in Montréal, Canada🇨🇦 on a whim only to discover that (unsurprisingly) it’s a completely different city in the summer than during the winter months when I had previously visited. I also enjoyed learning how little of my high school French remained in my brain. Gotta stay humble 😉 .

Anyway, I had such a great time that I’m going back for 2 months next summer to explore more of the city. I don’t usually do immediate location repeats, but this city was so massive, lovely and close to major US hubs that I couldn’t help myself.

And finally, I embarked on the trip that was originally meant to celebrate my retirement in 2020: Singapore🇸🇬, Australia🇦🇺 (and in Year 4 New Zealand). It finally happened!!! I’m writing countless posts about it, but in the meantime here’s a taste:

Outside of all of that international fun, I went back to the US and explored these 9 states:

- Maine

- New Jersey

- New York

- Connecticut

- Massachusetts

- New Hampshire

- California

- Washington

- Illinois

In addition to some wonderful new countries and cities that I’ve visited, I also got to experience some new luxury flights for a wildly low price:

Year 3 Spending

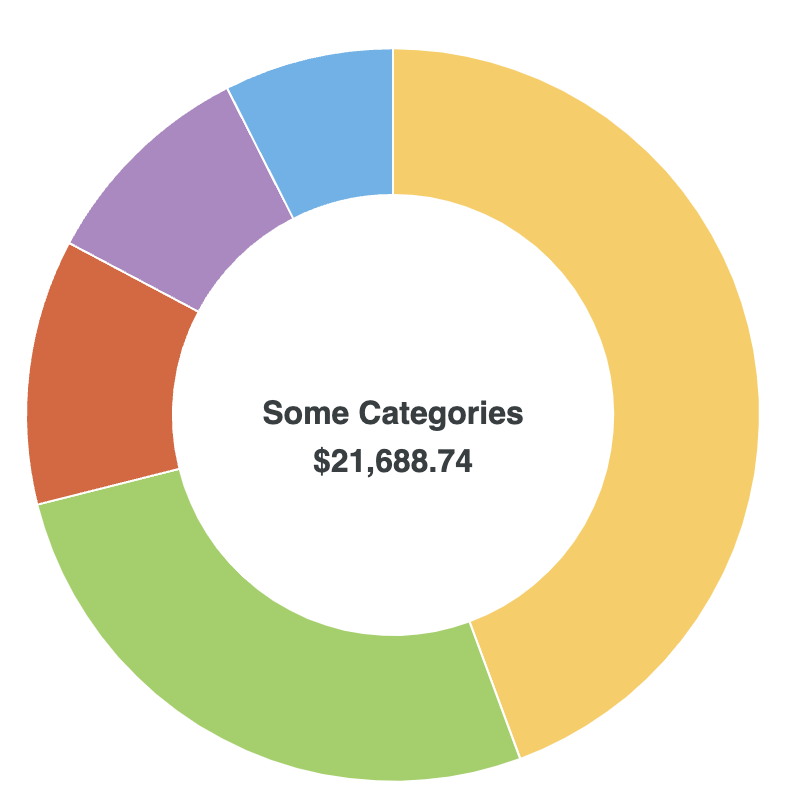

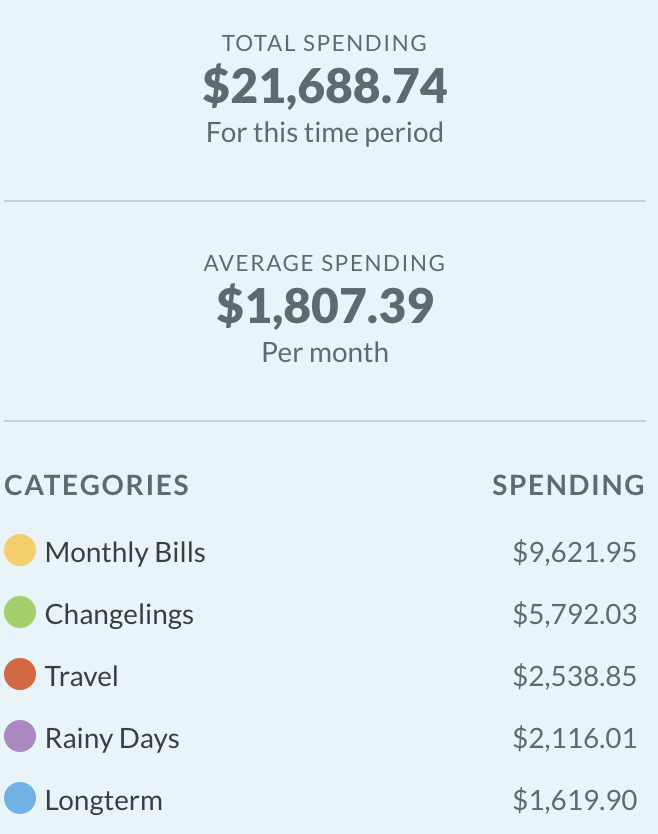

Before I get ahead of myself though, let’s see how much I spent living in 9 US states, Argentina, Canada, Singapore and Australia in the third year of retirement! Here’s the full picture:

Retirement Year 3 Spending Goal: $22,700

Actual Year 3 Spending: $21,688.74

I’m going to do a full breakdown of my spending in December like I have every year that I’ve written this blog if you want to know the details, but overall, I’m pleasantly surprised that all this travel hasn’t broken the bank 🙂 . In fact I was 4.5% under-budget despite all that’s happened in the last year. Wow 🙂 .

Year 3 Net Worth

So that’s how much I spent, but how has my money changed since I retired? Let’s see!

2020

Investments: $500,000

Cash: $40,000

TOTAL NET WORTH: $540,000

2023

Investments: $619,044.92

Cash: $36,944.08

TOTAL NET WORTH: $655,989

As you can see, when I retired I had a net worth of $540,000 including $40,000 of cash. As of this writing, I have a total net worth of about $655,989 including $36,944.08 of cash.

Originally the unexpectedly slow drain of my cash cushion was a result of a few thousand dollars of my taxable account’s dividends being deposited into my Ally High-Yield Savings Account, and a small amount of accidental income I’ve made. I always break that down fully in my annual December income post, so look out for that this year. As an example, here’s that post from 2022:

However, the $40,000 I saved in cash when I decided to retire in 2020 was supposed to run out long before this very moment. To celebrate entering Year 4 of retirement, I finally touched my portfolio and withdrew $20,000 so only about $16,000 of the above cash was remaining from my original cash cushion. If you’re curious how I sold my investments I explained it here:

Revelations

I Slowed Down…Even More

After the whirlwind of travel in Year 2 while learning an entire fucking language in one year, I gave myself permission to slow down. And I actually did it! Now while what I was doing in Year 2 was definitely still WAY less hectic than my life was when I was working…I was still tired at times 🙂 . And that just won’t do in retirement!

So this year I focused on slowing down and I think it was a success! I was more diligent about sleeping in if I didn’t feel rested when opening my eyes or taking quick afternoon naps if I was so inclined. I planned less things to do and enjoyed a good book if that’s what I felt like doing instead. And yet, I still did a shitton 🙂 . I definitely did a lot this year, but I took my permission to slow down to heart and I think I found an even better balance this year.

Finding The Perfect Temperature

Last year I concluded that I wanted to try cooler weather in Year 3 of retirement and I have! I previously had intentionally only spent time in warm or hot places, but then encountered some weather that was too hot even for this Georgia girl. So I wanted to branch out.

I spent two months of winter in the frozen wilds of New Hampshire and surprisingly enjoyed it despite the ice, chilly winds and snow. This might have been because the sunrises and sunsets were gorgeous and I didn’t mind running in the cold unless it was too icy to do so safely. I found wrapping myself in a blanket and reading with a hot cup to tea to be a wonderful way to spend my days.

However my partner didn’t enjoy it as much. That might have been because I was able to get outside during the (few) daylight hours that exist during winter to enjoy the world and instead it was already dark when he stopped working.

I remember that from my working days and it was quite depressing. So we’re putting more cold places on the back-burner for now, but I’ve developed a new love for falling snow so we’ll see what happens after a few years 😉 .

Overall it’s good to know that I don’t necessarily hate cold and the subsequent locations I’ve chosen in Year 3 were a cooler average of 65-70F degrees, which I really enjoyed.

Searching For A Food Balance

One of my favorite ways to explore a new country or city is to eat my way across it 🙂 . Eating the different food I discover and finding hidden gems in unexpected places has been a highlight of my travels in retirement. I’ve been trying to balance being keto when in a place I’ve been before with going off it to explore a new place and so far that’s worked pretty well.

However, despite my running regime and walking all over these cities, my pants have been getting tighter 🙂 . I’m not worried about that implication for my health because my indicators all still show that I’m more healthy as I’ve ever been. But I think bringing keto into my travels more will be a part of my Year 4 strategy.

I was able to stay keto and explore México because of their vegetable and meat heavy cuisine and I’m hopeful that I can do the same since I’m going back to México this winter and then going to Central America, which has some similar cuisine. So I’m going to have a heavier focus on healthy food in Year 4 while also increasing my running training regime. I want to hit some even wilder PRs 🙂 .

What’s Next?

So that’s where I am after 3 years of retirement. Financially things are going swimmingly. I still had a cash cushion and now that I’ve topped it up for the first time, I’m good to go for another year plus of retirement.

Overall, I’m still the happiest, most mentally at peace and physically fit I’ve ever been and it’s only gotten better this year. As for my day-to-day life, I’m excited to continue exploring the US and the world in Year 4 including trips to New Zealand🇳🇿, México🇲🇽, Costa Rica🇨🇷, Canada🇨🇦, Iceland🇮🇸 and Europe🇪🇺! So that’s what I’m up to. Let’s see what Year 4 holds!

Do you have any questions for me about Retirement Year 3?

Also if you’re interested in a more in-depth look at what I’ve been up to in Year 3, here are my monthly retirement recaps from the past year:

-

- The Month Of Acadia: October 2022 Recap

- The Month Of Argentina: November 2022 Recap

- The Month Of Holiday Cheer: December 2022 Recap

- The Month Of Snow: January 2023 Recap

- The Month Of New Hampshire: February 2023 Recap

- The Month Of Sea: March 2023 Recap

- The Month Of California: April 2023 Recap

- The Month Of Seattle: May 2023 Recap

- The Month Of Chicago: June 2023 Recap

- The Month Of Montréal: July 2023 Recap

- The Month Of Troy, NY: August 2023 Recap

- The Month Of Australia: September 2023 Recap

When and where will you be in México? My partner and I will be in México from Feb 7-Apr 24, mostly in Mérida and Oaxaca with some other travel sprinkled in. We’re taking your Spanish school rec 🙂

That’s cool! Our paths aren’t going to cross unfortunately. I’ll be on the west coast at the end of this year. That’s so awesome about the Mérida Spanish school! I hope you have a great time 🙂 .

“Overall, I’m still the happiest, most mentally at peace and physically fit I’ve ever been and it’s only gotten better this year.”

Freaking winning right here. And year 4 looks like it will be incredible! Jealous and happy for you, Purple!

Agreed 😉 . And thank you so much! I’m excited.

Congratulations on another successful year. I am looking forward to your Year 4 posts.

Thank you!

Congrats Purple! I love that you had a set plan of WHAT you wanted to retire to – definitely gives me a lot of ideas for my own plans! 😀

Yeah it’s been wild to go from working so hard I don’t remember what I like to do for fun to not finding enough hours in the day in retirement to do everything I want to 🙂 . I’m glad it’s given you ideas!

It’s incredible how much life and living you get from the amount you spend! I am wondering how I spend more when I mainly stay at home/indoors working lol. Also safe to say you survived through the potential headaches of SORR at this point being you’re 3 years into retiring which is amazing!

Thank you! And yeah – sequence of returns risk is becoming less and less of a concern 😉 .

Hi Purple – long time reader, occasional commenter here! Where will you be in Mexico this winter? I will be on Isla Mujeres for 2.5 weeks in Feb, would love to meet up. There is so much more to the island than the tourist books say!

One of the first things on our to do list when we retire is go to a language immersion school in Merida like you did.

Or if you’re ever in the Minneapolis area – definitely things to like here but not really a travel destination 🙂

Hi! Yeah – I’ll be on the west coast at the end of this year so it sounds like our paths sadly won’t cross. Next time! And good to know about Isla Mujeres – I’ve never visited even when I’ve been in Cancun. I’ll add it to my list for the future! And that’s awesome to hear about the school in Mérida. It’s so lovely 🙂 . I’ve actually been to Minneapolis several times, but yeah I’m probably not going back soon. Thank you for commenting!

Happy third anniversary! I’m thrilled for you that all things seem to be bubbling along so well.

I’ve been behind on blog reading this year mainly due to illness eating up what little time I had so am really glad to have caught this update when I did.

I’m not sure if you mentioned this elsewhere already but how did you earn your Krisflyer points? I love that first class suite, if only I could fly in that kind of style with the family, I wouldn’t dread flying nearly so much 😁

Thank you! I’m sorry to hear about your illness and hope you feel better soon. As for the points, we gathered those over literal years from cards that transfer points to Singapore Air, such as Chase, Citi, CapOne and AmEx. It’s definitely a lovely way to fly – I forgot I was on a plane most of the time 🙂 .

The amount you managed to amass (and grow) in such a short time is wild. I so often lament that I didn’t learn about FIRE until a couple of years ago because I’d have been retired by now too instead of having to spend another 6-7 years working. But oh well, live and learn! 15-20 years of working is way better than 40.

Truly impressed by your travel hacking on those flights too. I always thought it was a hassle, but you’re saving THOUSANDS so I’m about to start researching now lol. Do you find living part of the year overseas to be cheaper/help you keep costs down? I’m tossing that around as an idea.

All that to say: Congrats, seems like you’ve had an awesome few years, and I’m tryna get like you 😂

It was indeed wild 🙂 . The market was good to me. And that’s kinda funny to hear because I also lament I didn’t hear about it sooner – even though I learned about it very early in my career. Live and learn indeed. Anything less than 40 years is a win.

And thank you! It’s definitely work, but not $15K of work or whatever the ticket costs 😉 . It is getting more difficult to do though so feel free to check out the caveats I lay out here if they’re helpful: https://apurplelife.com/2023/01/24/how-to-travel-hack-a-step-by-step-guide/.

Going to other countries doesn’t necessarily keep costs down in places I’ve been this year like Canada and Australia, but definitely helps in places I’ve been recently like México and Thailand. So – yes, but depending on where you go.

Thanks so much! You’ve got this 🙂 .

I got into FIRE because of you and I love seeing everything you’ve been up to! I’m just wondering, with all the geopolitical tensions, do you feel any worry about your investments in the next few decades? I’m invested in the US stock market too and last I remember, that’s where all your investments are too, right? I’m asking because well, I worry, but if you’re not worried then I’ll tell myself to chill out haha.

Oh wow! That’s awesome to hear – thank you for telling me that 🙂 . Yes I’m 100% invested in VTSAX, the US total stock market index. I’m not currently worried no. There’s always been geopolitical tensions and these don’t seem to deviate much from those (unfortunate) norms. If I start becoming worried I will definitely write about it on this blog before changing my strategy. I also have a difficult timing chilling out sometimes 🙂 , but in this instance I’m still comfortable with my asset allocation.

I’d love to hear what your spending plans will look like after you deplete your travel points reserves. I do a little travel hacking myself, and I know how long it take take to bank up several hundred thousand points if you have lower spending (especially once you’ve done the sign on bonuses already).

Cheers to another retirement year! 🙂

I’m actually in a holding pattern, waiting to see if the US gets rid of points bonuses or makes them more difficult to obtain (check out the below bill up for vote). If they don’t get rid of them I’ll reassess then. Overall I talked in my travel hacking post below about how it’s getting more and more difficult to do so the ROI might not work for me in a post-pandemic landscape. However, if I keep it up and come up with a plan I’ll be sure to write about it!

https://www.congress.gov/bill/117th-congress/senate-bill/4674

https://apurplelife.com/2023/01/24/how-to-travel-hack-a-step-by-step-guide/